For the information in this chapter I am indebted to

Richard Werner whose paper

makes it all very clear. Until I found Werner's paper I really struggled to

understand it. Indeed after reading many other papers and opinions on the

subject I often ended up with more questions than answers.

What is it that prevents any company from creating money as

banks do? In fact it's very simple; banking licences exempt banks from the

'client money rules' set down by the Financial Conduct Authority (FCA). These

require that whenever a company handles a client's money that money must be

segregated from the company's own money and kept in an account that can't be

accessed by creditors in the event of bankruptcy of the company in question. In

other words client money is to be kept safe from failure of the company itself

and can only be used for the purposes for which it was supplied by the client. Such

companies include asset managers, solicitors, insurance brokers and many

others.

Because of these rules clients enjoy a very privileged

position with such companies. Their money is segregated from all other money

belonging to the company and remains secure, as opposed to non-client suppliers

of money or suppliers of goods and services whose payment has to come from the

company's own funds. In the event of bankruptcy such suppliers must join the

queue of creditors hoping to get at least some of their money back, whereas

clients have their money returned in full.

When a person deposits cash or bank money from another bank

into their bank account the bank need not segregate it from its own money

because it becomes the bank's own money, although more accurately it's the BoE

reserves that accompany the depositor's money that the bank uses as its own

money - see chapter 39. In the event of bankruptcy of the bank the depositor

becomes just one of many creditors of the bank and must wait in the queue with

the others hoping to get at least something back.

A very interesting point that Werner draws attention to

is that there is no legal basis by which a company is permitted to create money

from nothing, which banks do as a matter of course. Specifically the client

money rule exemption for banks only allows them to handle clients' money

differently from other companies, which strongly implies that such money must

have been in the possession of the client prior to it being transferred by the

client to the bank. But as we know it isn't. Banking is based on this bending

of the rules!

So how do banks create the impression that money they create

from nothing is deposited by the client in a bank account? They do it by a

very clever accounting trick. To see how the trick works we need to consider

what happens when a company other than a bank lends money. To do this it must take

existing money from its assets and swap it for the asset that is the loan

agreement. In effect it receives the loan agreement from the borrower,

which appears as an asset on its balance sheet, and to counter that it must

create a matching liability, which is the money that is available to the

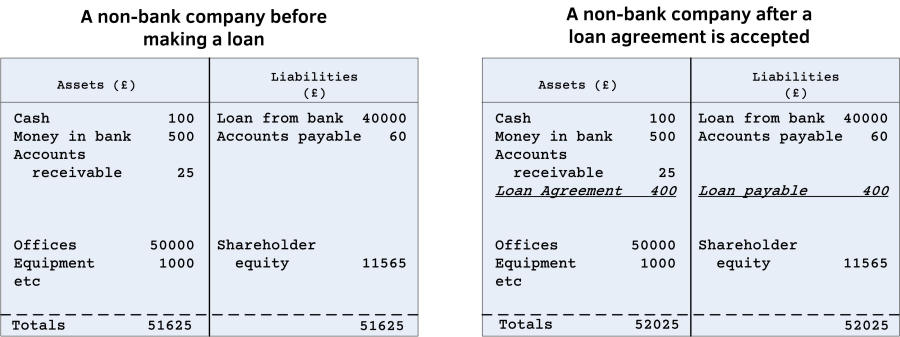

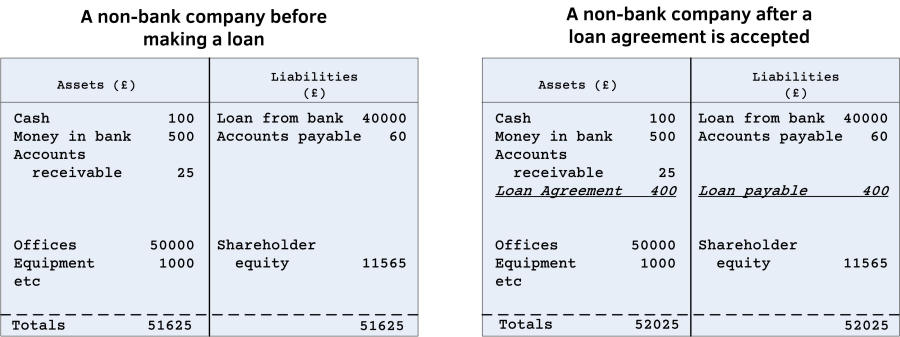

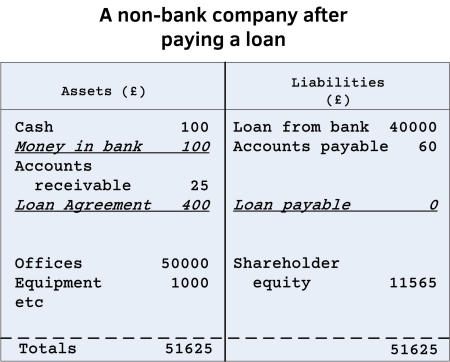

borrower to spend. In other words it owes the borrower money. This is shown in

Figure 47.1.

Figure 47.1: A non-bank company makes a loan available

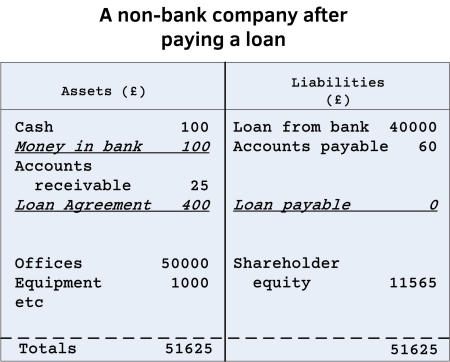

When the borrower is paid the money the non-bank company

must draw down some of its existing money in order to make the payment. This is

shown in figure 47.2.

Figure 47.2: The loan is paid to the borrower

The company's balance sheet now balances as it did before;

all that has happened is that £400 of the company's bank money has been

transferred to the borrower in exchange for the loan agreement.

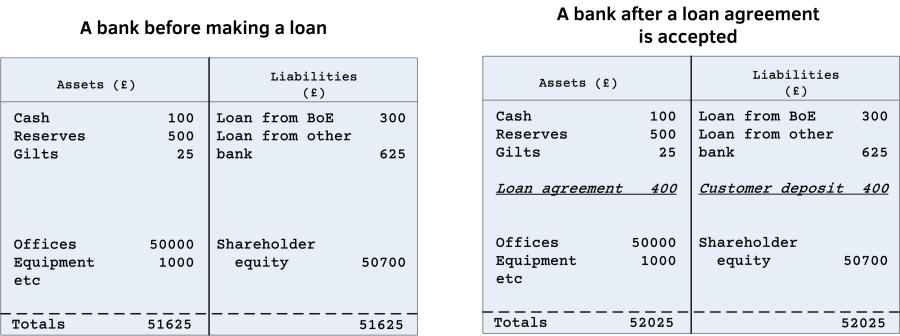

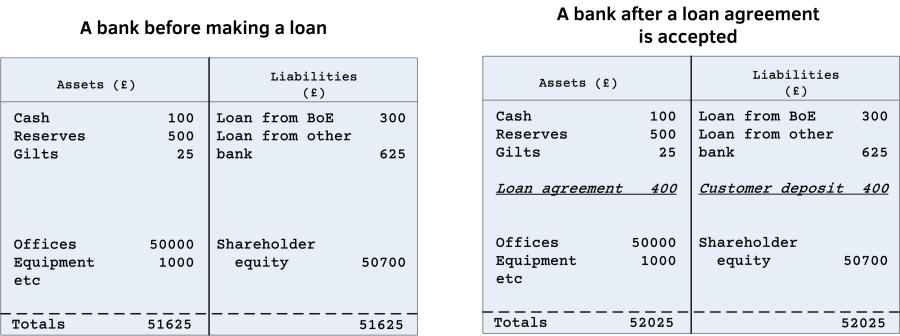

A bank does exactly the same but misses out the last step. Instead

of discharging its liability by paying the borrower it doesn't discharge its

liability at all, it merely calls the liability a customer deposit. This

is shown in figure 47.3.

Figure 47.3: A bank makes a loan

The fiction is that the bank has taken existing funds and

put them at the disposal of the borrower, by depositing them in the borrower's

account. In fact neither the bank nor anyone else has deposited anything, no

transfer of funds has taken place, it continues to owe the borrower money until

the borrower withdraws it in cash or instructs the bank to pay it to another

person or company, when the receiving bank takes over the liability to its

customer in return for reserves sent from the borrower's bank. The bank's

paying reserves to another bank isn't the same as a non-bank company paying a

borrower, because the receiving bank creates new bank money in return for the

reserves, the new bank money stays in the system. If the borrower takes the

loan in cash then that is the same as for the non-bank company, because the new

bank money is then destroyed in return for the cash, but very few such

transactions are settled in cash. The net effect on the bank's balance sheet is

very different to the effect for a non-bank company; both its assets and its

liabilities expand by the amount of the loan. The strict legality of this

operation is thus still open to question, though not only have the authorities

clearly chosen to turn a blind eye to it they have strengthened it by making it

much easier to pay taxes using bank money than by using cash.

Companies that make loans without a banking licence can only

do so either by transferring their own existing money to the borrower, or by

accepting money from investors and tying that money to specific loans or to

packages of specific loans. This is what Dave Fishwick's company does. He can't

call his company a bank, so unofficially he calls it 'Bank on Dave!', but the

official title is 'Burnley Savings and Loans Ltd'. What non-bank companies can't

do is take deposits and allow the depositor access to the cash that is supposed

to underlie those funds and at the same time allow others access to the very

same cash, as banks routinely do.