Chapter 11

Part 1: The Guaranteed Index Account

Here’s the key to The Barefoot Retirement Plan. It’s based

off of a little known unique variation of an asset that has been in existence

for over 150 years called dividend-paying life insurance.

It’s all made possible by a congressionally approved IRS Tax

Code # 7702 that allows us to have all the amazing benefits of the Guaranteed

Index Account mentioned above through the use of Indexed Universal Life.

Otherwise known as an IUL. Who would have thought that the Government allows

all of these benefits through the use of Index Universal Life? However, keep in

mind, this is NOT like anything else you’ve ever seen.

So yes, we are talking about a form of life insurance. But

it’s a highly specialized form of insurance. What we’re doing is using a form

of permanent life insurance as a savings vehicle the same ways the largest

banks in the world are using it.

Don’t be surprised if you’ve never heard of it. As a general

rule, most insurance agents, financial planners, financial media “experts” and stock brokers don’t have a clue about this nor do they even come close to

understanding it. The masses know nothing about this. You know what they say, “If

you follow the masses, you’ll end up in the same place as the masses.” Believe

me, retirement wise… you don’t want to end up where the masses are.

The first thing that pops into a lot of people’s heads is

something like this, “Hey, my brother-in-law sells insurance, so I’ll talk

with him about this and see what he thinks.” That’s fine, but keep this in

mind.

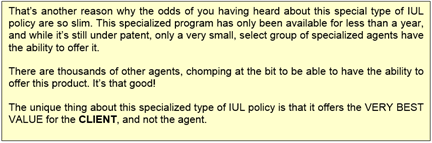

Probably less than 1 in a thousand insurance agents has even

heard of this concept and far, far fewer of them have any specialized knowledge

about this at all. Plus, this specific product is 100% EXCLUSIVE to our private

distribution channel. Anyone outside of our distribution channel CANNOT offer

this program and does not have access to it.

Out of approximately 1,000 major life insurance companies,

only a small handful of them offer policies that have features similar to the

ones we offer. When you couple this with the fact that there are advertising

limitations on these types of policies and with the fact that agents typically

make 50% to 70% less commission when selling these policies, it’s easy to

understand why most people have never heard of this.

The Single Most Powerful Tax-Strategy Legally Allowed in America.

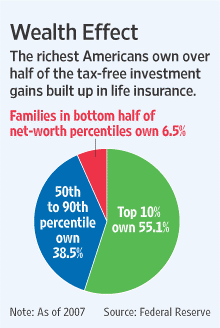

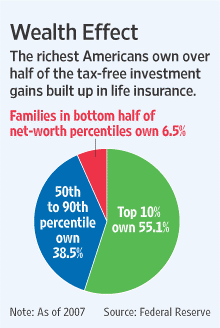

As you can see in this pie chart created by the Federal

Reserve, the top 10% of the wealthiest Americans own over 55% of some form of

this type of insurance. Furthermore, not shown on the chart but reported in the

Federal Reserve findings was the fact that the wealthiest 1% own 22% of this

type of insurance. That tells you a lot right there. The average person is

never going to hear about the strategies the rich use to grow their wealth.

Setting up one of these policies is a lot like going to a

medical specialist. If you have a problem with your heart, you’re not going to

go to a general practitioner, right? You’re going to go to a heart specialist.

You wouldn’t go ask your brother-in-law about your heart, unless of course,

he/she happened to be a heart specialist. The same is true in this case.

If you go to someone who does not specialize in this form of

IULs, you can risk everything. There are lots of variables, options and

sophisticated strategies that need to be considered and specifically used to

set these up properly. If they are not set up correctly, you can open yourself

up to having the policy fail altogether or even open yourself up to large

unnecessary tax liabilities.

Our Barefoot Retirement team specializes in setting up these

unique and specialized policies. We’re happy to schedule a free strategy

session with you, discuss your needs and options in great detail and produce

various illustrations that will clearly show you how a properly structured IUL

policy can have an amazingly positive impact on your retirement. It can even

allow you to have a barefoot lifestyle retirement, living life on your own

terms.

What Do Other Financial Experts Think of This Type of Program?

Fox Business published an article by Scott Mann titled “(Legally)

Cutting Out the Tax Man in Retirement. The article states, “The life

insurance industry has the best IRS-approved retirement savings plan today—,

and most investors know nothing about it.” “Despite sales of well over $1

Billion in 2011 for the top 39 carriers surveyed, it is the financial

industry’s No. 1 secret—Indexed Universal Life (IUL).”

The article went on to say, “To explain why IUL is a

powerful supplemental savings vehicle to an employer’s 401(k) plan, and a

replacement for those whose employers don’t offer one or for some people who

don’t trust the market, we need to start with the fact that after a generation

of use, qualified plans - comprised of equity-based investments - are generally

acknowledged as failures.”

Fox Business published an article by Tim Fussell titled, “Is

There Really A Perfect Life Insurance Contract?” The article concluded that

there was no one perfect policy that can solve everyone’s needs and there are

trade offs with each one. However, it went on to say, “But an emerging

and fast-growing contract design - the indexed universal life (IUL) policy -

may come very close to being the ideal contract for most consumers in today’s

interest and overall market environment.”

Timothy R. Fussell also published another excellent article

on Fox Business titled, “Indexed Universal Life Insurance Policies: The

Perfect Option for Professionals and Business Owners.” In this article, he

states, “For a professional such as a doctor, attorney or CPA, the Indexed

Universal Life policy is perfect for your retirement needs. Often as a

professional, you operate as a P.A. being taxed as a sole proprietor, an S

Corporation or a C Corporation, and under the tax codes you are limited to

retirement account choices. The SEP IRA, Solo-401k or the UNI-401k, all allow

you to save on a tax-deferred basis; but the maximum contribution limit is

still the same, $49,000.”

“Now let’s explore the IUL (indexed universal life) and

why it is a better choice. As a professional of these types, your income level

is much higher than average, so you max out your contribution very early in the

year. With the IUL, there is no limit on how much money you can contribute…”

So How and Why Is Our Plan So Different?

You may have heard of a variation of this concept before.

It’s sometimes called things like; Bank On Yourself, Becoming Your Own Banker,

a 770 Account, Tax-Free Retirement, etc. The HUGE majority of plans like this

rely on a form of Whole Life Insurance. The “special” version of

Indexed Universal Life (IUL) that we use for our program is vastly different

and easily outperforms these other plans by a mile. I mean it’s not even

close, and we’ll prove it to you in black and white.

Most of these other insurance policies focus on the Death

Benefit. While that’s important, and it’s definitely part of our program, it

makes the insurance part of the policy VERY EXPENSIVE.

When an insured person dies, all the other life insurance

policies are structured to offer beneficiaries a choice of a Lump Sum Payout OR Payments Over Time. It’s just been that way for well over

a hundred years, and it has always worked well. So if someone died with a

million-dollar life insurance policy, the beneficiary could choose to either

take the million dollars in a lump sum, all at one time, OR they could choose

to receive payments over time, per a schedule they choose for payments.

If you were the insurance company, you would need to accrue

to have the million dollars available to give the beneficiary if they choose

the lump sum option, and it’s very expensive to do that. However, if the

insurance company did not have to make that lump sum of money available, they

could keep that million dollars invested in other, longer term, productive

assets and growing much faster.

A very wise man who is part of our association came up with

a brilliantly simple idea that changed everything. He developed this concept;

IF you did not give the beneficiary an option to choose a lump-sum payment, and

only gave them the option to receive payments over time, this one little change

would greatly reduce the cost of insurance and thus allow clients to put a much

greater amount of capital to work for them, growing their retirement assets

even more.

This may seem like a small thing, but the results it yields

are huge! You’ll see just how huge it can be shortly, when we show you some

scenarios.

This little change can reduce the cost of the insurance

by up to 70%! That makes this type of IUL MUCH Less Expensive.

(Note: If the policy holder wishes, we can still structure

an IUL policy that does offer a lump sum payout if they choose it, but

it does make the cost of insurance greater. We have the flexibility to

structure any type of insurance program that best suits our client’s individual

needs.)

Trust me when I tell you how much less expensive our choice

is. Many of the people out there who sell Whole Life Insurance are quick to

tell you theirs is similar in price. It’s not. Not by a long shot. If you are

considering a Whole Life product or ANY other type of insurance product, I

challenge you to carefully compare prices. You will be shocked at the

difference! Ours offers much more value and benefits, for much less cost! Our

version of IUL is like buying a Lamborghini at bargain basement costs.

This concept was so revolutionary, they patented it.

You may have heard one of the complaints about the “regular” type of Whole Life Policies is that the agents make a TON of money on them.

It’s true. Agents make a lot of commissions on them, and I’m sure you know;

those commissions come from somewhere, right?

When agents sell the specialized type of policy that we are

talking about here, they usually make 50% to 75% LESS, than the guys

selling the Whole Life.

Almost every week we meet with other insurance agents who

are interested in joining our team, so they can gain access to this specialized

program and offer it to their clients. Sadly, a few of them actually turn us

down from time to time. Most of the ones who turn it down do so because there

isn’t enough profit in it for them.

The most common statement we hear from these people is, “Why

would I want to sell something that I would make up to 75% less on? Are you

nuts? My clients will buy anything I sell them, and I would rather sell them a

product that’s more profitable for me. I’ve got to take care of me and my

family, not theirs.” Wow! Not exactly what you want to hear from an agent,

right?

By the way, if you’re an insurance agent reading this book,

and you don’t mind putting your clients’ needs first and earning a lower commission

to be able to offer them the finest product they will ever see, give us a call.

We license other agents and agencies all the time.

Our philosophy is and always has been 100% customer focused.

We always put our customer’s needs FIRST, and then everything else works out.

Just like my old friend Zig Ziglar used to say, “You can get everything

in life you want, if you will just help enough other people get what they

want.”

Besides, if we can give our clients a superior product,

that’s a far better value than anyone else can offer, they’ll tell their

friends and bring us referral customers, and that’s the way we want it.

IRR (Internal Rate of Return)

Policies like IULs and Whole Life policies have a rating

system called an IRR or Internal Rate of Return. When you look at the IRR, it’s

like looking underneath the hood of that car you are considering purchasing. It

shows you how the policy will perform, based on the assumptions you’ve made and

the other variables such as age, amount invested, and years until withdrawal,

estimated market returns, etc.

If you are considering purchasing a Whole Life policy, ask

the agent to give you the IRR of the policy you’re considering. Sometimes it

may be difficult to get them to show this to you. Do you know why? It’s because

their IRR compared to their illustrated rate of return isn’t so hot. We will

gladly give you this information because we know ours is superior and can’t be

beat! We’re proud to show this and give it to you.

Our cost of insurance is the lowest you will find for

programs like this. There are even ways we can structure your policy where your

cost of insurance can completely stop. When that happens, one of your largest

internal costs is removed, and your IRR goes through the roof. That’s why our

program can’t be beat.

It’s Like Having a Life Insurance Plan and a Savings Plan, Rolled Into One

Plan

This program truly gives you the best of both worlds. You

get very affordable permanent life insurance to take care of your family, and

you also get tax-free income for retirement. This plan offers you the best

combination of safety, flexibility, guarantees, control, liquidity, and tax

advantages that’s ever been created. It helps you Protect, Grow and Leverage

your retirement savings.

The specialized IUL product we offer outperforms the

competition by drastically increasing the internal efficiency of the policy. By

increasing the efficiency, it means you have a lower expense ratio, a higher

account value, and significantly higher amounts you can take as income distributions.

How Safe and Secure Are the Life Insurance Companies That Issue This Type

of IUL?

That’s a very important question. Let’s break it down and

look at it. There are basically two different types of insurance companies.

Stock companies and Mutual companies.

Stock Companies: Stock companies are publicly traded.

They must always have their “shareholders” best interest in mind more-so

than their policy holders. They must focus on the short-terms demands of Wall

Street, and their values are subject to the ups and downs of the stock market.

Mutual Companies: Mutual insurance companies are not

publicly traded and do not have stocks or shareholders. They pay out their

profits in the form of dividends to their policy holders. They always have

their policy holder’s long-term best interest in mind. The payout of

dividends is not guaranteed, however, of all the mutual insurance companies

that we work with, not one of them has missed a single payment, EVER.

Most of these companies are over a hundred years old, and

they are among the financially strongest companies in the world. Warren Buffet

is even on record for saying that this business model of mutual insurance

companies is one of the safest businesses in the world. In 2008 during the

banking crisis studies indicate that 12% of banks failed and only .08% of life

insurance companies failed.

The primary company we work with for our flagship IUL

product is a mutual insurance company and has been in business since the 1880s

(over 130 years). They have over 13 million policy holders. Their stellar

record of financial strength and claims-paying ability positions them as one

of the most highly rated companies in America. In fact, they have nearly

$970 billion of life insurance in force. So the issuing company is as solid of a

company that you would ever hope to work with.

In the book Money, Bank Credit and Economic Cycles,

the author Jesus Huerta de Soto reported that, “In the last two hundred

years, a negligible number of life insurance companies have disappeared due to

financial difficulties.” In his book, he contrasts this to the high ‘financial

death rate’ of banks, which can systematically suspend their payments and

can fail without the support of the central banks.

We simply don’t think you can find a safer place on Planet

Earth for your retirement funds!