PART 8 Hyperinflation

What is hyperinflation? Ask any of the tens of millions of people from countries like Germany, Bolivia, Argentina, and Zimbabwe. They would tell you that it's not something you want to live through.

Essentially, hyperinflation is when governments print massive amounts of money without any corresponding increase in the amount of goods and services.

During hyperinflation, the government printing the money can't print money faster than the rate at which it is falling in value. It does not help to stimulate the economy.

After a country has gone through hyperinflation, there is usually a return to a gold standard or some sort of hard backing of the currency.

The effects that people feel during hyperinflation are

MASSIVELY higher prices in everything.

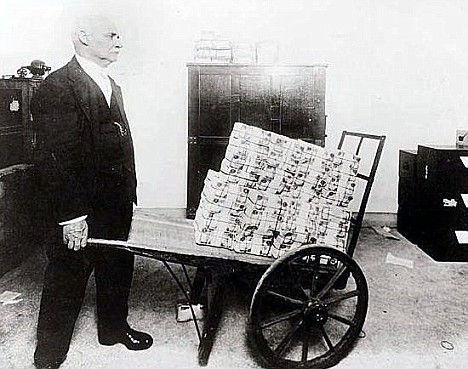

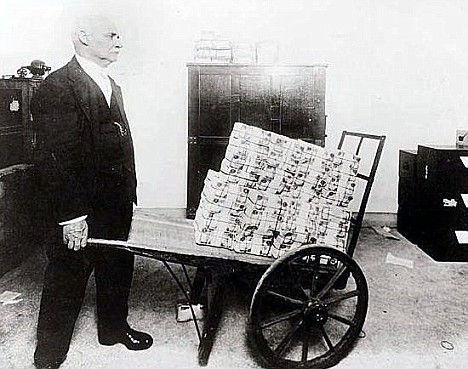

(In Weimar Germany in 1923, it took a wheelbarrow of money just to by a loaf of bread.)

(In Weimar Germany in 1923, it took a wheelbarrow of money just to by a loaf of bread.)

Price controls have been attempted by governments, but it always ends in a shortage of supply. Price controls are where governments tell businesses that they cannot charge more than say $10 for a hat.

This fails because the currency is falling fast and businesses will lose massive amounts of money if they don't charge more for their products.

During hyperinflation, people scramble to get rid of their dollars in exchange for tangible assets as fast as possible. Where the U.S. had a relatively stable inflation rate of 3-5% annually, during hyperinflation the inflation rate goes up hourly or by the minute.

Hyperinflation essentially wipes out the purchasing power of the public and private entities.

While hyperinflation is under way, most people don't have a clue what is happening. They don't realize that when the government prints money they are effectively stealing their hard earned wealth. It is common for countries to inflate their currencies during wartime. This is a means of funding the war that doesn't involve outright taxation. Inflation is still a tax, it is just hidden out of view because most people don't understand it.

Weimar Republic

From 1921-1923, a massive hyperinflation hit Weimar, Germany. It was after World War I and Germany had many war reparations they were required to pay.

The currency, known as the

Reichsmark, was inflated so badly that it cost 1 trillion marks to buy a loaf of bread.

(

1923 1 trillion Mark bill.)

The total

reparations

demanded was

132 billion Marks, which was way more than the

German

government could afford.

The Reichsbank printed the money needed, which resulted in hyperinflation.

In the first half of 1921, it took 60 Marks to buy one US Dollar. By the end of 1921 it took 330 Marks to buy one US Dollar, and by December 1922 it fell to 8,000 Marks per US dollar.

The cost of living in the Weimar Republic from June 1922 to December 1922 rose 16 times!

At the beginning of World War I the US Dollar was worth 4.2 Marks. By November of 1923 the US Dollar was worth 4.2 trillion Marks. The inflation peaked out, and the Reichsmark was replaced with a new currency termed the Rentenmark.

The Federal Reserve is a central bank which was

created after several "bank runs" happened

in the early 20th

century, and the

banks were

unable to pay out

the deposits of

customers. So,

the Federal Reserve was created under the guise that there needed to be a lender of last resort in case a bank run ensued and all of the people wanted their money out at once.

(

(