Chapter 16

How Does the IUL Compare To a ROTH IRA

We get this question from time to time. Some people will

say, “This sounds just like my ROTH account, without the insurance. I fund

my ROTH account with after taxed funds, my account grows over time, and I pay

no taxes on the funds when I pull them out in retirement.” That’s all true;

however, there are some MAJOR differences between the two programs.

Here’s a quick comparison: Currently, a ROTH IRA is

the only traditional financial retirement vehicle that allows you to withdraw

your money during retirement tax-free. However, the ROTH has two BIG

LIMITATIONS:

(1) Annual contributions are capped at approximately $5,500 per year. (The tax code is much too long to give all the details about

ROTH contributions here, but this amount will serve as a good general amount

for this discussion.) So your contribution amounts are very limited. If you

need to “make up lost ground” fast with your retirement program, this

limitation is going to severely limit you.

(2) Here’s another BIG problem with the ROTH. If you make

more than “approximately” $191,000 a year, you are NOT ALLOWED to open a

ROTH IRA. Boom. Door slammed in your face! The ROTH is simply not an

option for high- income earners.

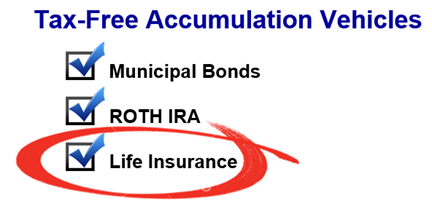

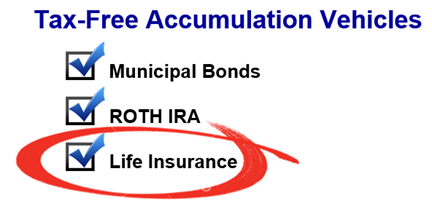

Tax-Free Retirement Options

If you’re convinced that Government spending is out of

control in this country, and you believe finding a tax-free retirement plan

will be one of the smartest moves you can make, you are basically limited to

only three options.

Municipal Bonds –

Income from municipal bonds is not subject to federal income

tax and depending on which state you live in, may be exempt from state and

local taxes. The problem with municipal bonds is that over time, they do not

have high enough returns to make them suitable for most people’s retirement

funds, plus they only offer limited diversification.

ROTH IRA –

As stated above, if you are a high-income earner, or if you

need to make up for lost ground with higher than allowed annual contributions,

you are out of luck with a ROTH. Plus, you have to adhere to the ROTH

withdrawal guidelines and have limited investment options.

Life Insurance –

Life Insurance is the hands-down clear winner here.

Depending on your qualifications, there is NO LIMIT to the amount you can

invest. So if you need to make up for lost ground, or if you want to sock away

a ton of money for retirement, life insurance lets you do that. You can invest

your funds in ANYTHING you wish and withdraw your funds at any time you wish

with no penalties or fees.

So if you are looking for a smart way to invest

larger sums of money into an account where you can withdraw it 100% tax-free, the

IUL is the ONLY real option.

As mentioned in the beginning of this book, that’s why so

many rich families, large companies and institutions are using this method so

aggressively. They desperately want to protect and save every penny they can

from taxes.