they do now.

Gold and silver are more popular as real money now than they have been since the gold standard was abandoned in 1971. There is a site called GoldMoney.com that

allows individuals to set up accounts based in gold.

The money in these accounts can then be used to purchase any goods and services

available over the Internet. Some states like Montana have even gone so far as to make gold a legal tender currency for use in commercial transactions within the

state.

35 - Chapter 3 - The Time Is Right for Precious Metal Investment Profit

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market These are just two more example of how these two precious metals can be used in

the exchange for goods with unfailing confidence. As world governments continue

to debase and over print their paper currencies, you can count on seeing a greater number of people turn back to gold as the ultimate store of value and even

currency with which to purchase goods and services. This is because unlike any

paper currency, be it the dollar, euro, or pound, gold and silver have real intrinsic value whose worth is not based on simply a faith in or the credit of any

government or organization.

Gold and Silver Have a Long History Together

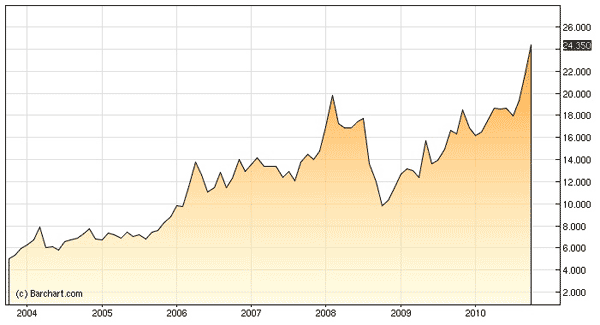

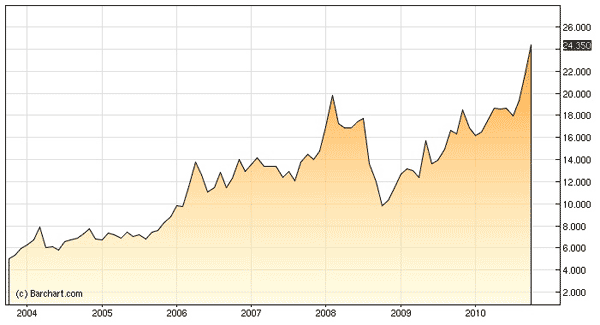

An overall boom in commodities began back in 2000 and is still very much

ongoing. Some have questioned how much longer this ten year long commodity

run can continue to last, since the gains have been so spectacular already.

Gold is up from $272 in 2000 to over $1,340 so far in 2010.

36 - Chapter 3 - The Time Is Right for Precious Metal Investment Profit

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market This represents an impressive over 390 percent gain so far, averaging over 30

percent returns per year. Silver is similarly performing well. Having begun the

decade at an average of $5 per ounce, it has gained to about $23 per ounce so far in 2010.

This also represents a major gain of three hundred and 65 percent, translating to

more than 30 percent average gains per year for ten years.

In light of these astonishing gains in the two precious metals, it is understandable that you may be in the ranks of those who are afraid of getting on to the gold and silver metals train after it has finished its monumental run. This happening now is unlikely to be the case for a variety of reasons.

The first reason for this is that bull markets typically run for twenty year time periods. If you were to take a look back at the history of such commodity bull

markets, then you would find that none of them lasted for less than fifteen to

sixteen years. In fact, the average commodity bull market runs closer to twenty

years. This is just the nature of the commodities cycle.

The twenty years before the major run began in 2000 mostly represented a

twenty year bear market cycle. When you consider the sixteen to twenty year

period that commodity bull runs always last, then you can relax in knowing that

we are only ten years into this particular commodity bull run.

The next reason that you should not be afraid that the commodity bull market will continue is because of the underlying supply and demand fundamentals for both

silver and gold. The demand for both has been rising in the wake of the Great

Recession, while supply is at a stand still or in decline.

Gold is the first case study of this. Even at record high prices, gold continues to be in high demand from India and China. The people of these two countries mostly

buy it in the form of gold jewelry and are expected to continue to do so.

37 - Chapter 3 - The Time Is Right for Precious Metal Investment Profit

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market Retail investment from Europe and the United States continues to grow and reduce available gold supplies.

In the last few years, the U.S. mint has even had to suspend orders for gold coins for the year on several different occasions as they ran out of bullion blanks to utilize. Besides this, gold demand in China is anticipated to expand significantly over a longer term time frame. Not only is the Chinese Central Bank looking to

increase its percentage of reserves that are kept in gold whenever it can, but The People’s Bank of China has recently produced a report that they expect will

encourage the demand for private individual gold for investments in the near

future.

Also, demand for gold in some electronics has picked up with the expanding global recovery. All of these demand factors point to an increase in the need for gold at a time when supplies simply are tight.

Gold supplies mined from the ground are no longer growing as they once were.

This is despite the fact that with record high prices, companies that are able to produce gold are aggressively trying to mine and sell more of it from remote parts of the world.

In fact, the worldwide gold production is actually in a terminal decline in spite of these ever expanding highs for gold. Aaron Regent, the president of the world’s

largest gold mining company Barrick Gold, has said that the worldwide production of gold has actually been declining by about a million ounces of gold per year

since the beginning of the gold bull market run back in 2000.

To make matter worse, the total gold mine supply has actually plummeted by ten

percent with ore quality dissipating. Regent claims that Peak Gold may have

already been reached. This is the point where the future output of gold will only decline year on year going forward, as all of the easily mined gold has already

been extracted from the earth.

38 - Chapter 3 - The Time Is Right for Precious Metal Investment Profit

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market Since production peaked in 2000 and has steadily declined since that point, and

Barrick Gold predicts that the decline will only continue and intensify as gold ore is becoming harder to find, the supplies of gold will only continue to tighten over time. This fundamental, coupled with the steady and rising demand, should

continue to support the gold bullion bull market for years to come.

Silver’s story is the same as gold’s where demand is concerned.

The demand for silver has been outstripping supply since 1996 or earlier.

The demand only continues to grow for silver as its industrial uses are expanded with new applications found for the versatile metal with practically every passing day.

Some experts have claimed that the yearly shortfall in silver could increase to up to two hundred and fifty million ounces of silver as new demands for silver grow and expand in popularity. This sounds far more significant when you consider that the present above ground inventories for silver are only six hundred million ounces.

The growing demand for silver is what will ultimately support the prices and even take them significantly higher. When silver reached its previous peak in 1980 at about $42.50 per ounce, fully one and a half billion additional ounces of silver billion existed than do now. Yet the price still shot up to nearly $50 an ounce.

Demand for silver is what will drive it once again.

The difference between 1980 and now is that a shift has taken place in the amount of silver that is available, all the while the many industrial uses and investment demands for silver are steadily and surely increasing.

Between the historical facts of bull market minimum fifteen year cycles and the

rising demand and falling supplies for silver and gold, the needed fundamentals to keep the price steady and rising are present.

39 - Chapter 3 - The Time Is Right for Precious Metal Investment Profit

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market All that you have to do is to take a look at the numbers. You will overcome your fears of having missed out on the bull market in silver and gold when you do.

Gold and Silver Provide the Best Defense

Yet another reason to own gold and silver today is because of the two precious

metals’ roles as safe havens in times of economic crises. There are two different aspects to this argument for owning gold and silver. The first is as a safe haven against a declining dollar. The second is as a safe haven against instability and crises in the world in general. Both are viable reasons underpinning the ongoing prices of gold and silver.

Gold and silver make the ultimate hedges against declining dollars for a very

simple reason. Both metals are actually priced in U.S. dollars, meaning that they are both bought and sold in them.

Any type of decline in the underlying dollar value means that the actual prices of

gold and silver can be counted on to rise, even if not in a perfect ratio.

You might ask why this should matter. After all, the U.S. dollar still proves to be the reserve currency of the whole world. It is the basic exchange medium used in international kinds of transactions, the base currency that all equities and

commodities are figured up in, the world’s main place to park savings no matter

what country a person lives in, and still the currency that is more held by the

central banks of the world than any other rival currency.

The truth is that nothing backs it up since the abandoning of the gold standard but confidence in the full faith and credit of the U.S. government. As you have read before, confidence is a shaky thing, particularly in the day and age in which you live.

It can crumple overnight, spurred on by a refusal of the Chinese to buy any more of our mountains of debt issued, or a severe terrorist attack.

40 - Chapter 3 - The Time Is Right for Precious Metal Investment Profit

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market When the confidence goes, the value of the dollar can wilt away faster than you

might believe to be possible.

In the end, the dollar represents nothing more than a promise and a