Coinbase.com

Coinbase is probably the easiest and safest way to purchase bitcoins in the U.S. Unlike BitStamp, Coinbase is not an exchange. They act as a counter-party to all customer trades, you buy or sell your bitcoins directly to Coinbase. The buy/sell fee is 1% on top of the buy/sell spread. The bid/ask is usually close to BitStamp where the firm gets its liquidity from. For example, the current bid is at $244.48 and the current ask is $247.07. In addition to this, the firm has daily limits on the amount of bitcoins bought/sold. These limits are not applied on the individual level. Basically Coinbase has a set amount of bitcoins that it is willing to buy or sell every day. During times or high volatility, users may not be able to buy/sell bitcoins until Coinbase decides to "refill" their stock. Here's a good explanation on this issue from their Customer Support:

‘’The limit you’re seeing is Coinbase’s daily limit being reached, not your personal limit. Sometimes the Coinbase site itself will run into a daily rolling limit on purchases or sales if there is an exceptional amount of activity in the bitcoin markets. We put up this temporary pause to make sure that we have enough funds to accommodate the transfer orders being created. This should be a rare exception rather than the general rule however. There is no specific time of the day where this limit starts – it’s on a 24 hour rolling basis. It might be best to check in at 6am or 7am Eastern Standard Time tomorrow. Sorry for any inconvenience this has caused you – we know this can be frustrating. This is something we’re working on as we speak.”

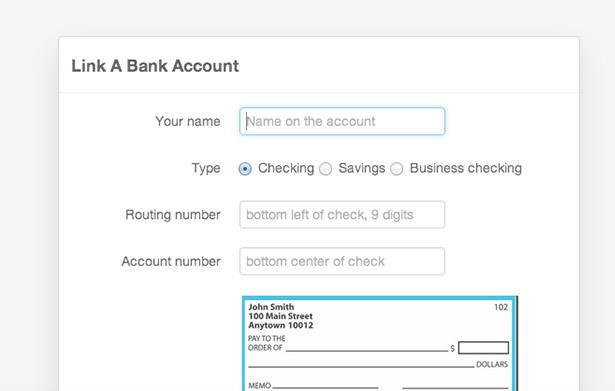

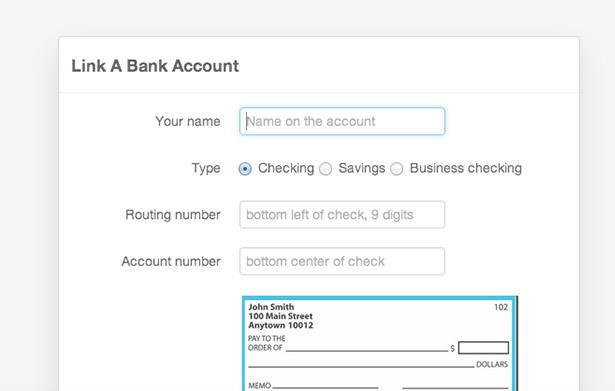

Coinbase claims that over 97% of all customer funds are stored offline in bank vaults to prevent theft or loss. If you live in the States, you can easily link your bank account to Coinbase to facilitate quick and easy bank transfers.

BTC-E.com

If you're a forex trader, BTC-E is probably the easiest exchange to get into. The company offers its own MetaTrader platform. The instrument comes with a leverage of 3 to 1 and the ability to short bitcoin. Shorting is not an option at Bitstamp. You can still sell any bitcoins you already own at these exchanges but you won't be able to short bitcoin outright.

The fees on MetaTrader are slightly higher, 0.3% per side compared to 0.2% if you used btc-e's web interface. If you're a forex trader btc-e might strike you as the best option of the three. But alas, nothing is as straightforward in bitcoin world.

No one knows who the real owners behind btc-e are. Apparently the headquarters of the company are in Bulgaria and the support staff is more familiar with Russian then with English, but the rest is a mystery. The company operates a complicated deposit and withdrawal process that relays the money through several banks and payment processors before depositing them to your account. If you plan to deposit on BTC-E, make sure to follow their deposit instructions to the letter. Because the deposits go through a web of banks, tracking down a lost deposit is near to impossible.

On the plus side, the company does offer deposit and withdrawal by several popular e-wallets like Webmoney, PerfectMoney, Ukash and Paypal (withdrawal only $500 minimum). According to user reviews, deposits and withdrawal by these methods are a lot faster and smoother compared to bank wires.

BTC-E does accept US clients. However, starting from the middle of December 2013, the company stopped processing US dollar wires or any wires connected to a US bank. Here is an email reply to a customer's question on this: "We don't accept international wire transfers from US Citizens or from US Banks. All transfers from US Citizens or US Bank will be refused by bank."

Other ways to purchase bitcoins

Aside from the exchanges, you can also buy bitcoins on ebay and similar auction sites. Keep in mind that due to the possibility for chargebacks and fraud, bitcoin and other cryptocurrencies trade at a premium on ebay. Face to face meetups are another option to acquire bitcoins. Checklocalbitcoins.com for bitcoin sellers and buyers near your area. Always exercise caution when doing an offline exchange. Meet during the daytime and in places with a lot of people around. If possible, bring a friend.

We'll leave the choice of where to buy your first bitcoin up to you, we hope that our presentation relayed enough information to help you make an informed decision. It all depends on your needs and requirements. Some exchanges are better for trading, others have superior banking relations with bankwire deposit and withdrawal options.

Leveraged Bitcoin Trading

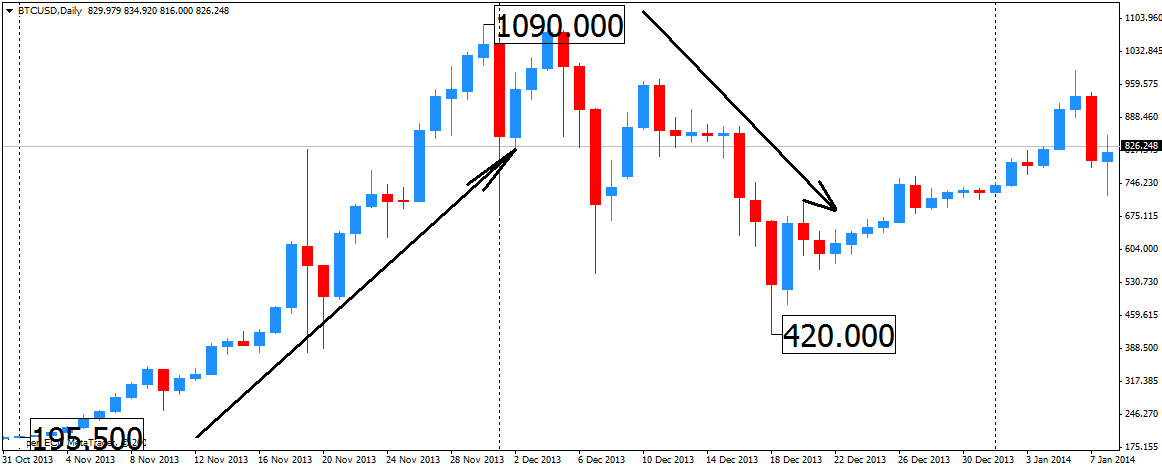

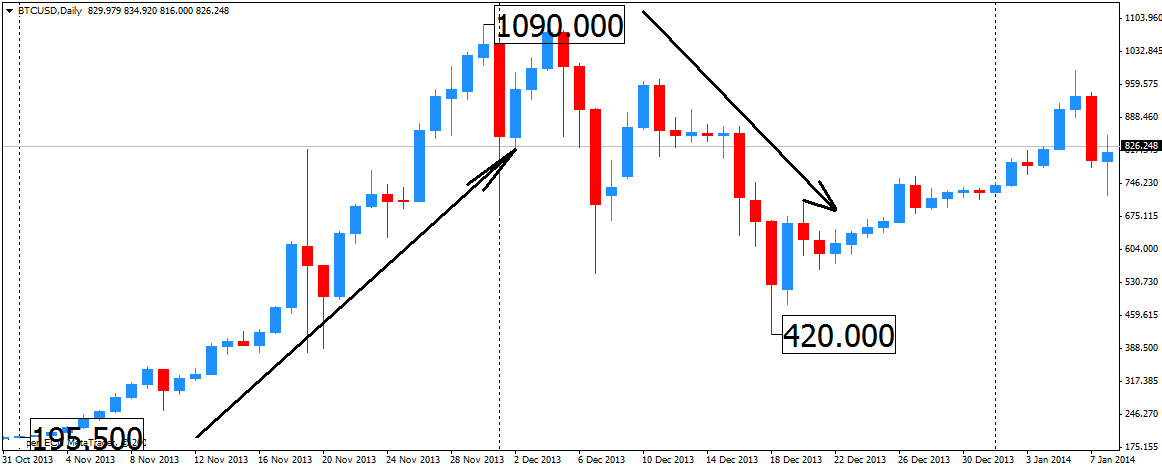

In this section we"ll go over several options for trading bitcoin on margin. We'll also outline the options to short the virtual currency. Before we go any further, a caution is in order. Bitcoin prices are highly volatile. Prices rose from a low of 195.50 on November 1st to a high of 1,090 by November 30th 2013. From here, the btc price crashed to a low of 420 on December 18th, only to go back up and retest the 1,000 level in January of last year. One bitcoin is currently worth 247.88 on btc-e. The chart below demonstrates this volatility.

Unlike major forex currency pairs which barely move 1 percent per day, bitcoin prices can rise or fall over 30 percent in a single day. If you know how to trade, you don't really need any leverage to make money with bitcoin. With that caution out of the way, let's get down to business and go over some of the options for leveraged btc trading.

We already wrote about one of the more competitive options for shorting bitcoin and leveraged trading, BTC-E. The Bulgarian exchange offers the popular MetaTrader platform with 3 to 1 leverage, shorting capability and a low fee of 0.3 percent per side.

AVA Trade

AVA Trade is a forex broker that offers bitcoin trading through a CFD. Two bitcoin CFDs are available, Bitcoin Mini and Bitcoin Weekly. The Bitcoin Weekly CFD has a 20 to 1 leverage and expires every Friday at 21:00 GMT. The Bitcoin Mini only has a 2 to 1 leverage but doesn't expire. Both contracts are using data from BTC-E and AVA Trade adds around 10$ premium on top of the exchange spread.