CHAPTER 2

THEORETICAL FOUNDATION

2.1. Capital Market

Capital market is investment transfer system from providers (retail and institutional investors) to users (businesses, governments and individuals) by using investment instruments like equity and debt securities. Equity security (stock) is an instrument that signifies an ownership position in an organization and represents a claim on its assets and profits. In contrast, debt security (treasury bills, bonds and commercial paper) refers to money borrowed that must be repaid which has a fixed amount, a maturity date, and usually a specific rate of interest. Moreover, capital markets consist of primary markets and secondary markets. In primary markets, new stock and bond issues are directly allocated to institutions, businesses, or individual investors. In secondary markets, existing securities are exchanged in standardized markets such as Indonesia Stock Exchange (IDX).

2.2. Business Cycle

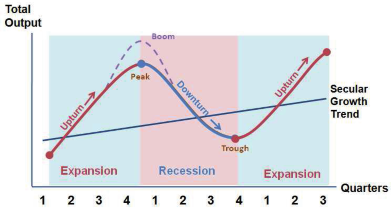

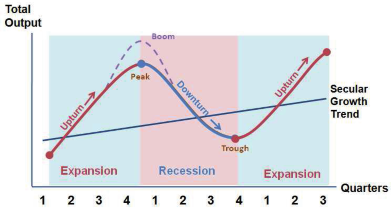

Business cycle is recognized as the asymmetrical up-and-down movement in economic activities that can be measured by real gross domestic product (GDP) and other macroeconomic factors. These fluctuations occur along with a long-term growth trend, and typically categorized by four phases peak, downturn, trough, upturn that imitate themselves over a period of time. However, economists state that the duration of business cycles can be anywhere from about two to twelve years, with most cycles averaging six years in length. The business cycle can be a critical determinant of equity sector performance over the intermediate term (Stangl, Jacobsen, & Visaltanachoti, 2009).

Previous study has gone into identifying business cycles and setting official reference dates for the beginnings and ends of contractions (the part of the business cycle below the long-term trend) and expansions (the part of the cycle above the long-term trend). As a result, business cycles have been divided into several stages and an explicit terminology has been developed nowadays. Business cycles have changeable durations and intensities, but economies have developed a terminology to describe all business cycles and just about any position on a given business cycle.

Source: Collander, D. C. (2004). Economics Fifth Edition. McGraw-Hill.

The top of a cycle can be defined as the peak, while a boom is a higher peak that denotes a big jump in output. A downturn depicts the phenomenon of economic activity starting to fall from a peak. A recession is commonly known as a decline in real output that lasts for more than two consecutive quarters of a year which causes many people are out of a job, while a depression is a large recession which is much longer and more severe than a recession. The bottom of a recession or depression is named the trough. Once total output begins to enlarge, the economy automatically comes out of the trough; which economists identify as an upturn. An expansion is signed as an upturn that persists at least two consecutive quarters of a year which leads business cycle back up to the peak again (Collander, 2004, Pg 495).

2.3. Leading Indicators

Leading indicators are a set of signs that have been developed by economist that point out when the business cycle phases about to occur. They consist of several tools such as average workweek, unemployment claims, new orders for consumer goods, vendor performance, index of consumer expectations, new orders for capital goods, building permits, stock prices, interest rate spread, and money supply (M2). Although stock prices categorized as one of them, it does not look very far into the future a few weeks or months at most.

2.4. Investment Strategy

In finance, most of knowledgeable investors usually use investment strategy as important guideline to select investment portfolio: some of them will decide to maximize expected returns by investing in risky assets, other will go for minimizing risk, but most will choose a plan somewhere in between. Unfortunately, countless studies show that inexpert investors do not believe these rules and expect to have low -high, sell- strategy.

Investors struggle to hit a balance between maximizing their profits from their portfolio and risk they are willing to take by diversification. While passive strategies are regularly applied to reduce transaction costs, active strategies such as market timing are an attempt to get optimal returns. The examples of better-known investment strategies can be described below:

-

Sheep Strategy (trades on emotion and the suggestions of others),

-

Buy and Hold (in the long run, equity markets give a good rate of return despite periods of volatility or decline),

-

Past Performance (select mutual funds based on past performance),

-

Value Investment (seek stocks of companies that are undervalued),

-

Growth Investment (look higher growth potential of a company than others in the same industry or market),

-

Dollar Cost Averaging (aimed at reducing the risk of incurring substantial losses resulted when