Chapter 3: Managing Debts, Efficiently

Why Do We Hate Monday Mornings?

… and Tuesday, Wednesday, Thursday Mornings?

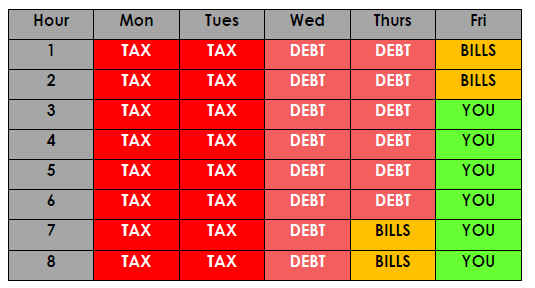

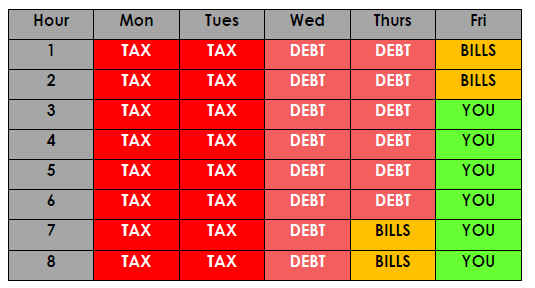

This table illustrates Mr & Mrs Average's working week based on a 40- hour week over 5 days.

You work Monday and Tuesday to pay the tax man (this is direct and indirect taxes). Wednesday and Thursday to pay your debts. The rest of Thursday and Friday Morning for your household bills and finally Friday afternoon for YOU!!

Now I know why I prefer Friday afternoons, how about you!!

Let's start by getting Wednesday and Thursday back in your pocket.

List Out All Debts

The first step to efficiently manage debts is to find out exactly what you owe and exactly what your income and expenditure is.

There are 2 things you will need to do.

i) Records every single transaction that you made. That includes ATM withdrawals. Jot down everything that you buy even if it is a cup of coffee or an ice cream.

The above will help you to monitor where your money goes to. Many people do not know where they spent their money. They buy things that they don't need and end up having lots of them.

Do the recording for a month and analyze how much you spent on food, transportation, leisure, groceries and such. Then, identify where you have overspent. Try to cut it down or see if you can replace it with something cheaper or better still, FREE!

Without spending on unnecessary things, you cut down your expenditure. Thus, creating more cash flow to reduce your debts!

ii) List out all debts that you know. Credit cards, car loan, mortgage loan, personal loan and money that you owe your friends.

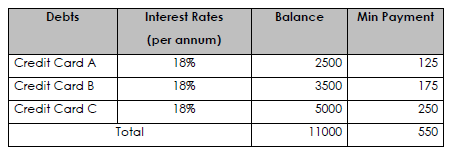

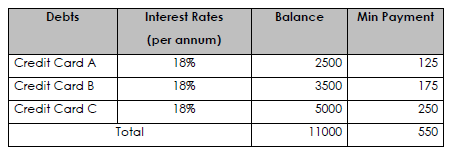

List them all out according to interest rates, from lowest to the highest. If they are all under the same interest rate (e.g. credit cards), list them according to the balance left, from lowest to highest.

Let's use the table below as example for credit card:

Pay Debts with Lower Interest + 10% more

The obvious way to do it is to first pay off balance for Credit Card A. The trick in this is to add 10% more to the minimum payment you make every month.

Which means, you will be paying RM375 instead for Credit Card A every month. Fix that RM250 extra payment. You will still need to pay for your Credit Card B & C but only the minimum payment.

What happen to your Credit Card A then? Every month, as you pay, your balance gets lower, which also means that the minimum payment is lesser. However, you still pay RM250 extra for Credit Card A. You will be able to clear Credit Card A in less than a year! (Provided you don't add on to the balance)

When it comes to Credit Card B & C, apply the same payment method. Add another RM250 to the