Chapter 4: Savings

Saving has always been a way of life for people who believed on its power. These people know that they have to save more money in order to create a more established future.

However, as time goes by, more and more people find it hard to save money. They said that saving is no longer a way of life but a resolution that they have to strictly adhere to just to put aside some amount of money.

Some people even insist that it is no longer possible for a person to save more money because most of them are already living paycheck to paycheck. With all the high-prices of commodities these days, saving more money seems like just a dream.

But the point is that people can indeed save more!

Pay Yourself First

The reason many people cannot save because they think that they don't have much to save. Have you heard of "I don't have money to save, wait till my income increase then I will have extra to save!"

Now, many didn't realize that when their income increases, so does their expenses. When you have more money, you then to spend more because you think you can afford it. Worse, if you think you can pay off the loan / debts with your new additional income.

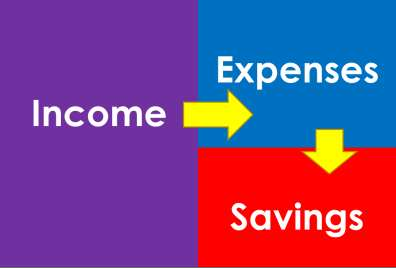

At the end of the day, you are back to square one - broke! The figure below illustrates how people spend their income.

Figure 4.1

Income - Expenses = Balance (Goes to Savings)

Most people practice the above model. They got their monthly salary, then they pay the bills, loans, debts, spend on food, leisure and then they 'try' to save whatever that is left.

The activity of saving needs two things to happen - motivation and habit. The amount of money is not the most important thing. No matter how much you save, be it RM1 or RM100, it is also a form of savings.

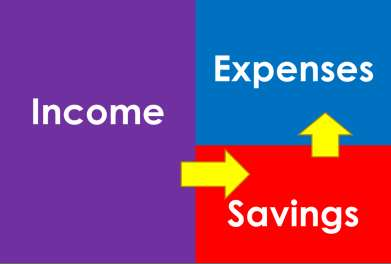

The concept of "Pay Yourself First" emphasize on the act of setting aside a certain amount of your income before you start spending. Thus, even if you spend all your money that is left, you already saved!

Figure 4.2

Income - Savings = Balance (Goes to Expenses)

With that, you will have the motivation to save because it is achievable! Don't worry about the amount because eventually 'little is better than none'.

Once you have the motivation to save, it is time to build a habit. Save a certain amount every day, every week or every month. Do it for at least 90 days and you will have the habit of saving.

But, how much every time?

As mention