The Present

Australia had fared well in the first few years of the post-Financial Crisis era, but since 2012, has been slowing down along with China and Australia now even in 2016 still has a housing bubble, but that bubble now seems close to popping. This chapter is going to look at Australia in the post-Financial Crisis Era.

The Housing Bubble

The Financial Crisis had brought an end to many housing bubbles. The crash in many of these bubbles weren't complete though. In the UK and the US, house prices in many areas had tanked, but in the cities the prices had continued to rise. This is the same case with Canada and Australia. The housing bubbles in these countries did not collapsed during the Financial Crisis and now housing prices in these countries, particularly in cities, is going through the roof. Australia's collapse in the mining sector had also partly collapsed its housing bubble in 2013 and so in Australia there are both bulls and bears in the housing market in different areas. What this means is that a bubble in a nation can be localised. There can be ridiculous housing prices in Sydney while houses are dirt cheap in some outback mining towns.

The Extent of the Bubble

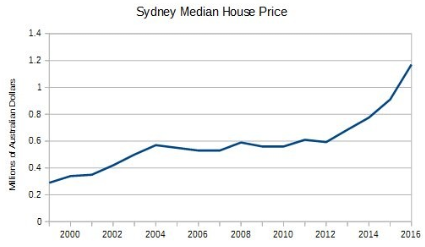

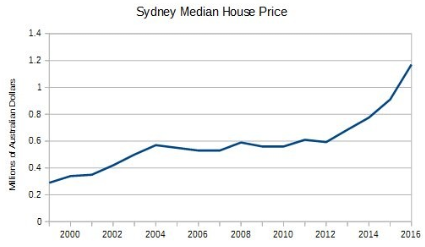

The housing (property) bubble is in existence throughout Australia particularly in it's main cities: Sydney, Brisbane, Darwin, Perth, Adelaide, Hobart, Melbourne and Canberra. Sydney is currently famous for its very high property prices that now on average exceed $1 million. The chart below is showing the median house price in Sydney and by looking at this chart you can see how house prices slumped during the Financial Crisis before rising again. For the other main Australian cities listed above, their housing prices are also very high, but Sydney by a large margin has the highest prices.

Source: Resdex

In the more rural areas of Australia, the housing bubble is less evident. There are towns that have fairly high housing prices while there are many mining towns that have very low housing prices. When determining if housing in an area is in a bubble there are several measures one can use. These measures are used to determine if the price of housing is undervalued, fair valued or overvalued. Several of these measures are:

-

Price: Obviously the most commonly used measure for determining the value of a house; price gives one an indicator on how affordable a house is. If an individual sees that the price of a house doesn't seem to match its value then they will see it as expensive like a shack costing half a million being seen as expensive.

-

Median house price/median household income ratio: This ratio is the median house price divided by the yearly median household income and shows how affordable housing is for the average Australian family. A ratio of 4 is overvalued, 2-3 is fair valued and 1 is undervalued.

-

Mortgage/rent ratio: This ratio indicates to you how much you have to pay for every dollar you get from renting out a house. A ratio below 1.0 means a loss and a ratio above 1.0 means a profit. As 1.0 is the historical average anything above is overvalued and anything below is undervalued.

-

Comparing property to other assets: This measure is actually several measures and involves comparing the price of housing to the price of other assets like stocks and gold. By determining how much of a particular asset it takes to buy a house during different times in history you can start finding trends that show if housing is in a bubble or not. If it takes more then the historical average amount of an asset to buy a house then housing is in a bubble. For example let's say on a historical average it takes 200 ounces of gold to buy a house, but at one point in history it takes 277 ounces. At that point in history, housing would be considered to be overvalued.

-

Supply and Demand: This is how many houses in general are for sale in an area (supply) compared to the number of buyers (demand). In an area I used to live, housing was sure performing poorly. Around half of the houses were for sale and there were hardly any buyers for that area.

-

Conditions: The conditions of the area is another measure not only to determine the value of a house, but also where its value will be in the future. If the local economy was in a recession or a natural disaster had occurred, housing prices in that area would be falling just like housing prices would rise if a local economic boom was occurring. Conditions can also determine the value between individual houses. A house would be more valuable then another house if it is closer to public transport and other public services and has better views then that other house.

Using the indicators

By using these above indicators (measures) we can determine if housing is in a bubble or not in a specific area. Let's use Coffs Harbour, New South Wales (NSW) for example. According to the Australian Census, the yearly median household income in Coffs Harbour is $44,00012 in 2012 and the median house price stands around $360,00013 . Using these figures, Coffs Harbour's median house price/median household income ratio is 8. Since 2012, the median price of housing has increased by $45,000 with the housing market in Coffs Harbour picking up speed. Coffs Harbour a few years ago began a major housing development named the Lakes Estate as part of the improvement of their housing market. Coffs Harbour has a fairly descent economy with a crime rate higher then the state average of NSW. This city and the surrounding region is however in a better economic condition then the Kempsey region south of it. In conclusion, we can draw from this data that Coffs Harbour has a minor housing bubble that is expanding.

How the Housing Bubble Started

The housing bubbles in many countries started in the early 2000's and globalisation caused property markets in different nations to follow similar trends. So, the housing bubbles in nations like the US, UK and Canada helped prop up Australia's housing market. Of course this was also one of the factors initially leading to this bubble. As already stated, the mass currency creation during the last few decades had created an artificial bull in many markets via inflation and this contributed to creating a boom during the 2000's. With this along with deregulation of many industries and low interest rates, one could say that this boom was artificially created and the Financial Crisis was the market restabilising. So the causes of the housing bubble are:

-

A housing boom in other nations supporting Australia's housing bubble

-

Mass currency creation that created an inflationary boom.

-

A tax system that encourages the use of credit and real estate investing.

-

The M3 currency supply increased by a whopping 350% from 2000 to 201514

-

The deregulation of many industries

-

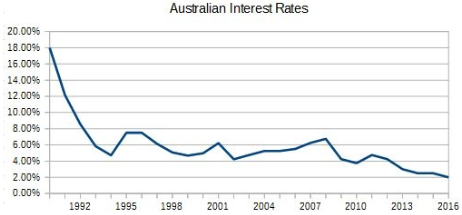

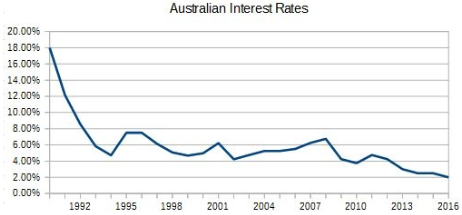

Low interest rates (see on graph below)

Source:WWW.TRADINGECONOMICS.COM I RESERVE BANK OF AUSTRALIA

The credit bubble

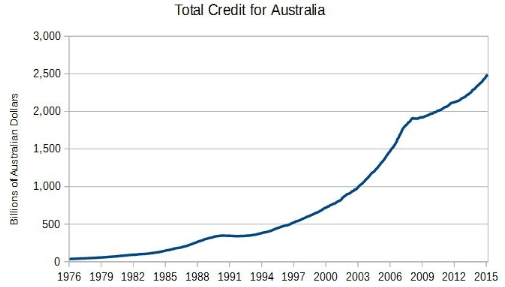

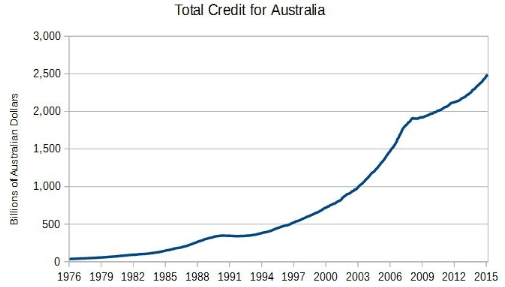

From 2000 to 2015, the M3 currency supply had increased by a whopping 350%14in Australia and this expansion of the currency supply has caused high inflation. The graph on the next page displays the total credit Australia has and this amount has increased by 250% from 2000 to 2015. Total credit includes debt instruments like loans, mortgages and credit card debt. This credit bubble has created inflation, but credit over time is written off as debts, which is either paid off or defaulted on. When this credit bubble pops there will be a massive deflation in the currency supply, GDP and prices, and those in debt will be wiped out like in the Great Depression.

All this credit has also been a support for Australia's housing market. Credit allows individuals to buy more assets then they usually can through methods such as gearing and mortgages. This acted as a rocket booster to the housing market and low interest rates are the fuel. Remember, the lower the interest rates, the less interest one has to pay. A nation should manage its interest rates in such a way that would avoid creating a credit bubble, but Australia didn't manage its interest rates well and now has a credit bubble.

Population

Population was another big catalyst for the housing bubble in Australia. Australia had experienced a large population growth during the last decade with the population growing from 19 million in 2000 to 24 million by 2016. 15 This large growth meant there were more home buyers and that demand would lead to higher housing prices. Just like demographics can benefit the economy, they can also hinder it. Many Western countries like the US, Japan, Germany and Italy are experiencing a problem with an aging population. As the population ages and starts shrinking in those nations, so will the demand for housing and there will be a massive bear market for housing. Australia will experience a similar fate if the current trends continue, but Australia is a couple decades behind these nations. The impact of demographics on Australia will be discussed further later in this chapter.

Chinese Investors

Within the last few years there has been a large increase in the number of Chinese investors investing in Australia. There has been Chinese investment before, but no where near the level it is now. A news article titled “Chinese property investment through the roof: What it really means” states that Chinese investors have claimed “23 per cent of new housing stock in Sydney and 20 per cent in Melbourne in 2013-14”. 16 There are divided views if Chinese investment in Australia will continue, as China tightens its capital controls and the weakening Australian economy are scaring investors away. Continued Chinese investment could maintain the housing bubble in the future.

Impact of the Housing Bubble

Housing and mining sectors have been the main drivers of the Australian economy within the last few decades and now that mining is in decline, real estate is the last thing holding the Australian economy out of recession. These two sectors had also been major reasons Australia fared much better then other nations during the Financial Crisis. The housing bubble has boosted the economy and is now responsible for holding it together. This bubble has driven investment away from other sectors of the economy and as a bubble, it will really hurt the Australian economy when it pops.

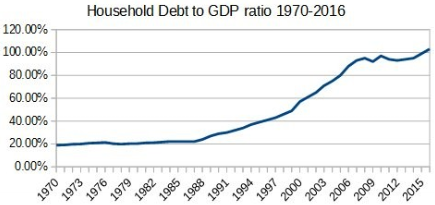

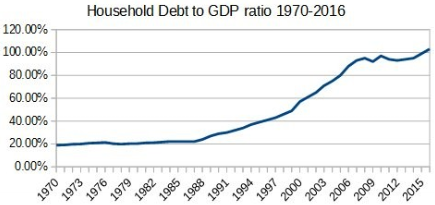

For investors and Australian citizens the bubble had both a positive and negative impact. They are positively impacted when the value of the house they own increase in value, but this only applies to original home owners. There are many that are negatively impacted by this though, especially in Sydney. In the areas where housing is in a bubble, its more expensive to rent and buy property and the cost of living in general is higher in these areas. The Sydneysider can now expect the price of a house to be ten times their yearly income and even the average Australian will experience similar issues. In 1980 (during the recession), the national house price-to-income ratio was around 3 and that number had reached 5.5 by 201517 with the national median house price reaching $650,000 18 . This is evidence in itself for the housing bubble and shows how the cost of living has increased in Australia. The chart below shows the result of the higher cost of living, which is a massive increase in household debt to GDP for Australians. This higher cost of living has also been a result of inflation.

Source: St. Louis Federal Reserve Bank, ABS, RBA

Signs of Weakness

China's recent slowdown had dealt a double-whammy to Australia. First it put the brakes on Australia's mining sector in 2013 and second it reduced the number of Australian exports and both of these events have increased the likelihood of Australia's housing market crashing.

Firstly, the reduction in the mining sector has weakened Australia's economy and has lead to economic problems in many mining towns. There used to be many booming mining towns with high house prices and rent that now have became backwater towns. Secondly, one third of Australian exports go to China, who's slowdown had reduced the number of exports Australia makes. This results in lower government revenue and a trade deficit for Australia. Both of these factors had put Australia's housing bubble in popping territory and if the bubble pops, then Australia will be all set for recession.