Demographics

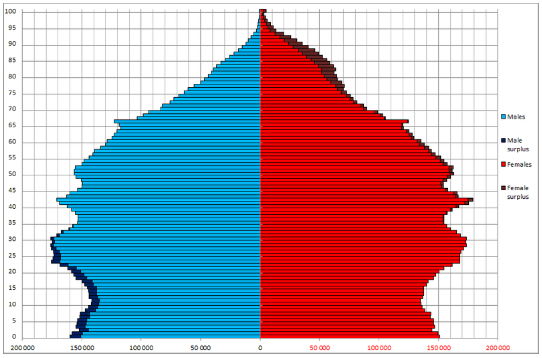

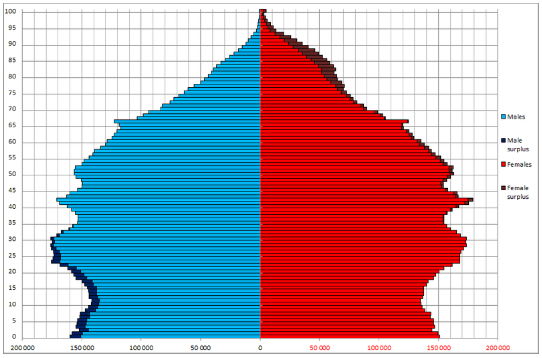

As I have stated at the start of this book: demographics play an important role in an economy. A welfare state won't work if the country has a large portion of old people compared to younger people. There are now many Western nations that have a problem with an aging population as I have stated in the section about Australia's housing bubble. Nations like Japan, Greece, Italy, the US, China and Germany have populations much older then most other nations. When you look at a demographic chart showing age by sex like the one below for these nations, the demographics are displayed almost like an upside down pyramid. This is a sign of an aging problem. A normal pyramid shape with most of the population on the bottom means a young population. A diamond shape with the population clustered around the centre means an aging population. An upside down pyramid shape with most of the population on the top means an old population.

This demographic chart shows the age by sex of the Australian population in 2013 and this looks like a pyramid turning into a diamond. This means that Australia's population is still fairly young, but is starting to age and Australia's population demographics in terms of age is much better then most other Western nations. If Australia has something going for it that will benefit it in the near future is its demographics. New Zealand too has good demographics.

Australian Demographic in 2013 (Age by sex)

Source: Wikipedia (author: Rickkly1409)

The Impact of Demographics

Make no mistake about it, demographics play a big role in economics. You need a young population to have a strong economy. For example, a welfare state only works with a young population as there will be many young people supporting the old retires. If the population is aged, then there are way fewer young people supporting many more old retires and a welfare state in such demographic conditions can't last.

Having a young population also means you have many more young people entering the workforce and investing in order to support the economy. However now in many nations we have few young people and many old people and that spells disaster for the stock and housing markets. First there are fewer young people to maintain the stock market and buy houses. Second as the old people retire they take their retirement funds out of the stock market and they move to smaller houses. This will cause a crash in house prices and in the stock market and the housing market will be further damaged if the population as a whole starts to shrink. So, Australia has several decades left before its stock and housing markets crash as a result of an aging population unless their birth rates go up again, but that's unlikely.

Decreasing Birth Rate

Australia's birth from 27.3 in 1900 has halved to 12.6 by 2012.28 This low birth rate that is below the replacement rate (rate to maintain population) is causing an aging population. Australia's birth rate is simply not high enough to stop an aging population and the chance of the birth rate going up is unlikely. This lowering birth rate extends to almost all Western nations and is a result of:

-

Western people marrying less and latter. In Australia the marriage rate has steadily decreased, but in the United States marriage rates are dropping fast.

-

Fewer Western people choosing to have children and those that do have less children. Families in the past where quite large when compared to now. In Australia the average household size in 1910 was 4.5 and now that number is 2.5. 29

-

More Western women are going into the workforce and choosing not to have families. This point relates to the two previous ones.

-

During a recession, birth rates plummet and Australia is on the verge of recession. The average family can find it hard to finance raising a child and this is definitely the case during a recession.