Chapter 12

How It Works

So Let’s Walk Through the Steps of Exactly How It Works

Getting Started

Getting started is actually very easy. You consult with one

of our highly specialized Barefoot Retirement agents. We look at your specific

situation, your goals, desires, needs, wants, resources, etc. and give you

advice on creating a custom-tailored plan that best suits your individual

needs. This is NOT a “cookie cutter” program. There are lots of

variables and options available, and our highly trained specialist will work

with you to structure a plan that perfectly meets your needs and helps you

achieve your goals.

Some of our plans are structured for contributions to be

made each year, for 5 to 7 years. (We can structure programs with much longer

contribution time periods if that best suits your needs). You would also

determine the amount of contributions that you wish to make on a monthly,

quarterly or annual basis. Typically, the minimum contribution amount is about

$300/month or $3,600 per year.

Our Barefoot Retirement group works with many high net worth

clients. Often times they see so much power, benefits and advantages with this

program that do everything possible to fund their programs with as much money

as they can possibly put together. Many of them also want to set up policies

for their spouses, children, grandchildren, businesses, key employees, etc.

Based on your qualifications, there is NO MAXIMUM limit to your contributions. Let me repeat, based on your qualifications,

there is NO MAXIMUM limit to your contributions. Really! Our

clients love this!

In most other cases, when you’re buying insurance primarily

for the death benefit, you look for ways to put as little into a policy

as you can. This is the opposite. Once you understand the massive power of what

we are talking about here, you’ll be looking hard to see just how much you can

put into this program to max it out. It really is that good!

There are many great people who love this program, but have

limited financial assets. As part of our mission, we’re determined to help as

many Americans as we possibly can, to obtain and achieve the Barefoot

Retirement they want and deserve. Many people see this program as the answer to

their prayers, but they just don’t have much unallocated funds sitting around

to start their IUL with. So, if you’re struggling to find ways to come up with

the money to fund your IUL, we have some ideas for you.

10 Ideas for Finding the Money for Your IUL

Note: Before you make any financial moves, it’s always

recommended that you seek professional guidance from specialists who are

knowledgeable in these specific areas. We do not give financial advice. These

are simply ideas that you may want to consider and do more research on.

1. Re-allocate under-performing assets

Many times people have under-performing assets in their portfolio that

could be better utilized. Why? Because it’s nearly impossible to keep your

portfolio 100% efficient. If you have some “dead” assets that have not been

performing up to par, and are not helping you to reach your financial goals,

you may consider using those funds. It’s kind of like the old saying, “What

have you done for me lately?”

2. Reduce your funding of your IRA, or 401(k)

After seeing all the advantages this program offers, many people can’t wait

to reduce or stop their funding of their qualified plans. However, if your

employer offers a matching amount, you could consider paying only the amount up

to the employer matching level.

3. Use some of the funds in your IRA, or 401(k)

There is a Federal rule that’s called the 72(t). This section in the tax

code allows you to pull money out of your traditional qualified retirement

plan. By using the 72(t) option, you avoid the 10% penalty that’s usually

assessed when you move funds out of qualified plans. This only applies to

people younger than 59 ½. Before making a move like this, be sure to talk with

a knowledgeable tax and financial professional.

4. Better management of your home equity

Some people make extra payments to their home mortgage every month. It’s

easy to re-allocate those funds to an IUL. Depending on your mortgage, you may

consider refinancing your loan to free up some extra funds. For many, this is

their largest expense so it’s a good place to look for savings.

5. Convert your current life insurance policy

Some people have been “sold” really bad and underperforming life insurance

policies over the years. In fact, I bet if you were to check the IRR (Internal

Rate of Return) on your policy, you may be in for a shock. This is not always a

good idea to do, and you should always seek professional advice before making a

move like this.

If this seems like your best option, you can take advantage

of a 1035 Exchange to transfer the cash value of your current policy to your

new policy. Our Barefoot Retirement advisors are happy to look at your old

policy and run some illustrations that will show the pros and cons of making a

move. They will then discuss the advantages and disadvantages with you so you

will have all the facts to make an informed decision.

6. Restructuring debt

If you have some personal or business debt that requires a good portion of

your monthly cash flow, you could look into possibly restructuring some of the

debt to free up some additional funds.

7. Savings accounts

If you have some portion of your savings accounts sitting around in bank

savings accounts earning 0.12% or in CDs earning not much more than a percent

or two, you may consider moving some of your savings into an IUL account. If

the market continues to perform as it has over the past few decades, you’re

likely to earn much more on those funds. Plus, you can purchase a rider on your

policy that will give you almost immediate access to borrow the majority of

those funds, should you need them.

8. Reducing your current monthly expenses

This is an area that in the past, many people didn’t want to talk about.

However, with the seriousness of having a properly funded retirement, many

people become remarkable creative in finding ways to cut back and reduce

unnecessary monthly expenses. For some, it’s as simple as keeping your car a

few years longer after it’s paid off. Others are reducing their vacation costs,

eating out less, going to the movies less, and just buying fewer new &

shiny objects that simply aren’t really necessary.

9. Part-time job

We know this doesn’t work for everyone, but for some, it can be a perfect

solution. Depending on your financial situation, this could be the smartest

thing you could do. For most, it will be easier to pick up a part-time job now,

while you’re younger and healthier, than it would be when you are much older,

and you just don’t have the stamina to go back to work. For some, it’s

short-term pain now, to ensure a long-term gain later.

One of our clients is a pharmacist. He absolutely loved this

program and could easily afford to contribute a significant amount on funds to

it on an annual basis. We ran various illustrations for him, showing him lots

of retirement options. After seeing just how amazing his retirement could be

with this program, if he really contributed to this program in a big way, he

decided to pick up a part-time pharmacy job for the next 5 years.

His view of how his retirement would be before he saw this

program, was just “okay.” After he realized just how powerful, the Barefoot

Retirement program really is, he decided to make a short-term sacrifice, in

return for having a vastly different retirement. With his new retirement plan,

he should now be able to retire at 60 (or sooner) instead of 65, and have a

significantly larger annual lifetime retirement income than he ever imagined.

10. Make changes to your annual tax refund

If you are one of those people who typically gets a large tax refund, you

may want to consider using that to fund your IUL. When the IRS gives you that

large tax refund each year, they are really just giving you back the money on

an interest-free loan that you’ve given them all year long. They are just

giving you your own money back that THEY have had the benefit of using. If this

sounds like you, you can first check with your tax advisor and then make some

simple withholding adjustments to your W-4 at work. Don’t worry, you can make

changes to your W-4 as often as you wish. By making this change you can often

immediately free up some extra monthly cash flow that you can use for your IUL.

Missing Contributions

Many of the standard Whole Life policies out there are

highly structured, and if you miss a payment contribution, or some payments, in

some cases it can even destroy the integrity and value of your entire policy. This

is a really, really big deal!

Our IUL program is DIFFERENT. If you miss a contribution

here or there, no problem. You can simply make it up later. These plans

are extremely flexible. There are three contribution amounts you can

choose from. You can mix and match these from year to year, even month to

month! There is a minimum, a maximum, and a Target.

The Target is what insurance companies tell you that you

need to keep the death benefit in force through your lifetime. This isn’t the

number we want to use for maximum efficiency. The minimum is the bare minimum

you can contribute over a given time period (monthly or yearly). The maximum,

in how we structure these plans, is the maximum amount the IRS will allow you to

put into the policy based on the amount of death benefit you select.

Don’t worry if you find this confusing. We walk you

step-by-step through every aspect to help you stay on course and maximize your

policy. It’s really very simple once you understand it.

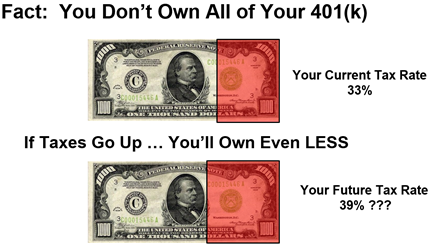

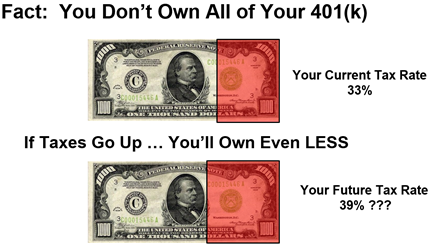

Using After Taxed Dollars

You fund your IUL with after taxed dollars. These are funds

that you’ve already paid taxes on. As you know, with a “qualified” retirement program like an IRA or a 401(k), you fund those programs with before

taxed dollars.

That’s the big “claim to fame” of qualified programs

and what they brag so much about. They tell you how great it is that you make

your contributions with pre-taxed money, so you can pay less in taxes now and invest more funds now.

What they don’t focus on is the little fact that you WILL

have to pay taxes on ALL the funds when you start withdrawing them

during your retirement. That’s right. With qualified plans like IRAs

& 401(k) s, when you start drawing your money out, you will have to pay

taxes on the initial amount you invested AND on ALL OF YOUR

GAINS.

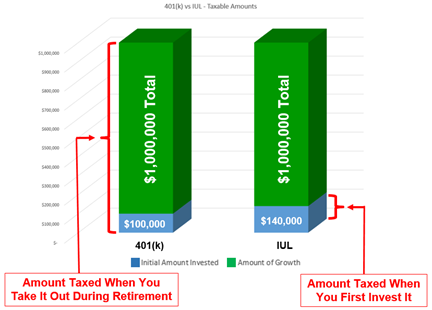

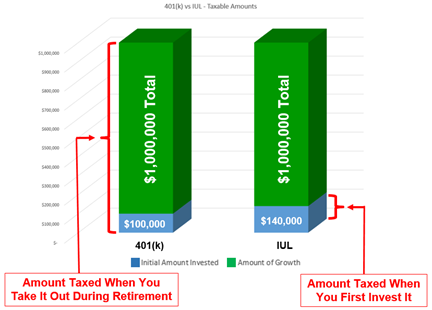

So let’s think about this for a moment and see which way

seems smarter. Let’s use a simple general example to help understand the

difference. Say you wanted to put $100,000 in your retirement account, and you

were at the 28% tax bracket. If you are putting it into an IRA or 401(k), you

pay no up-front tax on that 100k. It all goes into your retirement account.

However, if you contribute to an IUL account, you would need to have close to

$140,000 and pay the tax on that amount upfront, to be able to net the $100,000

to put into your IUL.

Now let’s just say that you invested well and that when you

reach retirement age, your account has grown to be worth 1 million dollars. If

you had put it into an IRA or 401(k), you would have to pay taxes on ALL the money you take out, every single penny of it.

And, who knows what the tax rates will be when you get ready

to retire. Not a single knowledgeable person I talk with about this believes

taxes will be lower in the future. They all believe taxes will be higher. Much

higher, not lower.

However, for this example, let’s just say tax rates stay the

same, and you’re at the 28% tax bracket throughout the entire time period you

withdraw your retirement funds to live on.

28% of 1 million dollars is $280,000. So that’s a bit more

than the additional $40k we had to pay in taxes initially to fund our IUL.

Would you rather pay Uncle Sam $40,000 today, or $280,000

when you retire?

Another way to look at this is as if you were a farmer. If

you had the choice to pay taxes on your planting seeds or on your entire

harvest, wouldn’t you rather pay taxes on your small bags of planting seeds

instead of paying taxes on your entire harvest?

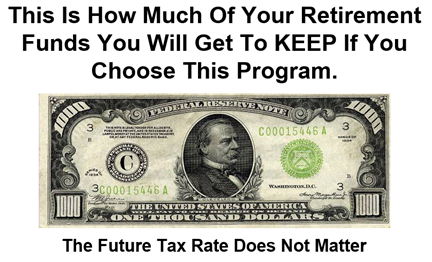

You Get To Keep It ALL. It’s 100% Tax-Free!

Plus, most people are going to need all the funds they can

get during retirement. Who knows what kinds of unforeseen medical expenses,

etc. will arise? It seems cruel to me that the Government steps in at a time

when most people can least afford to part with their money, and collects their share of people’s retirement funds.

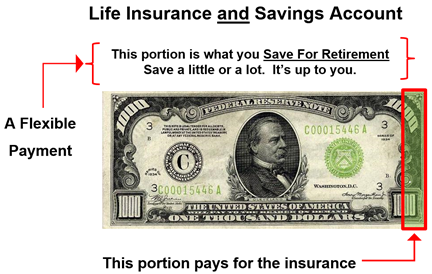

Now That Our IUL Account Is Funded, What Happens Next?

Death Benefit – The Life Insurance Portion

First off, you can have the additional peace of mind knowing

that in addition to having put investment funds into the finest retirement

programs in the world, you also have a fantastic life insurance policy, with a

great death benefit for your family should something happen to you. Some of our

clients look at this as an added perk and others look at it as a critical

aspect of this program.

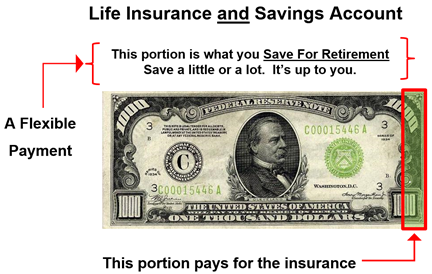

When you compare putting your funds into a qualified plan

like an IRA or a 401(k), versus putting them into our unique version of an IUL,

having the death benefit in place is a great extra benefit that you just don’t

get with the other qualified programs. The IUL is like having life insurance

and an iron-clad savings account, all rolled into one.

Death Benefit

Let’s say you put the $100,000 into a typical IRA or 401(k)

account, and let your broker or advisor (or even yourself) invest it. What do

you think they would say if you called them up the next day and said something

like, “Hey Bill, I was just wondering, you know the $100,000 you’re managing

for me in my IRA or 401(k)? I was just wondering, if I were to die prematurely,

how much of a death benefit would my family receive from my investment?”

I think you know what the answer would be, right? Your IRA

or 401(k) would simply become part of your estate, and your heirs would only

receive the actual value of the account, and not a penny more. Plus they would

most likely have to pay taxes on those funds.

The IUL option offers a significant death benefit that’s

usually much, much larger than the amount you invest. So it’s kind of like

getting the death benefit as a bonus, for the exact same amount of funds

invested.

While the death benefit proceeds are not estate-tax free

(unless special types of trusts are set up in advance), they are income

tax-free. If a policy holder has any loans out against his policy, (more on

this shortly), his tax-free and interest-free loans received are paid off and

then all remaining proceeds are paid to his beneficiary(s) income-tax free as

the death benefit.

While most of our focus in this book is on the retirement

aspect of this plan, let’s not forget how significant the death benefit can be

with an IUL. If you would like to have the numbers run for you so you can see

exactly how much of a death benefit you could have with a properly structured

IUL contact us, and we’ll be happy to run various illustrations for you.

Now, let’s do a quick comparison of this program to a typical IRA or

401(k).

Risks: If you put the $100,000 into a typical IRA or

401(k) account, you’re still subject to all the ups and downs of the market,

and you have full risk. You may be saying to yourself, but my broker or advisor

is really watching it carefully. Haaa. Do you remember just how many of the

guru super smart brokers and advisors totally got the market wrong in 2008?

These were trained and experienced professionals who have access to the best

data in the world, and most of them missed it by a mile and got creamed.

Do you really think they’ve learned from history and will

avoid it next time? Do you think history repeats itself? If you are either

running out of time or simply sick-and-tired of taking these gigantic hits to

your retirement account, then this solution offers a much better alternative.

How Your Funds Increase In Value

As we have mentioned above, each IUL account is set up

specifically for each individual’s needs. For many accounts, we recommend that

they choose a blended indexed account strategy. (We review all the options with

you, and you choose the ones that are best suited for you). Plus, you can

easily change your selections from time to time.

Our blended index is made up of the S&P 500 (35%),

Russell 2000 (10%), Barclays Capital U.S. Aggregate Bond Index (35%), and

EUROSTOXX50 (20%).

Each year, the cash value of your account gets credited with

an amount of interest gain based on the performance of the blended index.

Just so we are clear here; your funds are not actually

invested in the stock market nor in these indexes themselves. They are just

credited with the performance gains of the index blend. Here’s the REALLY GOOD

PART….

You Can NEVER Lose Money Due to Market Downturns.

It’s true. When you use our flagship IUL product, you are

100% GUARANTEED to NEVER LOSE MONEY with your account due to market downturns. To

protect you, your money and your retirement, we have a guaranteed 0% base. We

also have a 17% cap on returns. This is such an amazingly powerful part of the

Barefoot Retirement Program. Let’s look at an example to better understand

this.

Let’s say you have $100,000 in your IUL account, and you’ve

chosen the blended index. Now, let’s say the stock market and the S&P 500

index falls 38% like it did in 2008. No problem. You have a 0% guaranteed base

so you can NEVER lose money. So at the end of that year, let’s say the blended

index was down 38%, your account would be credited 0%, or in other words, it

would still be worth $100,000 (fewer internal expenses like cost of insurance

in the early years). (However, you would NOT have sustained a 38% loss, and

your account would not have gone down to $62,000.)

Now, let’s say the next year, the market and the blended

index value goes up 20%. At the end of the year, your account will be credited

a 17% gain, or an additional $17,000 since we have a cap at 17%. So you may be

thinking, yes… but I got jipped out of the additional 3%. True, kind-of. However, would you like to take a guess of how this works out over the long

run? Just wait until you see this next example.