CHAPTER 3

METHODOLOGY

3.1. Research Design

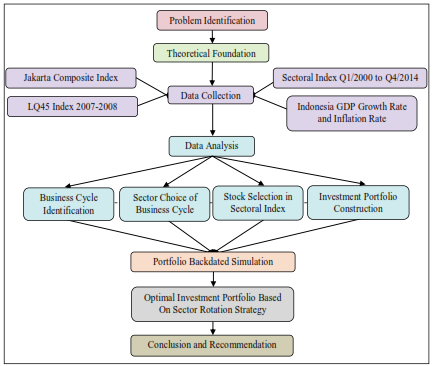

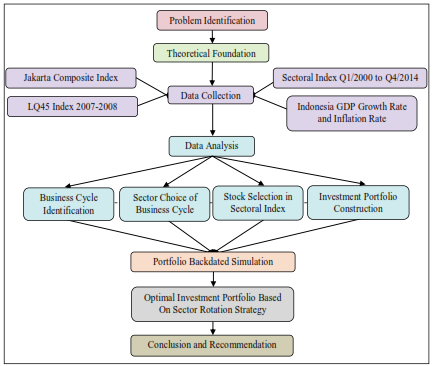

The research will be conducted based on these steps taken by the author. Overall, there are five major steps that have to be taken in order to complete this research which are Problem Identification, Theoretical Foundation, Data Collection, Data Analysis, and Conclusion and Recommendation. The steps are mentioned in the diagram as follows:

Figure 3.1 Research Design

First, the author determines the research problem, research objective, scope and limitation as well as writing structure. Second, theoretical foundation consists of literature review that proves the theoretical background of the research. Third, author constructs research framework and collects the data related to the research. Fourth, the author has to analyze the data to test hypotheses. Fifth, last but not least, the author concludes the result of the research as well as gives recommendations related to the research.

3.2. Problem Identification

Problem identification is the beginning critical step done by the author. In fact, the author had already scanned the situation and symptom as well as developed the probable problem in order to identify a very clearly defined and specific problem. By effectively applying the problem-solving process, the author can determine the goals to be achieved through research execution.

The author found out that some investors suffer difficulties in investing on equity fund in Indonesia capital market. This problem actually can be solved logically by using sector rotation strategy to formulate investment portfolio optimization. However, the author further realized that studies about sector rotation strategy in Indonesia that demonstrate the advantages of investing in capital market based on business cycle has been very limited. From these findings, the author pointed out the problems which become the basis of this research.

Based on the findings of problems, the author main objective of this research is to identify the pattern of relationship between business cycle and selected performance in Indonesia Stock Exchange. In addition, the author also plans to measure the effectiveness of sector rotation strategy implementation to investment portfolio by comparing with passive strategy. By doing this research, the author hopes that more people could understand the sector rotation strategy advantages to optimize their investment portfolio.

3.3. Theoretical Foundation

In order to further understand the basic knowledge and guidelines, the author has to build theoretical foundation of the research. The author has to collect literature review of relevant theory about the research through textbook, reliable journal, website, and article. Furthermore, the author has to evaluate the appropriate literatures that focused on the research data, scope and limitation, methodology, its major findings, and further research suggestion. Then, the author has to develop research hypotheses as a proposed explanation for phenomenon.

3.4. Data Collection

Data collection section describes type of data which will be needed and what kind of sampling method that will be chosen.

Jakarta Composite Index and Sector Index

Jakarta Composite Index and Sector Index

Jakarta Composite Index and Sector Index are obtained on reliable website finance.yahoo.com. The author uses keyword such as ^JKSE for Composite Index; ^JKAGRI for Agricultural Index; ^JKMING for Mining Index; ^JKBIND for Basic Industry and Chemicals Index; ^JKMISC for Miscellaneous Index; ^JKCONS for Consumer Goods Index; ^JKPROP for Construction, Property & Real Estate Index; ^JKINFA for Infrastructure; ^JKFINA for Finance Index, Utility & Transportation Index; and ^JKTRADE for Trade & Service Index. The index data is compiled on daily adjusted close with the time frame from Q1/2000 to Q4/2014.

LQ45 Index 2007-2008

LQ45 Index 2007-2008

Benchmark data are required as a basis to compare the performance with the active investment strategy. The author chooses LQ45 Index as the market capitalization-weighted index that captures the performance of the 45 most liquid companies listed on the Indonesia Stock Exchange. The IDX Index which covers at least 70% of the stock market capitalization and transaction values in the published throughout the trading hours of the IDX. This data can be found on Indonesia Stock Exchange official website www.idx.co.id.

Indonesia GDP Growth Rate

Indonesia GDP Growth Rate

Indonesia real GDP growth rate database can be downloaded on Federal Reserve Economic Data (FRED) trustworthy website www.research.stlouisfed.org. The author selects GDP growth rate by Expenditure in Constant Prices from Q1/2000 to Q4/2014 because it offers a better perspective than nominal GDP when tracking economic output.

Indonesia Inflation GDP Deflator Rate

Indonesia Inflation GDP Deflator Rate

Like real GDP growth rate, Indonesia inflation rate is also acquired on FRED website from Q1/2000 to Q4/2014. The author decides to measure inflation by using GDP implicit price deflator which is an index of the price level of aggregate output relative to a base year.

Historical Stock Price and Market Capitalization

Historical Stock Price and Market Capitalization

To define stock selection in simulation period, the author need sufficient historical stock price and market capitalization. Historical stock price (daily adjusted close price) will be obtained from finance.yahoo.com while market capitalization at year ended of 2007 will be taken from www.sahamok.com for calculating number shares of outstanding and stock price.

3.5. Data Analysis

As soon as all the data has been gathered, the author continues to analyze