Chapter 21

The Best College Savings Program You’ve Never Heard Of

If you think this program looks good for adults structuring

it for retirement, you should see how well it works for young children.

Talk about the perfect college savings fund, this is

it.

Most of the traditional college type saving’s funds out

there are loaded with restrictions and limitations. As you know, this is

different.

Most of the popular collage savings programs limit you and

require that you ONLY use the funds for college tuition. If you take the funds

out for any other reason, you get slapped with big penalties and/or fines. What

if your child decides that college is not right for them? What if an unexpected

emergency comes up, and you need the funds for something else? If you are stuck

in one of those college savings programs, you simply do not have many good

options. You either use the funds for college, or you are forced to pay the

penalties and fees.

A properly structured and funded IUL can serve double

duty. You can set it up to take care of your child’s college expenses AND

also serve as a retirement program for them.

Simply put, this is how it works.

You fund an IUL for your child. You can start at any age,

even newborns. When your child reaches college age, IF they decide they don’t

want to go to college, no problem. YOU are in control. It’s YOUR policy. You

can use the funds for ANYTHING you want like helping your child start their own

business, travel the world or covering medical expenses. You can spend the

funds on anything wish; it doesn’t matter. There are NO RESTRICTIONS on

taking funds out and there are no penalties for taking funds out.

If your child does decide to go to college, you simply take

loans out against the policy to pay for college. The funds in the policy

CONTINE to have the ability to grow, depending on market conditions, even

though you borrowed against them.

You can then choose to pay back the loans, or not.

Then you simply let the policy grow until your child reaches retirement and

bingo, your child has a retirement program that they can rely on. This program

quite simply beats the pants off of ANY other college saving program anywhere!

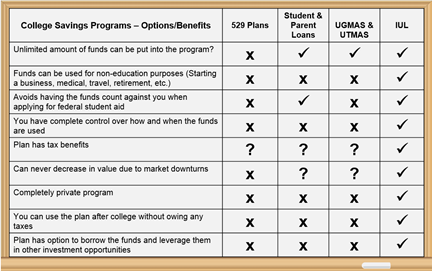

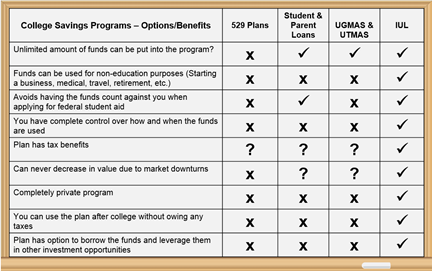

Check out how it compares to other plans on the chart below.

Just like for adults, we will be happy to run some analysis

for you on your children, grandchildren, etc. When you factor in the years

these young people will have to grow their IULs, the results can be amazing.