CHAPTER 1 0

BOOM AND BUST

As chaotic as the 1970s had been in Texas, with winter natural gas shortages and gasoline lines, most of the next decade proved even tougher.

The 1980s did at least get off to a good start. The state's economy rose faster than a drugstore cowboy thrown from the mechanical bull at Gilley's Club, a country western dance hall in Houston owned by singer Mickey Gilley. Sales of 10-gallon hats with fancy feather bands and custom-made ostrich skin boots soared as Baby Boomers, even those who had descended on Texas from the North, decided they were urban cowboys and cowgirls. Private jets from Midland took oil men and their wives or girlfriends to Las Vegas for an evening of gambling and booze, or to Dallas to pick up another fur coat at Neiman Marcus. Willie Nelson sang, cocaine disappeared into nostrils up rolled $100 bills and with the hugely popular TV series Dallas extending the Texas myth worldwide, one of the weightier questions of the day became "Who Shot ]. R.?," a reference to the March 21, 1980, season finale in which lead character ]. R. Ewing-quintessential mythical Dallas oilman-took a bullet from a mysterious assailant.

By the summer of 1981, however, a new buzzword emerged in the news media, "glut." As in "oil glut." Time MagaZine said "the world temporarily floats in a glut of oil." The New York Times also used the g-word, announcing in ]une that an "oil glut…is here." Whistling past the proverbial graveyard, the head of Exxon said the industry faced only a temporary surplus of product, the use of "glut" merely being illustrative of "our American penchant for exaggerated language." The reality is that two factors led to a downward spiral in the price of crude, a reduction in U.S. energy consumption and over-production by an industry wanting to capitalize on the good times.

The drop in usage tied to the consumer's desire to save money when possible, coupled with a growing environmental movement. Having endured two rounds of gasoline lines and price hikes inside six years, U.S. consumers started being more judicious in their use of gasoline. Suddenly, foreign-made, higher-mileage vehicles began to be increasingly popular. Americans also had begun paying more attention to their monthly electric bill, turning off light switches and setting air conditioner thermostats higher than they used to.

Even with crude prices dropping while supply rose, Texas's economic adrenaline ran so strong that it took another four years before it became evident once again that Newton's Law applied to oil prices as well as anything else: What goes up, must come down.

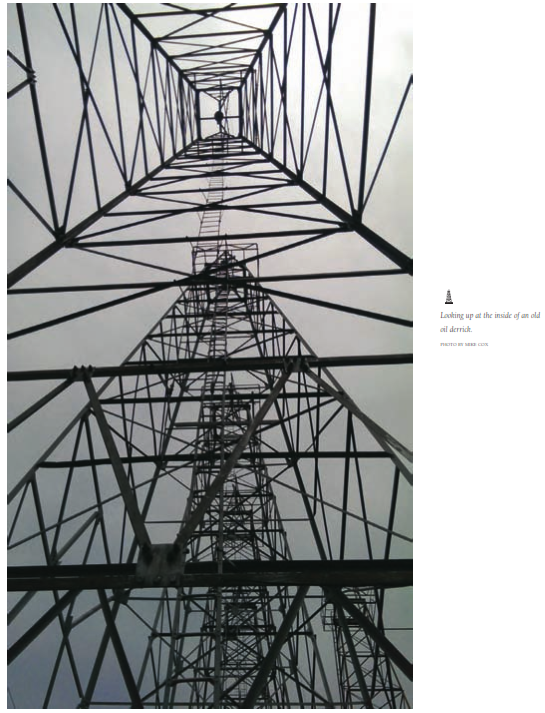

Oil prices started a slow slip in early 1982, holding at around $27 a barrel in 1985. Then prices collapsed like an old wooden derrick in a well fire, bottoming out at $10 in 1986. By the end of the year, it had become painfully evident to those associated with the Texas oil industry that rather than the much-repeated "$85 in '85" slogan, the reality was $10 in '86.

The initial impact of the oil bust came in the Permian Basin, which produced most of Texas' oil. Drilling slowed and exploration ceased. Oil field workers had to get by working reduced hours, though soon even that looked like a good deal as hundreds and then thousands lost their jobs while scores of independent operators lost their companies. On most days, Midland's posh Petroleum Club sat emptier than a rusted-out oil drum, though its bar had no shortage of men drowning their worries in a stiff drink or two or six. In October 1983, the Midland National Bank failed and had to be bailed out by the federal government, a particularly onerous development in that highly conservative city. Soon, owners of office buildings saw vacancy rates of 25 percent or more, housing construction starts stopped and the effect continued to spread like so much spilled oil.

"You're going to see the vast number of independents pretty well dried up," predicted William Fisher, then director of the Bureau of Economic Geology at the University of Texas. "They [independent oil companies] might have enough production to hang on, but they're not going to be plowing the money back in and drilling new wells."