Elliott Wave Principle

Now we will learn about some simple methods to predict future trend development (of course, with a certain degree of probability). How can it be done? Of course, we cannot see into the future, we cannot predict hurricanes, server crashes, law suits or hacker attacks. However, the point is that the evolution of prices depends largely on traders" psychology; and the behavior of a large number of people is statistically predictable.

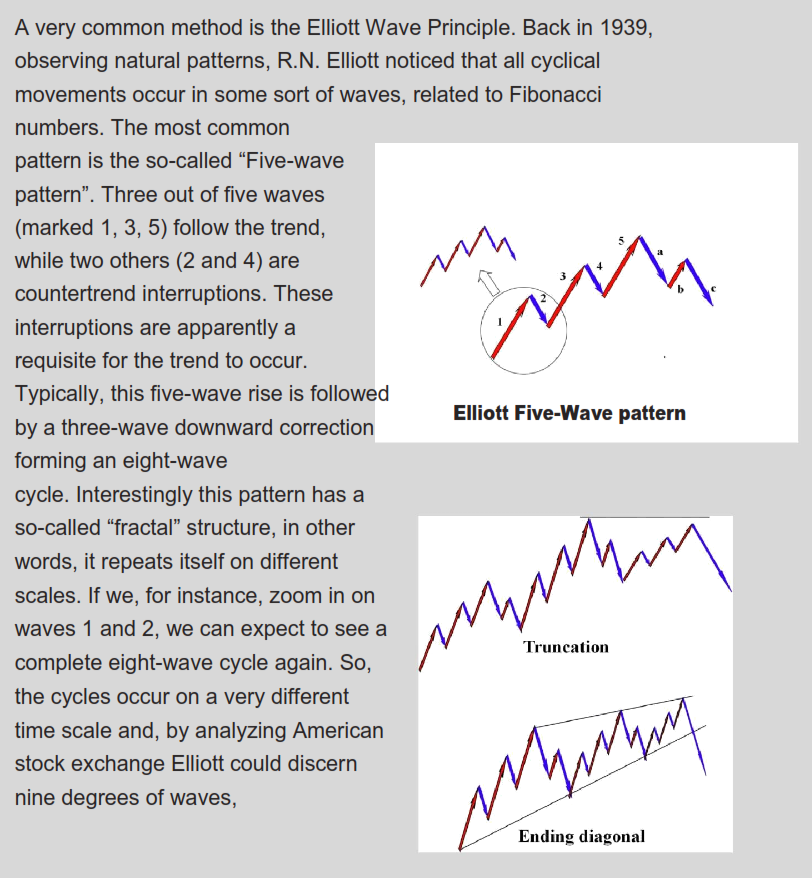

from a long-term Grand Cycle down to very short-term Subminuette. The figure shows schematically Elliott Wave for a bullish market, but a similar pattern (now, with a main trend downwards) will occur for a bearish market as well.

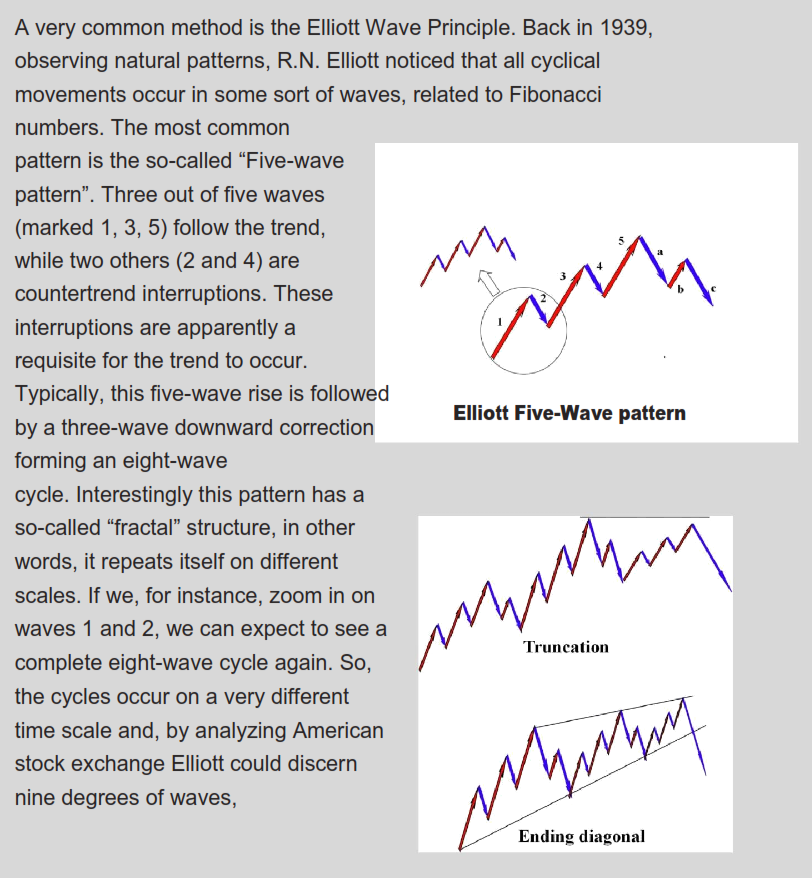

By following Elliott Wave, you can predict the next move of the market and, for instance, foresee the trend change. Two typical patterns indicating weakness of a bullish market are shown below: truncated fifth wave and diagonal triangles.

Elliott Waves Principle and Golden Ratio

Another dimension of the Elliott Waves Principle is the Fibonacci sequence. This sequence, in which the sum of two adjacent numbers produces the next element of the sequence, has been known to mathematicians for hundreds of years: 1, 1, 2, 3, 5, 8, 13, 21,… and so on to infinity. This sequence is ubiquitous in Nature and present on all scales from our DNA to the galaxies. One of its features is that the ratio of two subsequent terms approaches 1.618, the famous Golden Ratio. Coming back to the Elliott Waves, so-called Fibonacciretracements help to identify areas of support and resistance. For example, a sharp correction commonly tends to retrace around 0.618 of the preceding wave, while sideways correction often retraces 0.382 of the previous impulse wave. The Golden Ratio is also present as a ratio of the impulse waves, which are often related as equality, 1.618, or 2.618 ratios.

Elliott Waves Principle offers you a formidable arsenal for forecasting market movement, but you should always remember that we always talk about probabilities. If the market moves beyond the predicted pattern, meaning that your conclusion is wrong, then the funds at risk should be reclaimed immediately.

The science and practice of Elliott Waves is very rich and many observations have been made since the time they were first discovered. If you are interested, you can find a wealth of resources on internet. The web site of Elliott Wave International is a good starting point.

Your own trading system?

Based on technical analysis knowledge, you can develop your trading system. The first thing you need to set is the timeframe of your investment. If you can invest a large chunk of money, your preference will be a long-term investment. Long-term technical analysis produces more clear results since you can filter out all these day-to-day price fluctuation and look at long-term trends. If you cannot afford this, it is better to try medium and short range investments. This is a complicated task and I would advise you to start with a long-term technical analysis first, prove your ideas and predictions using historical data, and only then focus on a shorter timeframes. The next task of your trading system is to define the entry point. The first thing here is to determine the long-term trend.It is not advisable to open any position if the trend is downwards. The last and the most important task of you trading system is to define the exit point. You need to decide for yourself when you want to secure your profit (Take Profit level) and also place StopLoss level in the case when market starts to move in the oppositedirection.

Spoiler Alert:

You can develop your own system OR ... why not let an automated Robot trade for you? How about trading on Autopilot with a Bitcoin robot? By the end of our ebook, you will learn how you can profit with Bitcoin on Autopilot without need to develop a system yourself!