Section 2: GLAD

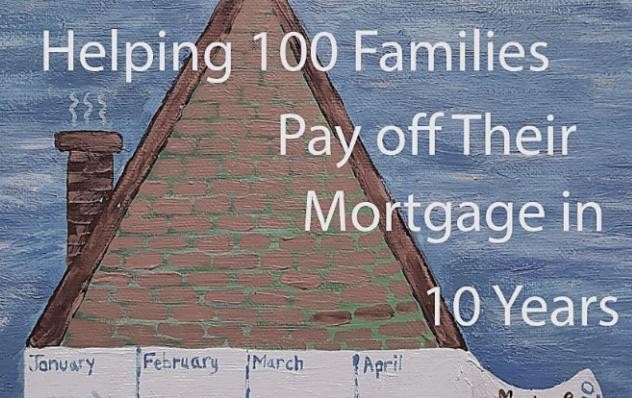

Many of us grow up being told to live within our means and pay off our debt. For some reason, however, this never seems to apply to our own mortgage. Indeed, most of us hold our mortgage for 25, 35 and at some point, even for 40 years (banks don’t allow the 40-year amortization any more). Unfortunately, some families never pay off their mortgage. A research paper from 2010 reported that 1 in every 4 Canadian homeowner between the ages of 60 and 69 still have a mortgage (Statistics Canada: W. Mark Brown, 2010).

Thus, how is it that everything we are raised to believe in about money, in terms of savings, paying things off and living within means, do not apply to a mortgage? This could be because our parents never realized how they could become mortgage-free. Alternatively, the housing prices were never, ever this high to the point where paying it off became such a dream. For many families who bought their home during the sky-high price increase in the Toronto market, their mortgage will never be paid off. The average household debt is growing, with two-thirds representing the mortgage debt (Chawla, 2011) and one-third representing consumer debt.

After saving and often struggling to pool their funds for the down payment, many families are living paycheck to paycheck while paying their mortgage to the bank each month. Many are willing to take on the “house broke” lifestyle knowing that their hard earned money is going into their own home rather than into renting – and paying someone else’s mortgage.

In a low interest rate environment, many families maxed out their mortgage; in other words, they took out the largest mortgage amount the banks would lend them. This, along with the US real estate crash, led to the government implementing the mortgage “stress test”. If you’re not familiar with the stress test, this is not the time to get stressed out about it. No pun intended of course. The stress test is just a means of regulating the banks and mortgages lenders to ensure that families who take out a mortgage are able to pay their monthly mortgage even if the interest rates were to rise.

Instead of getting $500k in a mortgage, you would only qualify for $450k. Ultimately, you would probably still be able to afford the house, but you’d have to come up with a bigger down payment or come up with the difference between what your house purchase price is and the mortgage the bank is willing to give you.

This book starts on the premise that you already have your property with an existing mortgage. Thus, you might ask, “Who is an ideal candidate for this Project 100-10-10?”

Read on.

Becoming Mortgage-Free

Buying a home is an investment in your future net worth and contributes to financial security. Becoming mortgage-free is something many families seek, but few know how to obtain it. In today’s society where consumerism is against us: Halloween decorations, having to put together a banquet for a three-year-old birthday party, spending hundreds on Christmas gifts, and Black Friday now has become a whole weekend thing, spilling into Monday sales. The level to which you implement these suggestions and strategies from this book will determine your success.

The first suggestion is to determine why you want to become mortgage-free. After I bought my second house using the equity from the first property, I realized the power of using other people’s money (in this case, the bank) and if I was to continue to do this (perpetuity leveraging), I would never become mortgage-free. This didn’t mean that I stopped paying extra into my mortgage each month and looking at paying the lump sum payments each year. Quite the opposite: I continued to reduce my principal any way I could. But what I realized early on was I would never become mortgage-free, and am I okay with this? Are you okay with never being mortgage-free? If your answer is no, then figure out why.

Once you know why it is important for you to become mortgage-free, it will be easier to put that $100 against your mortgage rather than ordering another night of Chinese takeout. Your reasons may be different then your significant other, or your neighbours. Here are some reasons my clients have given me:

“I want to feel secure knowing I will always have a roof over my head.”

“I saw my parents lose their home due to the high interest rates during the early 1990s. I never want to be in that position.”

“I want to pass something onto my kids.”

“I want to sleep at night knowing I don’t owe anyone any money.”

The second suggestion is to realize your home is not an asset until you own it outright or until your home is making you positive cash flow.

If you are living in your home, then most likely, you are not renting it or parts of it out. Thus, most likely you are paying out of pocket rather than your home putting money into your pocket. Thus, your home is not an asset.

Robert Kiyosaki is famous for teaching that your home is not your asset, but a liability. Your home is an asset to the bank.

The third suggestion is to make a short-term plan for your mortgage and a long-term plan. Then review the plan and make modifications to the plan on an annual basis. Unless you are excellent in excel and understand the ins and outs of compound interest and lending rules, work with a trusted financial advisor to do this.

The last suggestion is to get rid of your rainy day fund. I am not going to spoil it here. When I started writing this section, it grew too large, so I figured I would create a section of its own.

GLAD: 4 Ways to Pay off Your Mortgage Faster

Listed below are four ways to pay off your mortgage faster. Keep in mind that the point is to reduce the principal as quickly as you can.

Four ways to pay off your mortgage faster (GLAD)

- Go accelerated

- Lump sum

- Annual increase

- Double-up payments

You will be GLAD you have this book.

Therefore, here again, is my disclaimer: This is only my opinion. You should seek professional advice from your financial advisor before doing what I am about to suggest to you.

The only way to decrease your amortization from 25 or 30 years down to 10 years is to take advantage of the four ways of paying off your mortgage faster. Just one option will allow you to achieve your goal of paying off your mortgage off faster. However, if your goal is to pay off your mortgage off within 10 years, then you need to use a combination of these four options, the more the better. Unless you manage to pay it off in one lump sum, there’s simply no other way.

Therefore, the four ways of paying off your mortgage faster are:

1 Go accelerated weekly (or accelerated bi- weekly)

Accelerated-weekly is an option you can use at any point during the life of your mortgage. Best of all, it doesn’t cost anything to set up. You can simply contact your lender and change your principal and interest payments to weekly-accelerated (also known as accelerated-weekly payments).

Accelerated-weekly payments mean that you pay your mortgage payment on a weekly basis at a slightly higher amount; the different in the amount, goes directly towards your principal with no additional effort on your part.

You would only want to do this, if you have extra room in your paycheque or you need the forced automatic help. If you are living paycheque to paycheque then this extra amount might be difficult for you.

Let’s look at the difference is between monthly payments versus accelerated-weekly.

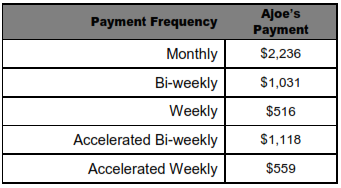

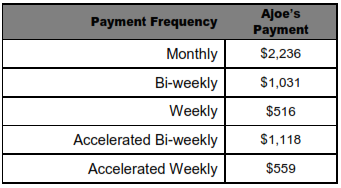

If your mortgage amount were $425k (this is what the bank is lending you) at a 4% interest rate, amortized over 25 years, your monthly payments would be about $2,236. On a bi-weekly basis (every two weeks, which is different from semi-monthly), it would be $1,031 (not exactly 50%). On a weekly basis, your payment is now $516 (notice this is exactly 50% of the bi-weekly amount). As you can see in Table 7, this option doesn’t really benefit you except that the payments are split during the month; thus, it may be more manageable for you.

Table 7: Ajoe’s Mortgage on Accelerated

However, if you changed the frequency to accelerated- biweekly, the payment would change to $1,118. If Ajoe used the accelerated-weekly option, the payments would be half ($559). As you can see going from weekly to accelerated-weekly increases your payment by $43 ($559 – $516). Keep in mind this is per week so that means for one month thus you would be paying an extra $172 toward your mortgage, which goes directly to your principal. Let’s look at the bigger picture.

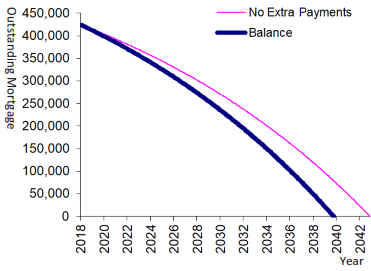

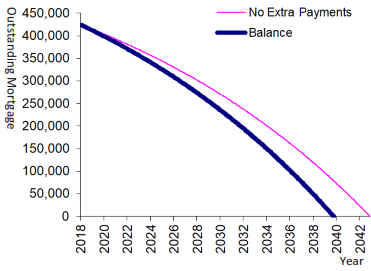

Using the accelerated payment option, Ajoe would pay off his mortgage in under 22 years rather than 25 years.

In addition, he would save $35k in interest! However, this option alone wouldn’t be enough to become mortgage-free in 10 years.

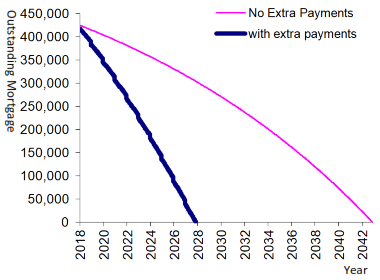

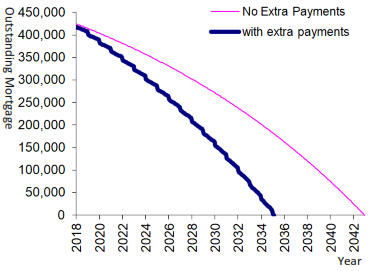

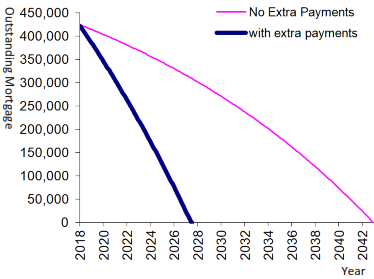

Chart 4: Ajoe’s Mortgage on Accelerated Payment

Keep in mind that you can always revert to monthly payments at any point without incurring a penalty. Depending on what your tax situation is and goals are, it might make sense to choose a monthly payment schedule.

The reason why bi-weekly is not exactly 50% of the monthly mortgage payment is because, bi-weekly uses a 26 payment schedule. This means you have an extra two payment each year. In a monthly mortgage payment schedule, this would be equivalent to a 24 semi monthly payment schedule (12 months x 2 times = 24).

2 Make an annual lump sum payment

The annual lump sum payment allowable is usually 10% of your original entire mortgage amount. Some banks will allow you to make a 15% or even a 20% lump sum payment. If your mortgage were originally $425k, then 10% of that would equal $42.5k.

You would be able to make a payment of up to $42.5k per year. Keep in mind; this is UP TO $42.5k. Thus, even a $10k lump sum payment goes a long way. There are two things to keep in mind, however. One is that you can only do this once a year. You can’t make a $10k payment and make another 10k payment six months later. The second consideration is that the period is not always January to December. Rather, the period depends on when you got your mortgage. If you took out your mortgage in August, then you could make one lump sum payment between August and July of the following year.

The earlier you make any lump sum payment the better, as your mortgage will be paid off faster. The lump sum amount goes directly toward the principal and reduces the compound interest over the life of your mortgage, thus allowing you to pay off your mortgage faster.

Realistically, however, Ajoe would never be able to save $42.5k each year on a $70k per year salary. If he were able to pay $42.5k each year, then implementing only this option would allow him to pay off his mortgage sooner than the 10 years.

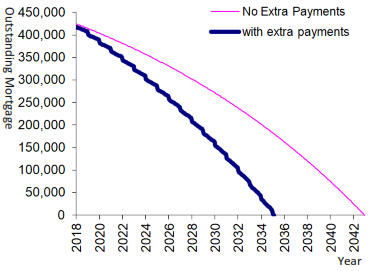

Chart 5: Ajoe’s Mortgage with

$7K Annual Lump Sum Payment

More realistically, Ajoe should be able to save 10% of his $70k salary, which equals $7k per year. Therefore, if Ajoe made a $7k annual lump sum payment to his mortgage, he would pay off his mortgage within 17.5 years (Chart 5) saving $84k in interest. However, this option alone isn’t enough to become mortgage-free in 10 years. If Ajoe were to choose the accelerated weekly payment and 10% annual lump sum payment, he would become mortgage-free is 16 years. As you can see, using these two options alone wouldn’t be enough to become mortgage-free in 10 years.

3 Annual Increase by 10%

The third option calls for increasing your regular principal and interest payment by 10% for every payment going forward until renewal. Some banks may allow you to go as high as 20%. You need to check with your bank to determine the annual increase they allow. You can only request this increase once a year, and then all future payments will be at the higher amount.

Should you need to reduce your payment, the banks usually will let you do so without a penalty as long as you don’t reduce your mortgage payment below the original amount. The great thing about taking advantage of this option is you’re increasing the previous increase by 10%, thus you’re compounding the annual increase payback allowance.

So for example, if your monthly payment is $1k, you can increase it up to $1,100. The extra $100 per month or $1,200 ($100 x 12) per year will go directly to the principle and thus reduce the compound interest and make your mortgage-free faster. Even if you don’t have $100 extra per month, an increase of $25 per month goes a long way. And then in another year you can increase it by another 10% if finances permit.

If Ajoe were to increase his mortgage payment by 10% each year, he would become mortgage-free in 19 year. This option therefore wouldn’t be enough to become mortgage-free in 10 years. However, if Ajoe were to combine the accelerated payment, and the annual lump sum of $7k along with the 10% annual increase, he would become mortgage-free in 10 years (see Chart 6).

Chart 6: Effect of GLA on Ajoe’s Mortgage

4 Double-up your payment

Regardless of where you bank, you’ll be able to make a double-up payment. A double-up payment allows you to match each mortgage payment by 100%, which 100% goes directly toward your principal. For example, if your monthly payment (principal and interest) is $1k you can make an extra $1k payment each month for a total payment of $2k each month. In this case, over the course of the year, you would make a $12k payment directly to the principal. Again, it is UP TO 100%. Even an extra month payment of $200 goes a long way. Also, you’re not required to do this every payment. In addition, you can set this up automatically by contacting your bank and telling them to arrange automatic double-up payments, which you can stop at any time.

If Ajoe chose the double-up payment option, and nothing else, he would become mortgage-free in 10 years. However, this is unrealistic, as it means that Ajoe would be paying an extra $2,236 on his mortgage each month. This amounts to more than 35% of Ajoe’s disposable income.

If Ajoe were to change the monthly payment frequency to accelerated weekly, and add on a double-up payment, he could become mortgage-free in 10 years if his double-up payment was a minimum of $425 each payment. This arrangement isn’t realistic either as $425 each week would equal $1,700 extra each month, which is about 29% of Ajoe’s disposable income.

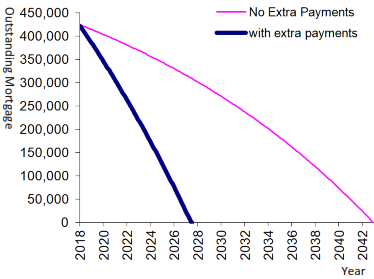

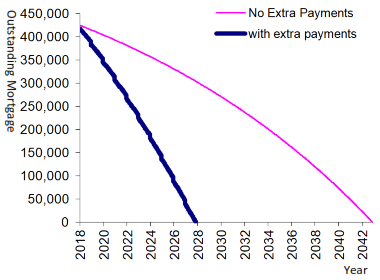

However, if Ajoe were to combine the accelerated payment, and the annual lump sum of $7k along with $230 as the double-up payment, he would become mortgage-free in 10 years (Chart 7). Alternatively, if Ajoe were to combine the accelerated payment, and the annual increases of 10% along with double-up payments, he would become mortgage-free in 10 years (see Chart 7). As you can see, this scenario looks very similar to Chart 6.

Making double-up payments and increasing your monthly payment annually isn’t the same thing. They are two very different choices you can make, so don’t get these two options confused. Also, you’re capped at how much you can increase without incurring a penalty, as the banks make money on the interest that you pay not on the principal. Thus, before you exceed your repayment amounts, you should confirm what the penalties are, if any, with your bank.

Chart 7: Effect of GLD or LAD on Ajoe’s Mortgage

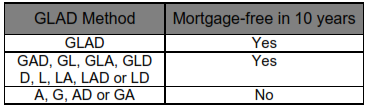

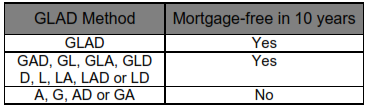

See Table 8 for a simplified combination of GLAD to pay off your mortgage faster.

Sit down with your bank or contact us at huong@cashproperty.ca to determine how you can implement the GLAD and become mortgage-free faster. Keep in mind, your bank won’t be familiar with the term GLAD. This is something I made up.

Summary: The GLAD Method

Taking advantage of all of these four payment options will help reduce your mortgage amortization to 10 years. The GLAD method is: Going accelerated, Lump sum, Annual increase and Double-up payment. Aren’t you GLAD you have this book?

Table 8: Implementation of GLAD to become

Mortgage-Free in 10 years

With any of the above four options (GLAD), you don’t have to do the full amount. You can do a lump sum payment UP TO 10%. Therefore, if you only have $5K, you can make that as a lump sum payment or make a double-up payment of $100 every two months. Alternatively, you could increase your monthly payment by 5% rather than 10%. Even 1% will make a difference. As long as the money goes on the principal, the compound interest will be reduced and your mortgage will be paid off faster. If you sit down with your bank (or us) they’ll be able to tell you how much interest you will be able to save with any of these options.

Of course, the one million dollar question is this: “Where do I find the extra money to take advantage of any of these four options?”

12 Places to Find Extra Money

Here are some ways you might find extra money without making a sacrifice to your lifestyle. There are more ways to find extra money than these provide here, but we choice to include options that are within your control. Not all of these will apply to you, so I am going to lay out a list of options. Just like a buffet table. There are many options to choose from so you pick that works best for you.

12 places to find extra money:

- Use your annual salary increase

- Get another job

- Use your tax return

- Smith Manoeuvre

- Sell items from your house

- Ixnay amortization extension at renewal

- Keep your payments the same

- Look at rates

- Pay off high interest loans first

- Save from discount

- Get rid of your rainy day fund

- Use your RRSP, RESP or TFSA money

1 Use your annual salary increase

If you receive an annual salary increase, which is typically 2% to 5%, you could then use this money to take advantage of one of the above GLAD options.

In order to qualify for your mortgage, you must have a steady income. There’s no arguing that part. So one of the ways to get money, you already have access to: Your full-time job. Using your full-time job, you can actually get more money. If you enjoy your job and you don’t think about leaving it, then what you want to do is figure out a way that you can add more value every day at your job.

Adding value could increase your annual raises and potentially result in a promotion. When you get an increase in pay at your job, that increase can be put toward your mortgage payments. Do not take any of those extra funds to buy any new toys or make any trips. Any increases you get year-over-year can be used to decrease your principal, which will then allow you to become mortgage-free sooner.

How do you add value at your current job? Ask yourself the following questions:

“What’s one thing I can do today to add value?”

“What is a challenge that my boss is currently facing that I can help with?”

“What can I do to assist my manager and make them look good? “

Here is a quote I was told by one of my senior managers

“What interests my boss, fascinates me.”

2 Get another job

Another way to find extra money is to look for another job that pays more. You could get a part time job, but that is not what we are suggesting. Instead of waiting for your annual raise, you may want to consider finding a new job. Even a lateral move could put more money in your pocket.

During the salary negotiations, make sure you add an extra 10% to 20% to your current salary. Do not be shy to negotiate for more money. Think of it this way: how many years would you have to work at your current position to earn an extra 10%? If you’re only getting a 2% raise, you’d have to work for almost four years before getting the same salary at a new job with a 10% increase!

If you are in the lucky position in which head-hunters are calling you to fill a position, then you have grounds to negotiate for a higher salary. Don’t worry about them knowing how much you currently make.

The same thing applies to any extra money that you negotiate. Put that increase in salary toward your mortgage payments and your the principal.

3 Use your tax return

When you get your tax return, rather than buying a new BBQ or upgrading to your iPhone, you could put that money toward your mortgage – and your principal. This of course is assuming you get a return.

If you currently do not get a tax return refund, then this would be a good time to review your taxes with your accountant. A good accountant is worth paying a couple of hundred dollars to get an assessment on how you can potentially reduce your taxes. There are many potential ways of doing this, i.e. maxing out your RRSP contribution, making a charitable donation, claiming your children's extracurricular activities, etc. Rather than us providing an exhaustive list, you should sit down with your accountant. If after reviewing your tax situation, your accountant does not give you an improvement, then sit down with your bank or financial advisor to consider the next idea.

4 Use the Smith Manoeuvre

Rather than go into the detail of what the Smith Manoeuvre is, I would suggest that you read this book (The Smith Manoeuvre by Fraser Smith). Alternatively, you could Google Smith Manoeuvre.

The idea of the Smith Manoeuvre is to use the interest that you pay on your mortgage as a tax deduction. There is a system on how this can be done. Under normal circumstances. you would never be able to claim your interest payment on your primary residence as a tax deduction in Canada. Fortunately, the Smith Manoeuvre is a powerful financial method that gradually restructures the largest non-deductible debt of your lifetime (your mortgage) into a deductible investment loan.

Additionally, reduce years off your mortgage, and increase your net worth – all using legal methods reviewed by the Canada Revenue Agency (CRA).

The Smith Manoeuvre requires homeowners to use the equity in their home via a line of credit to make investments. The interest you pay on the line of credit is then used as a tax deduction. As you make a profit on your investments, you in turn, put the profit into your mortgage, thus freeing more equity via a line of credit to circle through the Smith Manoeuvre. One could argue that this is perpetual leveraging. In addition, it does require you to know other investment strategies that would generate a return.

5 Sell items from your house that you no longer need

Take a look at what you have laying around the house that you don’t really need any more. What about all those toys your kids have outgrown? What about those kitchen items or home décor things?

You could also trade items you don’t need any more within your local area for items that you would use. Thus, you are not paying out of pocket for new items.

Have your heard about the Minimalism Movement? This is where you eliminate belongings of no value, and everything must be multi-purposed.

6 Ixnay amortization extension at renewal

Let's say, you’ve just finished your first 5-year term. Congratulations (you barely made a dent in your mortgage). Now it is time to renew. You’ll have the option of extending the amortization back to 25 years.

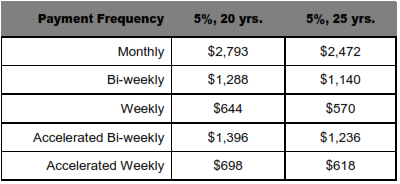

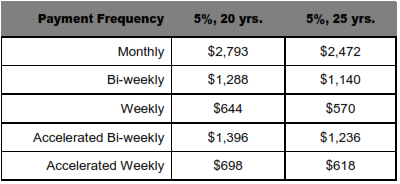

In Ajoe's case, if the interest rate increased from 4% to 5%, Ajoe now would have the option of renewing for another 5-year term at 5% over a 20-year amortization.

Ajoe could also renew a 5-year term at 5% over 25 years’ amortization. Let's take a look (see Table 9).

Table 9: Ajoe’s Options at Renewal

This example raises two very important points.

- Many families are not able to handle a 1% increase in interest rates. A 1% increase in this case is about $557 a month ($2,793-$2,236) in additional mortgage payments.

- By extending the amortization to 25 years, you are now carrying a mortgage for an extra five years with the majority of your mortgage payments going towards the interest again.

Many families would take the five-year extension, as the monthly payment is closer to what they’ve been paying. Most likely, you are sitting down while reading this book. But if you are not sitting down, now is the time to sit down. By extending the amortization by an extra 5 years at 5%, at the end of this term, you’d be paying an extra $70k in interest!

But don't take our word for it: download the Excel sheets from www.cashproperty.ca/tools/ and enter the numbers and play with various interest rate scenarios.

7 Keep your payments the same

When your mortgage comes up for renewal, you would normally negotiate for a new term (even though the majority of families renew for a 5-year term) and a new rate.

For the last few years, interest rates have been decreasing. For example, the interest rate most likely have gone down since the last time you renewed your mortgage. You should definitely take the