Race to the Moon

It seems that countries today just want to print their currencies into oblivion and stack up mountains of debt. Today countries are expanding their currency supplies at unprecedented rates. From the Financial Crisis to today, the United States have quintupled their M0 currency supply from US$0.8 trillion to US$4.0 trillion, all in just 8 years.25 Switzerland is even worse, expanding their currency supply by ten times within that same time period.26 It is not just these countries, almost all countries are rapidly expanding their currency supplies, which includes Australia. All countries are in a grand competition to see who can print the fastest.

True Inflation

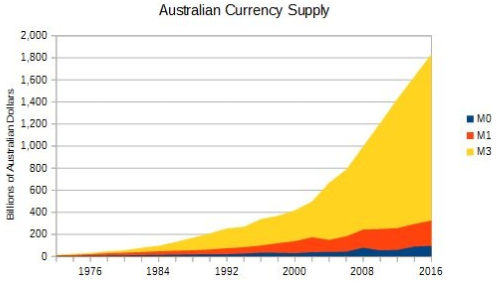

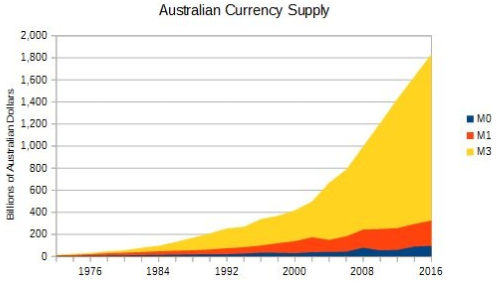

There are many factors that contribute to inflation, but what you see in the chart below is the main cause for inflation; the expansion of the currency supply. It's just shocking on how fast Australia is expanding their currency supply, especially the M3 measure, which has increased by 350% in the last 15 years as shown by the chart below.

Source: Trading Economics

So What is the True Inflation Rate

Australia officially stated inflation rate is just below 2%, yet when I'm at the shops, I don't see a 2% inflation rate. I remember several years back when the price of unleaded petrol was below AUD$1, but now the price is above AUD$1.20. The official inflation rate doesn't match real-life experience with inflation. So what is the inflation rate. Well, we can look at the inflation rate of another currency and carry that over to the Australian Dollar.

The US Dollar's inflation rate of almost 0% also doesn't match real-life, but we can figure out their true inflation rate. Before 1980, the United States used a more accurate method of calculating their inflation and John Williams uses this method to calculate today's inflation for the United States, which he posts on his website ShadowStats. The 1990's method shows an inflation of 4% and the older method from the 1980's reports an inflation of almost 8%.27

Since, the US Dollar has an inflation of 8%, then the inflation rate of other currencies will be similar based on the exchange rate. Considering that the Australian Dollar has depreciated significantly against the US Dollar within the last few years, we can conclude that Australia's annual inflation rate is more around 10%.

A Debt Problem

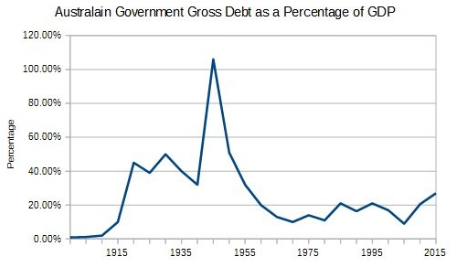

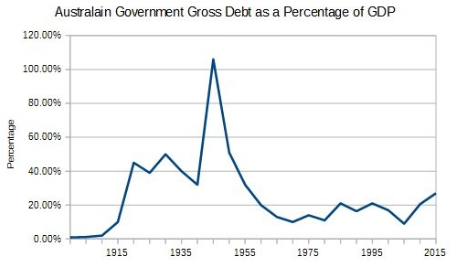

This next chart shows Australia's government debt as a percentage of Australia's GDP. By looking at this graph, we can see the huge debt problems Australia had during World War Two and that now Australia is going further into debt. This recent increase in debt has been due to a number of factors such as a weakening Australian economy and increased government spending. Australia's debt problem is much less then that of other countries, which many of have much higher debt to GDP ratios. Japan, the United States and Greece all have debt greater then their GDP. The United States generate debt by borrowing their currency into existence through the Federal Reserve, which is a process explained in my previous book: A Beginner's Guide To Economics And Investing. One can expect Australia's debt to continue to rise until a deflationary recession happens.

Source: ABS, AOFM, Barnard, Butlin