Bitcoin and transparency

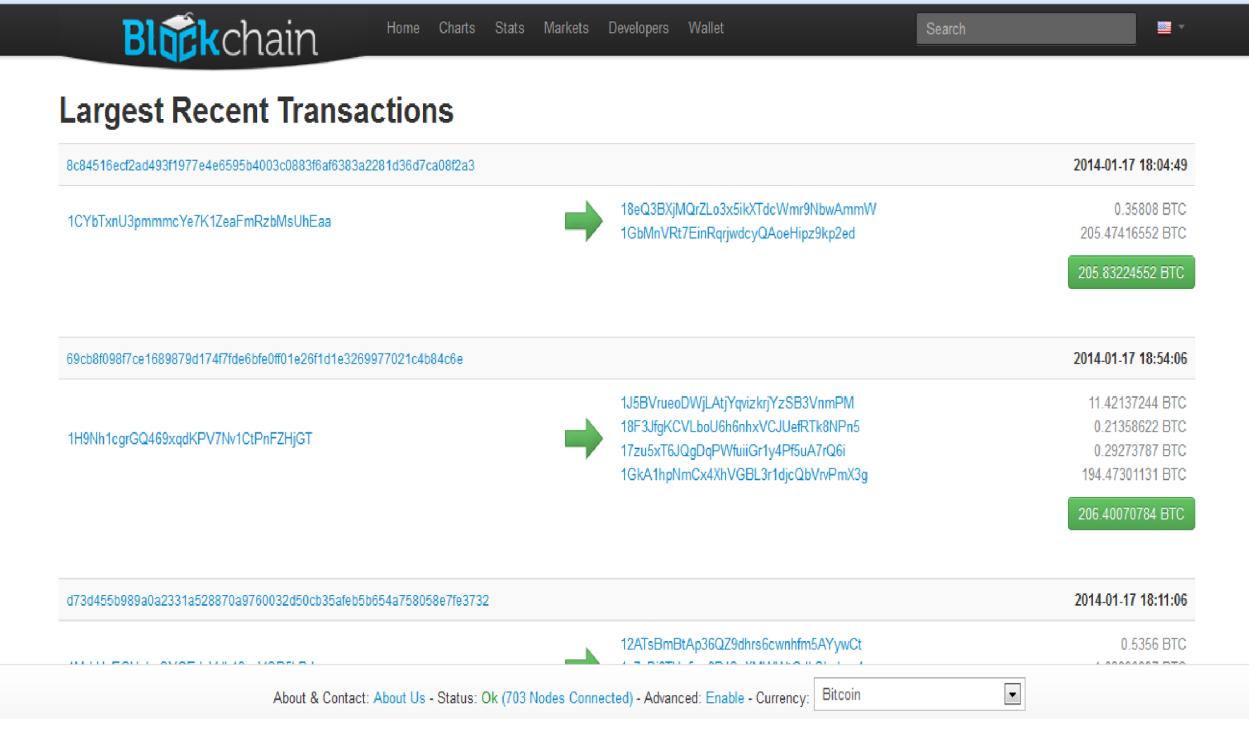

The picture above shows some of the recent large transactions recorded in the block chain. The first transaction is for 205 BTC, the equivalent of $51,250 at today's prices. The long lines of letters and numbers you see in the pic are bitcoin addresses. A bitcoin address consists of 27-34 alphanumeric characters, beginning with the number 1 or 3. You can have as many addresses as you want, they"re free and easy to generate.

Notice that there is no name that goes along with the bitcoin address. This is what outside observers mean when they say " Bitcoin is anonymous". Bitcoin is in fact "pseudo anonymous". While all bitcoin addresses and transactions are public, the holders of those addresses remain hidden.

The only thing that can be discerned by looking at the block chain is that address 1XXxxxXXXxxxxxxXX sent 100 Bitcoins to address 3XXxxxXXXxxXXxxXX at a certain time. Who sent the coins, the reason for sending, and the users location is not revealed.

However, keep in mind that as soon as you connect your bitcoin address to your real identity (for example, by purchasing bitcoins online or in a face to face meeting), the pseudo anonymity provided by bitcoin is lost. There are ways to regain the lost anonymity but that is beyond the scope of this introductory article.

Buying Your First Bitcoin

But how can you actually get a hold of a bitcoin? The easiest way to acquire bitcoins is to buy them at an online exchange. There are three major bitcoin exchanges, each of them with their own unique properties and a different fee structure.

Bitstamp.net

If you're European, Bitstamp is your best bet to get some bitcoins at a low cost. The company is based in Slovenia, part of the EU. Deposits by SEPA are free, withdrawals are charged a fixed 0.90€ fee once the funds are converted to Euros. Because Bitstamp only offers trading in BTC/USD (Bitcoin versus the US Dollar) all Euro transfers are immediately converted to Dollars. If you want to withdraw by SEPA, you have to convert your funds back to Euros.

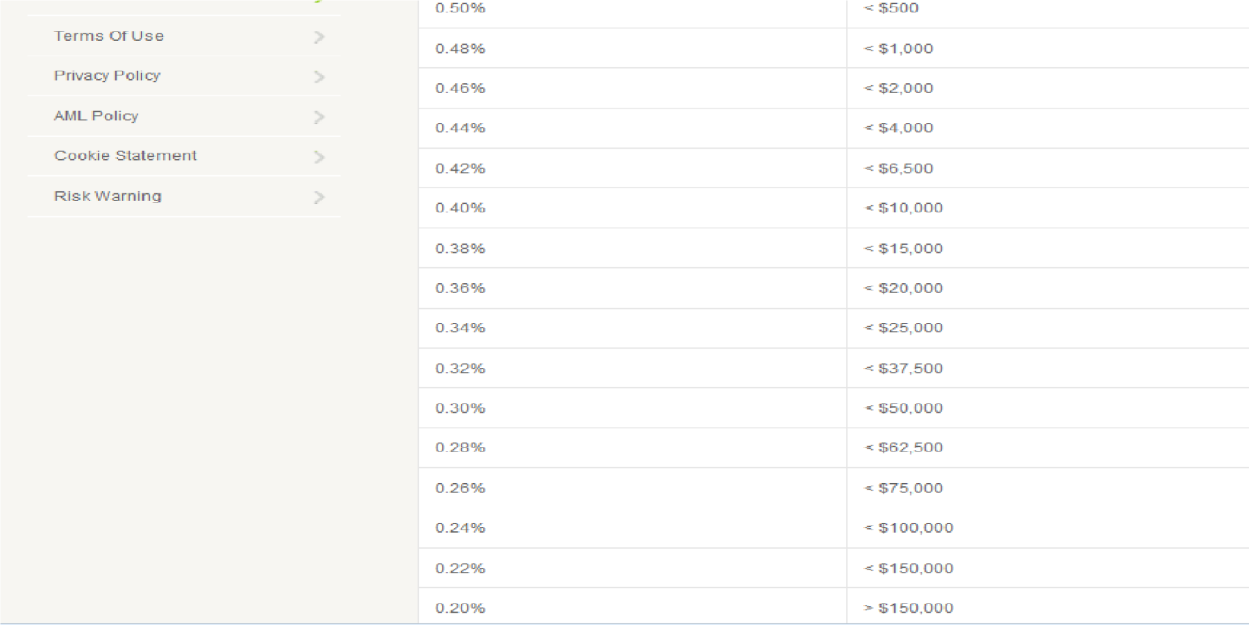

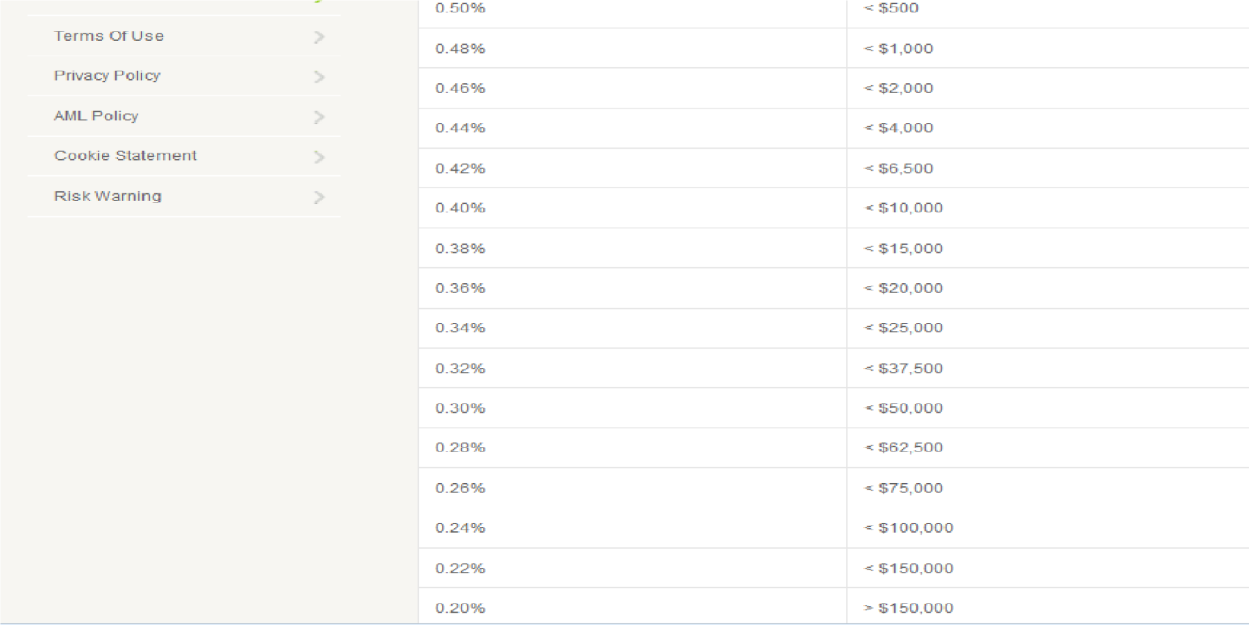

The fee structure favours big traders and market makers. The basic fee for new accounts starts at 0.5% and goes all the way down to 0.2% if you trade over $150,000 in one month.

Yes forex traders, you heard that right, the LOWEST fee structure is 0.2 percent. The 0.2% charge is per side, so you will get hit with this fee whenever you buy or sell bitcoins.

Luckily, the spread between the bid and the ask price is very low, most of the time ranging between 1 and 2 dollars. At a current bitcoin rate of $250, this amounts to an added cost of 0.1 to 0.25%. You only pay the spread if you want to enter a trade right away with a market order. If you placed a limit order to buy and you're willing to wait until someone wants to sell, you can purchase your bitcoins at a small discount at the bid and later sell them at the ask, pocketing the spread in the process.

Bitstamp has largely avoided the deposit and withdrawal problems that plague many bitcoin exchanges. With a lack of regulation on the upcoming virtual currency and its checkered past, many financial institutions remain reluctant to get involved with processing bitcoin related transactions. You can deposit funds in USD, EUR, GBP and CHF. US clients are accepted.