PART 9 Federal Reserve

The Federal Reserve was also created to “control inflation” by manipulating the money supply via interest rates. What most people don’t know is that our dollar has lost 95% of its value since 1913 when the Federal Reserve was created.

The Federal Reserve was not the only central bank in the U.S.’s history. There were two prior central banks in the U.S. during the 18th and 19th century, and both failed to maintain any longevity.

The first central bank in America was chartered in 1791 and ended in 1811. It was known as "

The First Bank of The United States".

(The First Bank of The United States- Philadelphia, PA)

This central bank was opposed by both Thomas Jefferson and James Madison. They knew all too well the dangers of leaving the money creation up to a private central bank.

The Second Bank of The United States was created in 1816 just 5 years after the closure of the first bank. It also failed to stay around for any serious amount of time and did not get its charter renewed after 20 years.

(The Second Bank of The United States- Carpenters' Hall, Philadelphia)

Thomas Jefferson was very aware of the fact that if the money supply ever came under the control of a private bank, the people would suffer due to greed and selfish interests. He quoted the following:

"If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around them (around the banks), will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered."

The writers of the constitution knew that paper money was a fraud, so they made sure that only gold and silver could be coined by our government as a tender in payment of debt.

Article I Section 10 of the U.S. Constitution stated that

“No State shall make any thing but gold and silver coin a tender in payment of debts.”

The Federal Reserve is not a government entity. It’s a private bank owned by private investors who lend money to the U.S. government with interest. Guess who pays the interest on the loans from the private Federal Reserve. We do. The real reason the Federal Reserve was established was to make money for a few elite bankers and businessmen.

Author and historian G Edward Griffin points this out in his book "The Creature From Jekyll Island".

The Federal Reserve is not being honest with the American people about where these bailout packages are going and how much these overseas banks are getting. When asked about this, Ben Bernanke simply said he would not say where the money went.

There needs to be transparency

in our monetary system and the

Federal Reserve should show

all accounts of where taxpayer

money has gone.

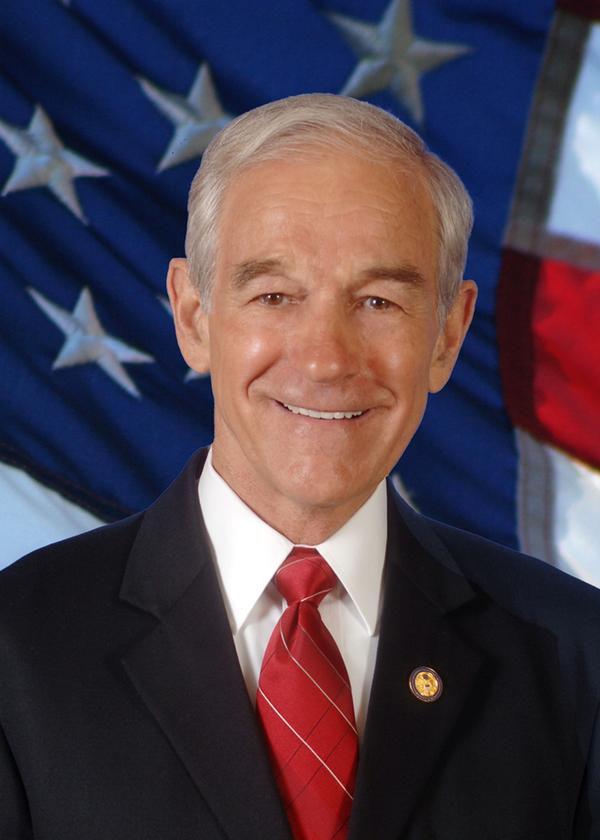

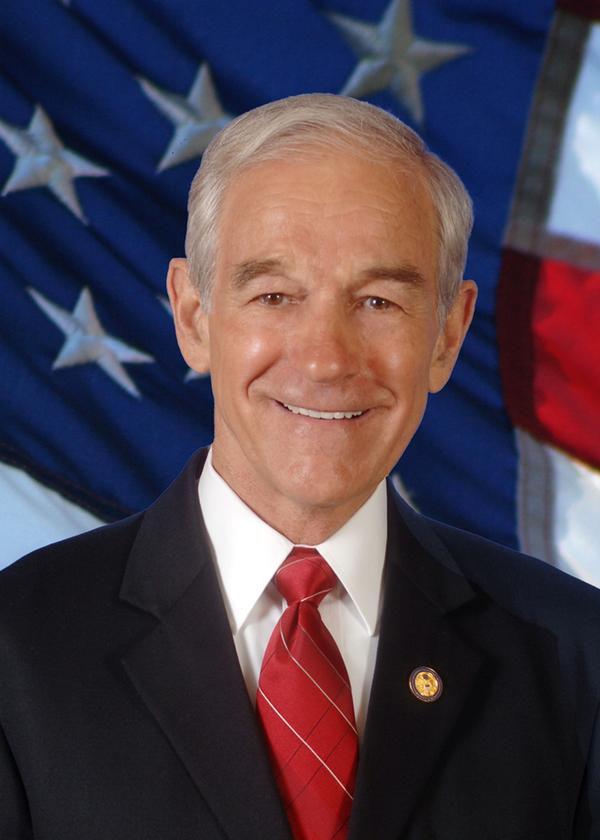

Congressman Ron Paul has

been fighting the Federal

Reserve for 40 years now. He

has a bill (HR 1207) that

would allow an open audit of

the Federal Reserve.

If passed in both the house and

senate, it could mean our

nation will go back to a gold

standard where our money

would be stable.

Central banks around the world also play a role in suppressing the price of gold by flooding the markets with gold thus driving down the price.

Central banks have gotten away with this for some time, but they are running out of gold to push to market.