Chapter 17

Part 2: Outside Investment Accelerator or (Double Dipping)

Now we’re going to really get into the strategies that the

ultra-rich have been using for centuries to massively grow their wealth. For

the most part, these strategies have been largely unknown and unavailable to

the average investor. Up until now, there’s simply been few easy and affordable

vehicles available for the average person to participate in this type of thing

unless you had an army of attorneys and the best financial minds on the planet

devising and implementing these types of multiplication strategies.

Lucky for us, the Government has granted these amazing

options as part of the specialized benefits of IUL policies. If you work with a

skilled and specially trained advisor, and set up and fund your IUL policy

correctly…

This is such a powerful program! When you fully understand

how much of a difference it can make in your retirement program, you will lose

some sleep thinking about it for sure.

Our clients are absolutely delighted with this option. It

gives them diversification and outstanding peace of mind. They know their IUL

retirement program has the potential to grow and grow with no market downside

risk, while they invest those same funds into other areas.

Some clients are content to just stay with core part of the

IUL program and not take advantage of the leveraging options the program

offers. And that’s perfectly fine. It’s your choice.

Everyone has different needs and tolerances, and you should

always do what you’re comfortable with. However, if you’re looking for a way to

possibly put your retirement on steroids, you’re going to love Part 2.

Often when clients first come to us, they plug their numbers

into our custom Barefoot Retirement calculator that we give you and discover

that they’re not going to have near enough to retire the way they want to.

Their options are often limited to;

(a) Keep doing what they have been doing and make the

decision to continue working during retirement.

(b) Decide to retire at a much lower standard of living than

they had hoped to.

(c) Choose to utilize the power of leverage and put their

retirement funds to work for them, on double duty, to potentially make up lost

ground and still be able to reach their retirement goals.

We use a number of different names to describe the concept,

but one of the main ones is:

The Power of LEVERAGE is amazing! Now, you don’t have to

settle for either/or if you don’t want to. This strategy gives you the power to

employ 2 different investment options, with the same money, at the same time,

and earn returns on BOTH of them. And before you ask, of course this is

100% legal, ethical, moral and doable.

First let me give you a simplified general idea of the

strategy, then I’ll break it down into detail of how it works within our

strategy.

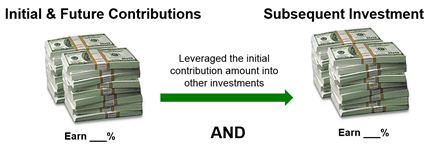

Let’s just say you had $100,000, and you put it into our

blended index fund. This concept allows you to keep the initial $100,000

working and earning for you, but allows you to borrow against it and invest the

majority of those same funds into any type of investment you wish. Any type! And it gives you the potential to earn two different returns on the same

money.

So if your investments perform well, you have the potential

to earn two different returns on the SAME funds. Pretty amazing, right? Can you

imagine how much faster your retirement funds could grow if you had them

working for you in two different places at the same time?

To put this in perspective, let’s compare this to a regular

IRA or 401k. Try calling up your broker and saying something like this, “He

Bill. You know the 100k I invested in my IRA? I want to take most of it out and

invest it in something else, but I want to keep earning the standard returns

you get for me on the 100k in my IRA. That’s okay, right? I mean, you can do

that for me, right?” Just try that and see what happens.

Now, let’s break this down and see exactly how this works.

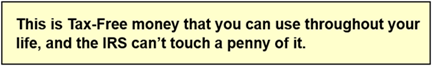

First off, it’s important to know that a life insurance

policy is by definition tax-deferred, it’s not tax-free. The cash value of an

IUL policy grows without being taxed. However, IF the money is “withdrawn,” then all the gains within the policy (the amount earned in addition to the

total premiums paid) will be taxed as income and not as capital gains. Rest

assured that our strategy does not involve ‘withdrawing’ your funds nor having

to pay taxes on them.

Our method gives you Tax-Free Access to your funds.

The key is doing it correctly, and that’s why it is so important to work with

people who are specifically skilled on these exact types of policies like our

team is.

Our clients use a contractual policy feature that allows a

policy holder to have access to tax-free money in their policy by using their

life insurance cash value as collateral. It’s called a Policy Loan Provision and

is one of the most valuable and amazing aspects of this program. When executed

correctly, the policy owner is able to avoid any and ALL taxes on the funds

they receive. The distinction here is that it is simply a loan from a financial

institution and NOT a withdrawal from an insurance policy.

(Note, a policy holder is able to take a tax-free withdrawal from their policy only up to the amount of total premiums paid into the policy

to date, subject to surrender charges, because those funds were taxed before

they went into the policy. If you choose to withdraw funds above the total

premiums paid, the withdrawal of the gain is taxed as income. When using our

strategy correctly, you will not be withdrawing funds.)

When you use the policy loan provision correctly, as we

advise you, you take out a loan AGAINST the cash value in the policy. You are

not taking out a loan FROM the cash value and there is a huge difference here.

The cash value within the policy is the collateral for the loan.

Remember when you borrowed money to buy your last car? Was

the loan that you got from the bank taxed? No. Loans are not taxed. Yes, you

probably paid tax on the car when you bought it but the loan itself was not

taxed. The distinction here is that loans are not taxed. When you buy goods and

services, they are taxed, but not loans.

Also, when you borrow money in the form of a loan, you have

to pay interest on the loan, right? Correct. That’s true. When setting up your

IUL and structuring policy loans, there are quite a few different options

available and your advisor will give you great advice in this area. At the time

this book is being written, the average amount charged for policy loans by the

issuing insurance company is around 4.5%.

So how and when do we pay the cost of funds back?

As you may have guessed by now, there are lots of different

options here.

Option 1: You NEVER have to pay it back during your

lifetime. That’s right? If you don’t pay the interest back the insurance

company will simply deduct it from your death benefit amount. They policy

should still be monitored carefully each year to ensure the ratios are fine,

but as long as you do this correctly, you can take out a lone against your

policy and never, ever have to pay it back if you don’t wish to. I’ll show you an

example of how this works in just a moment.

Option 2: You can pay back as much as you wish, when

you wish. You have total flexibility here. You get to choose if you want to pay

back the interest charges and if so, how much you want to pay back and when you

want to pay them back. (Don’t you wish your bank was this easy to work with?)

Option 3: Wash Loan Provision. One of your options is

to choose a fixed indexed return on the cash value of your account. Currently,

the fixed return is around 3.5%. These amounts do vary from time to time but

generally speaking, if it cost you 4.5% to borrow the funds, and if you can

choose to receive a 3.5% fixed return, then the net cost of your loan is only

about 1%. Plus, with our flagship product, after 10 years the company drops the

wash loan amount down to .1%.

While most people borrow the funds against their policies

from the insurance company itself, you always have to option to go to any

outside institution and borrow the funds from them. Some of our clients are

doing this right now and are borrowing from banks at rates around 2% to 3%. Why

you may ask would a bank give a borrower such a low rate? It’s because the loan

is collateralized by the cash value of the life insurance policy, and that’s

one of the most secure forms of collateral a lender can have. Note, getting a

lone from a bank is not guaranteed and may require work than just calling the

insurance company.

How Long Do You Have To Wait To Borrow Funds From Your Policy?

Most similar policies and most Whole Life policies require

that you wait many years before you can begin to borrow funds from your policy.

However, some of our clients choose to purchase a rider on

their policy that enables them to borrow up to approximately 80% of the cash

value of their policy beginning in the very first month that your policy is

taken out. This can be a huge benefit. (Note: There are lots of options when

setting up these policies so the percentage amount that can be borrowed can

vary depending on many variables.)

The great news is that since the funds are distributed as a

loan, they DO NOT show up in any tax reporting, and they will NOT be shown on

your tax returns.

Hence, it's PRIVATE!

For most of the people I know and talk with, privacy is a

huge issue these days. The more they can stay off the grid, the better!

It’s important to note that you shouldn’t take too much

money out of your policy to the point that the policy becomes non

self-sustaining. Again, this is where your advisor and help keep your policy

safeguarded and functioning correctly. It’s not hard to do at all, but you

should just be aware of it and monitor it from time to time.

What Does My Policy Look Like If I Never Pay My Loans Back?

Some people initially have a hard time wrapping their mind

around this concept. It just doesn’t seem plausible that you can borrow the

money from your policy, not pay a single penny back, and still have your policy

give you a great lifetime, tax-free income… Plus have the money you borrowed

out of it to boot. Right? Well, I totally understand that. I’ll prove it to you

right now with an actual IUL illustration.

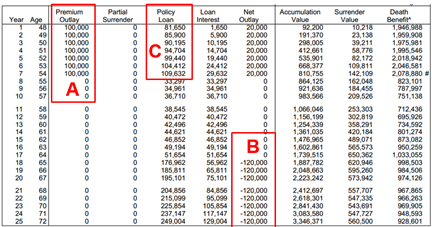

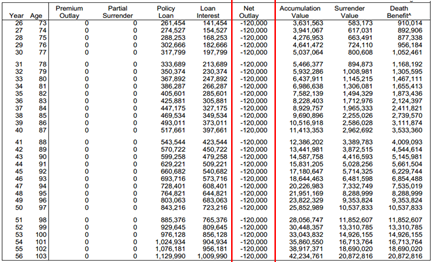

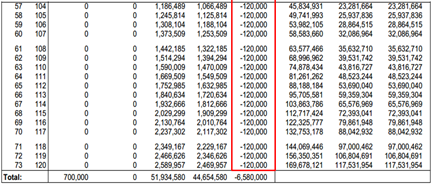

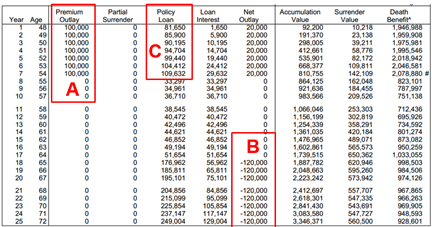

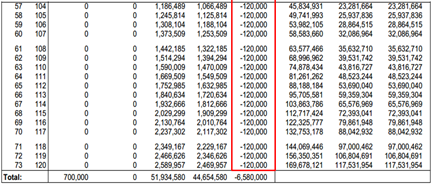

In this illustration below we took a 48-year-old man whom we

will call Don and structured the policy where he would invest $100,000 per

year, each year, for 7 years. After the 7th year, Don would NEVER

have to put another penny into the policy, ever.

(If you happen not to be a high-income earner or don’t have

a larger amount to invest, please don’t let the $100,000 example scare you.

It’s an easy round number to demonstrate this with. If you only have several

hundred dollars a month to put into a policy, you can still participate

and still get ALL of the awesome benefits of this program.)

Without getting into all of the details of the illustration

below, let’s just focus on a few main points.

A. In the red box area where you see the A, that

shows where the policy holder invests $100,000 per year for 7 years. That was

his premium outlay amount.

B. In the red box area where you see the B, that

shows where the policy holder borrowed $80,000 a year from his policy, each

year, for 7 years. Over 7 years Don borrows $560,000 from the policy. (More

detail on this in a moment. We can also structure policies where you can borrow

over 90% however, we wanted to keep this example somewhat conservative.)

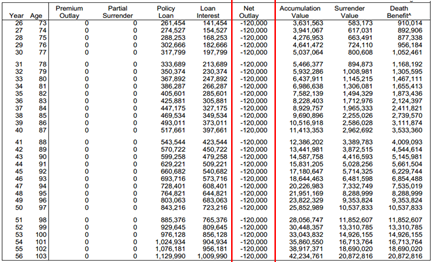

C. In the red box area where you see the C, that

shows where the policy holder, at age 65 starts borrowing $120,000 of tax-free

money, each and every year, until he dies or until he reaches 120 years old.

It’s that absolutely amazing!

Here the policy holder borrows $80,000 a year for each of

the 7 years. He can choose to borrow nothing, or chose to borrow any amount he

wishes per year, up to the $80,000 amount shown in this illustration. He can

take that $80,000 a year and invest it in ANYTHING he wants to. He does not

have to ask anyone for permission, and he does not have to abide by any

guidelines that dictate where he can put the money.

This is your retirement fund so it is serious business, and

you should only invest these funds into solid and safe investments that you

believe will serve you the best. But just to be crystal clear and to make a

point, if you want to borrow those funds and take a vacation around the world,

you could. You could choose to spend it all on a new home or boat, plane, on

medical costs, give it to charity, or buy anything your heart desires. The

point is, YOU get to choose. Neither the Government nor any other entity

is there to tell you what you can and cannot do with your money.

Hopefully, the policy holder will choose wisely and make

wise investments that will help fund the retirement of his dreams. If he makes

some wise investment decisions, he could turn that $560,000 into millions, by

the time he retires.

Here is the great part. It doesn’t matter if he makes millions

with the funds borrowed, or if he lost it all on a wild weekend in Las Vegas.

As long as the policy continues to perform as illustrated above, when he turns

age 65, he will get to take $120,000 of tax-free income out per year, each and

every year, until he either dies or reaches age 120. How powerful is that?

Imagine the peace-of-mind you could have with a safety-net like this?

By the way, if the policy holder happened to be in a 38% tax

bracket when he started taking out the funds, the $120,000 tax-free dollars a

year would be approximately the equivalent of $210,000 taxable dollars.

Lastly, the illustration above shows how the policy performs

if he chooses to never pay back a single penny of the funds he borrowed. If he

did choose to pay back some or all of the borrowed funds, the more he pays

back, the larger the Net Outlay is or the amount of tax-free dollars that he

gets to take out during retirement, each and every year until he dies or

reaches 120 years old.

In the example above, if Don paid back the loans he borrowed

each year, his net outlay would increase to approximately $240,000 per year

until he reaches 120 years old.

What Investment Options Do You Have With the Funds You Borrow?

That’s always a great question that comes up. The reason it

comes up so frequently is because most people are so “conditioned” by

the rules, regulations and restrictions of qualified retirement plans like

IRAs, 401(k), etc., they are just accustomed to having strict limitation’s

dictating what you can invest in and what you can’t invest in.

This is totally different.

With a properly structured IUL, you can invest in ANYTHING

you want. Anything! There are no limitations what-so-ever. You can keep your

IUL locked up, in the blended index account, earning 0% to 17% a year, with

zero chance of losing a penny due to market downturns, and then take out a lone

against your policy and invest it in anything you wish.

Here is a short list of just some of the things you can invest in:

• Businesses, business equipment, sustaining and growing

your business, business loans, etc.

• Real Estate of any type, notes and mortgages

• Precious Metals of any type (gold, silver, platinum,

palladium, etc.)

• Oil & Gas

• Stocks, Bonds, Mutual Funds, ETFs, etc.

• Art & Collectibles of any type

• Cars, boats, airplanes, etc. (It’s usually better to

choose assets that are likely to increase in value.)

With this program, you can invest in anything that makes

sense to you, that you believe you can make a positive return on, and that you

believe is wise and safe.