Before going on it will be helpful to introduce balance

sheets, because these are vital to banks, as indeed they are to any business.

A balance sheet presents a snapshot of the financial state

of a business at a specific point in time, indicating the nature and value of

all its assets (money and wealth that the business owns or is owed) and

liabilities (money and wealth in the custody of the business owned by others or

due to be paid or transferred to others), and therefore whether or not the

business is solvent (its assets exceed its liabilities). Balance sheets arise

out of the process of double-entry bookkeeping, which is a powerful and

informative way to set down transactions that the business carries out. They

consist of a number of linked accounts, each account representing an entity

that can both give and receive value, the most important ones exchanging value

between the business and the outside world. The accounts are meaningful with

respect to the nature of the business. Imagine the accounts as pots containing quantities

(which can also be deficits) of money or things of value related to the

business. All value associated with the business is represented by the accounts,

which give a continuously changing picture of the financial state of the

business as it carries out its transactions. Values, whether of wealth or

money, are always expressed in terms of money, but money need not always change

hands.

Balance sheet accounting can become quite complex, but it will

be sufficient for our purposes to take a simple approach. Every business

transaction involves two accounts (sometimes more, but we'll consider only two),

one that gives value, either to the outside world or to another account, and

one that receives value, either from the outside world or from the giving

account. The fact that entries are made in two accounts gives rise to the term 'double-entry'.

The account that gives value is credited - it has the value given added to it,

and the receiving account is debited - it has the value received subtracted

from it. Accounts that have a positive balance represent net givers; representing

value owed by the business (liabilities), whereas accounts that have a negative

balance represent net receivers; representing value that the business owns or

is owed (assets). Because the amount of each transaction is always both added to

and subtracted from the business accounts the sum of all the accounts is always

zero.

It is important to define all accounts very clearly in terms

of the nature of wealth or money that they contain. Misunderstandings at this

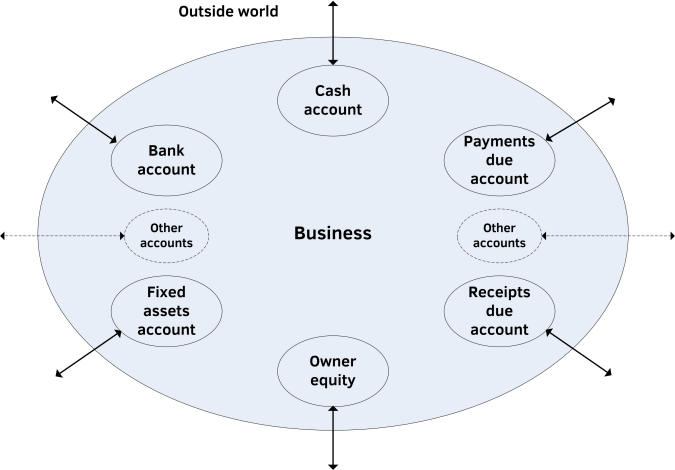

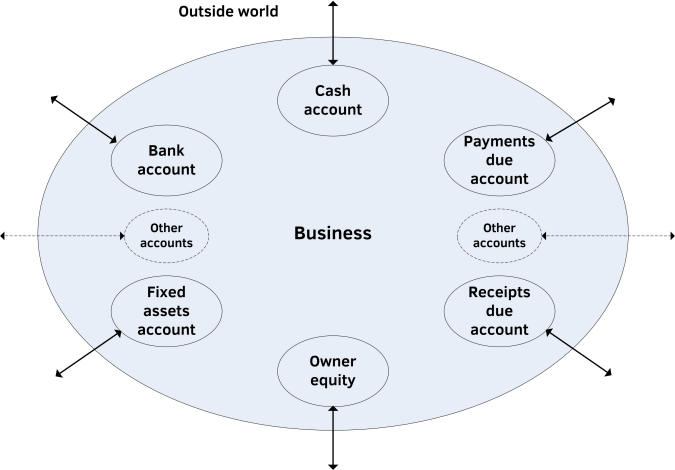

level can easily cause confusion and errors. Figure 43.1 illustrates a simple

structure. Here the cash and bank accounts are fairly straightforward. The cash

account holds all the business' cash, and the bank account does the same for

the business' bank money. The 'payments due' account records payments that the

business must make in the short term, usually no more than a year in advance,

so these are liabilities. The value that the 'payments due' account gives to

the outside world is a number of promises to pay, which represent IOUs from the

business to others. The 'receipts due' account records money that is owed to

the business but has not yet been paid, again in the short term. The value

received from the outside world in this case is another number of promises to

pay, representing IOUs from others to the business. The 'fixed asset' account

represents all the business' fixed assets - offices, equipment, machines and so

on. Owner equity is a bit more complex and is discussed later.

Figure 43.1 A simplified business account structure.

In operating the accounts the purchase of an office would

appear as a debit in the 'fixed assets' account - wealth in the form of the

office is received by the business from the office supplier outside the

business, and as a credit in the bank account - bank money is given by the

business to the office supplier.

The number and types of accounts depend on the nature of the

business. Small businesses might have only a handful of accounts, whereas large

businesses might have hundreds. Also there might be a hierarchy of accounts,

where a top level account might be 'Long-term debts', representing all debts

owed by the business falling due later than a year in advance. This might

contain the combined totals of a group of subordinate accounts, for example

'Corporate bonds repayable 2019 - 2025', 'Repayment mortgage', and so on. The

subordinate accounts record the detail of each relevant transaction, and the

top level account contains the net amount at the date of the balance sheet.

Note that the business is a trading entity in its own right,

so its owner is separate from the business and is represented within the

business by a special liability account called something like Owner Equity or for

a larger business Shareholder Equity, which is the net value of the business to

its owner(s) consisting of all assets minus all other liabilities. This account

is a liability because it represents value owed by the business to the outside

world (the owners). Initially it consists of the start-up capital and

subsequently of that value plus any increase or minus any decrease resulting

from business trading. The business is solvent provided that it is positive

A point that often causes confusion is that because accounts

that receive value are debited, cash and bank accounts are negative when

healthy. For example if the business bank account contains £100 then it will be

shown as £-100. The reason this seems odd is that when someone receives a bank

statement the account is healthy when it is in credit, meaning that the account

holder is a creditor of the bank (she has lent the bank money). But a bank

statement is drawn up from the bank's own point of view - it is the bank itself

that is the business that prints the statements - so a customer account is in

credit when the bank owes that customer money, which is healthy from the

customer's point of view. A positive customer account is a liability of the

bank. If a business has a bank account then from the business' point of view

the situation is reversed, its bank account is healthy provided that it is

negative. Interestingly and in contrast credit card statements are drawn

up from the customers' point of view. The amount that the customer owes is

shown as a positive balance and payments made to the credit account are

deducted from that balance. This is done I assume for ease of understanding. Perhaps

an increasing negative balance might be confusing to some people.

A balance sheet is just one of the major elements of a

business' accounts but the one that is relevant for our purposes. The others

are the income statement (also called profit and loss statement), the statement

of cash flows, and the statement of stockholders' equity. These don't concern

us directly so they aren't discussed further.

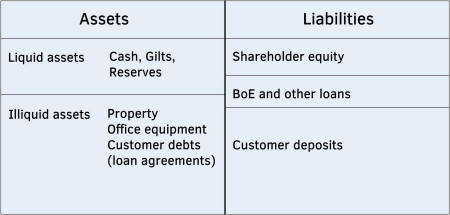

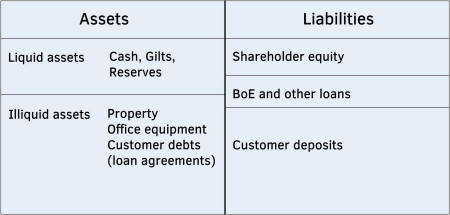

Bank assets consist of liquid (easily convertible to cash)

and illiquid (not easily convertible to cash) assets:

Liquid assets consist in the main of:

·

government debts - in the form of bonds issued by the government

(gilts), tradable on the open market, and bought either directly from the government

or from the market;

·

cash and central bank reserves.

Illiquid assets consist in the main of:

·

buildings and offices, computers, furniture, consumables and so

on;

·

customer debts - agreements to repay signed by borrowers.

Bank liabilities consist of:

·

positive balances in customers' accounts (deposits);

·

loans from the BoE, other banks and money markets;

·

shareholder equity - this is the difference between all other

liabilities and all assets. If it is positive the bank is solvent, if

negative the bank is insolvent.

This can be shown on a simple diagram - see figure 43.2 -

where the convention is to show assets on the left and liabilities on the right:

Figure 43.2 A simplified bank balance sheet