The Gold Rush!

In 1848, the gold rush in California began, but that was a short one. Australia however had a nation wide, multi-decade long gold rush. This gold rush was the boom between the 1840's and 1890's depressions and it began in earnest in 1851 when gold was found in Australia. Most of the gold found was in Northern Western Australia, Victoria and NSW. This gold rush is a famous moment in Australian history that lead to a large increase of immigration to Australia, development of Australia's mining sector and it had a big impact on the Australian Economy.

Discovery!

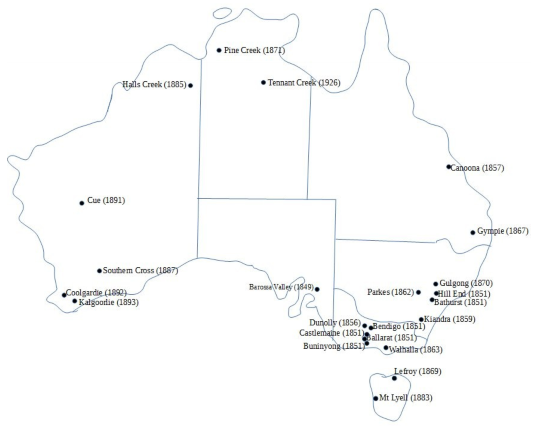

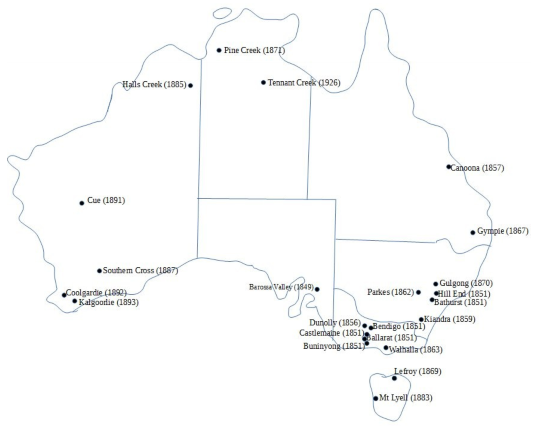

Before 1851, gold had been found in Australia in numerous locations, but these finds didn't start any gold rushes. The California Gold Rush had been driving people away from Australia and the Australian colonies where worried about this and so they capitalised on Edward Hargraves' discovery of gold at Bathurst in 1851. Bathurst is near Orange, NSW. He was rewarded for his find by the NSW colony after he reported his find and the word spread quickly and many prospectors (people seeking gold) flocked to Bathurst. By a week after the find there was 400 people there. This discovery was followed by many more and there would soon be a swarm of migrants coming to Australia seeking their fortune. The following map shows the time and location of some of the gold discoveries.

The Impact

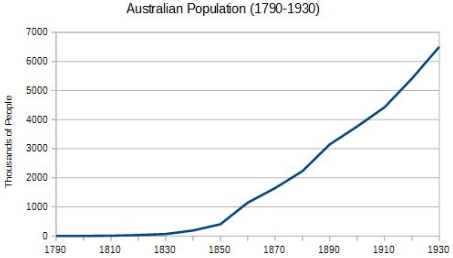

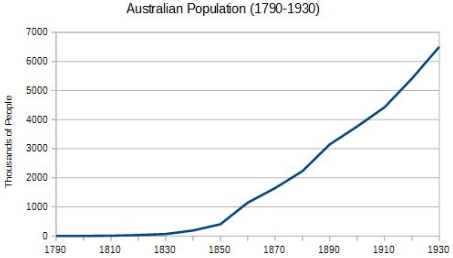

As previously mentioned the gold rush had a big impact on Australia in terms of mass immigration, economic growth and the development of the mining sector. As seen by the graph below, Australia's population exploded after 1851 with 370,000 immigrants arriving in 1852 alone. Victoria was the main site of gold discoveries during the 1850's and they really benefited from that. Their population went from 80,000 at the start of the gold rush to 500,000 a decade later and during that decade they produced a third of the World's gold output. The mass immigration and discovery of gold lead to the creation of many new businesses, towns, railways and telegraph networks. Australia's economy went into a massive boom as a result of this gold rush.

Source: Chartsbin.com

Supply and Demand

Despite being a great benefit for Australia, the gold rush also had negative impacts on the Australian economy. All this new gold caused a glut in the gold market and lowered the value of gold. Simple supply and demand. If there is more supply of gold then demand for gold, then its value and price lowers. Gold is valuable because its rare and when there is more around, its value will decrease. Silver's value for example decreased when the Spanish started mining up all the silver in the Americas.

I remember back when I watched the film titled: The Hobbit. In this film, Bilbo and the Dwarfs are going to the Lonely Mountain to defeat Smaug and get hold of all the gold there and I wonder what would happen when all this gold gets dumped onto the market. If all that gold was dumped on the Middle Earth market, then there would be inflation big time, because...supply and demand. The dwarfs despite wanting to hoard the gold will spend a lot of it to reconstruct their home and give some of it to the elves. The inflation would be mainly localised. The same thing happened during the Australian Gold Rush; there was an inflation due to the gold discoveries. Gold was used as money during that time and inflation happened to be high during the peak of the California and Australian gold rushes. The value of the gold held by private individuals and by governments worldwide lost its value, but Australia avoided this loss by holding on to a greater percentage of the world's gold. Therefore Australia benefited from at the expense of the others.

Life for the Miners

Life for the miners was overall difficult. Miners first had to get a miner's license to work on a claim. There would be miners working on claims all over the goldfields and they would erect huge tent fields where the miners lived. As the goldfields developed, these tents became huts and business's were created and eventually mining towns were established. Some of these towns became large and prosperous, but a number of these towns after the gold rush became ghost towns. Consumer goods were also expensive to buy and there were soldiers at the goldfields.

And Onwards

A large number of the gold discoveries occurred within the first year (1851) of the gold rush and there were several more discoveries during the next ten years. Throughout the next few decades there were several more finds over Australia and the gold rush officially ended in the 1930's. What this means is that the gold rush peaked within its first few years before it petered out throughout the next few decades. The gold rush boom ended with the 1890's depression and the centralisation of Australia. The colonies became states that federated in 1901 to form the Commonwealth of Australia.

The 20th Century

Australia during the 19thcentury had economic growth based on settling new land and by the turn of the century, the whole country had essentially been colonised, so Australia needed another source for economic growth. This of course would be the development of the already settled land. After federation in 1901, the manufacturing and mining sectors would grow to become important industries in Australia and the government regulations on the economy would rapidly increase during this time frame.

Manufacturing

During most of the 20th century, manufacturing was the main driver of the Australian economy. This century saw manufacturing develop, peak and then decline. Before 1901, manufacturing was on a small-scale and rural level with little technological advancement and opportunities and so growth was slow. After 1901, an increase in technological advancement and the scale of manufacturing along with better employment conditions and foreign investment started to accelerate the growth of manufacturing. Prior to WWII manufacturing was mainly based on textiles and agriculture, but after the war, this sector leaned more towards other areas like electronics, steel and vehicles.

Manufacturing peaked in the 1960's with it contributing 28% to Australian output. From then on, manufacturing slowly started to decline. The cost of employment in many Western countries by that time was getting expensive and many businesses started to outsource their business activities to developing nations like China and India where manufacturing is cheaper. This process really heated up during the 2000's and the loss of manufacturing will be a big blow to the economies of the Western nations, which will become importers instead of exporters.

The US for example got out of the Great Depression because they had a young labour force and were exporters and because they had large scale manufacturing, but now the US doesn't have this and this is being a major burden on their economy. A nation like the US will end up running a trade deficit and will end up having serious debt problems.

Mining

The decline of manufacturing was made up by the rise of mining in Australia. From the 1950's onwards Australia started to experience its long-lived Mining Boom. Mining would not be playing a big role in Australia's economy until the later half of the century and it would contribute to a strong Australian Dollar. The Mining Boom would see the rise mining companies like BHP Billiton, Rio Tinto and Chalco.

The Role and Development of Government

The Australian Government during the 20th century would go through a period of centralisation. The state governments would give up more sovereign rights, which the federal government took control of such as law making. Each state had separate laws, but over the years many of them were superseded by the federal government. This centralisation also involved removing inter-domestic tariffs and increasing national tariffs.

The new federal government introduced several national regulatory bodies that dealt with areas like industrial disputes and wages. The different sectors of the economy had been highly regulated since 1901, but during the 1980's onwards there was a massive deregulation of these sectors, especially for the financial industry. This made it easy for business's to access to foreign finance and competition.

Sowing the Seeds of Financial Destruction

The deregulation of the financial sector had been a mistake that future generations would pay for. The financial businesses could now get involved in many more risky activities like derivatives to make megabucks at the expense of the stability of the economy. A derivative is a paper asset that derived from an underlying asset. A bank selling a mortgage off to another company is an example of derivatives. These risky activities have really damaged the world economy and now in 2016 are about to reap the seeds of financial destruction they sowed. LTCM (Refer to Australia in a Global Economy) use of derivatives almost froze up the world financial system and that was on a very small-scale. Now in 2016 derivatives are worth over US$1 Quadrillion (more then ten times the world GDP) and if that blows, the coming disaster will cause a colossal cataclysmic event. The financial sector had already been responsible for causing the Financial Crisis in 2008 by selling off all the mortgages as derivatives around the planet, making the damage that much greater.

A New Monetary System

Australia introduced the Australian Pound, which was fixed to the British pound sterling. Australia during that time was on a gold standard, which is where their paper currency is backed by vault gold. In 1933, during the Great Depression, Australia left the gold standard. Australia changed its monetary system again in 1966 by introducing the Australian Dollar.

Foreign Impacts

There where several changes in Australia's foreign relations and trade with other nations. First, Britain was replaced by the US as Australia's main ally during WWII. During the 1960's, Australia started getting most of its imports from the US and Japan became the main source of its imports. Near the end of the century, China would became Australia's main trading partner in terms of imports and exports. Australia would end up becoming trading partners with many other East Asia countries as they started to play a bigger role in Australia's foreign activities.

The Great Depression

The deflationary economic crash in the US with the failure of their banking system was felt all over the world with Australia's economy slumping as a result of it. Australia was forced off the gold standard and was pushed into recession with falling foreign investment, exports and profits for agriculture businesses. The boom in manufacturing had however reduced the effect the depression had on Australia, but this still became the worst depression Australia lived through.

The Post-War Boom

Australia would enter another boom after World War Two with the baby boom generation and massive immigration. This boom was associated with the start of the Mining Boom, peak of the manufacturing boom and high employment. The high level of exports also was a contributing factor in sustaining this boom by paying for imports and government expenditures, but the fall in exports due to the weakening global economy caused Australia to go into recession during the 1970's. The graph below shows Australian exports as a share of Australia's GDP and illustrates the relationship between the business cycle and exports. Exports are high during booms and low during recessions. A nation will not go well if their exports are low. An exporting nation experiences economic growth and an importing nation experiences economic decline by running trade deficits.

Source: Cuffelinks.com.au I Philo Capital

Into the Recession

The weakening global economy had caused Australia to go into an inflationary recession experienced with falling exports, increasing unemployment, rising prices and stagflation. Stagflation is inflation with high unemployment. 6 If unemployment is high and demand for goods and services is down, then one would expect deflation, but sometimes there is inflation instead of deflation. This recession during the 1970's-80's with stagflation occurred because:

-

There was runaway inflation in the form of currency creation. If you increase the currency supply, then the purchasing power of that currency lowers. Australia's M1 currency supply of AUD$800 million in 1976 was increased by 900% to AUD$8 billion by 19907 and their M3 currency supply of $10 billion in 1970 was expanded to AUD$25 billion by 1990, which is a 150% increase. 8 No wonder there was so much inflation with all that currency being created.

-

The Great Depression had caused a whole generation to save and the next generation had all this currency to spend during the 1970's, which caused inflation.

-

The problem of an aging population started happening during the 1970's. There were an increasing number of older people and a decreasing number of younger people from the 1970's onwards. The recession was quite bad due to the alarming aging rate of the population during that time. 9

-

Interest rates were high during that time period to combat inflation. Higher interest rates reduces inflation, but also causes recessions by making accessing to credit harder. The inflation rate was around 10%10and the interest rate was well over 10% 11 during the 1970's and 1980's. The central bank (Reserve Bank of Australia) controls the currency supply and interest rates.

So, the above are some of the main reasons why Australia had such a bad recession during that time period. Now lets look at how Australia got out of that recession.

And Out of the Recession

During the 1990's, the recession started to subside as the global economic conditions started to improve. A global deregulation of several industries and the tech boom contributed to ending the recession. Australia made many reforms such as making the Australian Dollar free-floating (fluctuates on the exchange rate), tax reform, reduced wage controls and promotion of competition. Australia also joined the Asia-Pacific Economic Cooperation (APEC) in 1989, which promotes international trade.

The tech boom was a technological revolution coupled with a bubble in technology stocks. This was a major stock market bubble that crashed in the early 2000's, but the damage done by this crash wasn't as significant as other crashes and the boom continued into the 2000's. The Financial Crisis in 2008 would bring an end to that recession.

The Financial Crisis

In 2008, the world was shocked by the Financial Crisis that was engineered by poor human fiscal decisions in the United States. The United States with sub-prime and NINJA loans and low interest rates allowed almost anyone to get access to cheap mortgages and credit, which created an unstable bubble. The banks made this bubble worse by selling off the mortgages as derivatives to investors. This was meant to spread the risk, but instead increased the risk and would make more people suffer from a single default on a loan. When the United States increased their interest rates, it became harder for debtors to pay their mortgages and this caused a wave of defaults on mortgages. This resulted in the bubble being popped.

The United States went into a recession and due to globalisation this recession was felt worldwide. Australia like in the 1930's and in the 1970's managed to avoid the worst of the recession. Australia's own housing bubble only stagnated during the recession while the housing bubble in the United States ended. A major reason why Australia avoided the worst, was because they had a Mining Boom to carry their economy through the Financial Crisis.

The Housing Bubble

Before the Financial Crisis of the 2000's, there was a presumed boom in all asset classes. This was wrong. The rise in asset prices was actually a result of inflation with only housing, gold and silver being in bulls. If you adjusted the rise in asset prices with inflation then you will see that most assets performed poorly. Normally there would be a bull in Asset A while there is a bear in Asset B while the capital flows from Asset A to Asset B, but all the currency creation during that time caused runaway inflation. Freshly printed currency was used to put all the assets in a bull. Australia itself had increased its M1 currency supply from 120 billion at the start of the century to 230 billion by 2008. 7

The Great Recession Another name for the Financial Crisis in 2008 is the Great Recession.