Appendix B--Maintaining cost discipline

For some teams, creating an environment of cost discipline represents a distinct change of culture. This appendix organizes and presents material your authors have used in cost disciplined projects and in training teams for cost discipline over the years.

Cost discipline in design has gone under several names, such as design-to-cost, cost as independent variable, target cost, etc. There are some differences in emphasis, as pointed out in chapter 11, but this appendix attempts to capture what is common to them.

We believe that there are two main issues in achieving cost discipline. The first is creating an acute awareness among team members of what “cost” means in the project context. Many team members have only the vaguest understanding of the concept and why it is important. The second is an understanding of the many management issues raised by attempting cost discipline, and how to deal with them. Accordingly, this appendix has two sections:

-

Understanding the language of cost.

-

Management issues in maintaining cost discipline.

Understanding the language of cost

The U.S. Department of Defense (DoD) has taken many “hits” in recent years over poor procurement practices. Moreover, there is a long history of cost overruns going back to the 1950s. Sometimes it has seemed that the DoD couldn’t do anything right when it came to buying military systems.

This problem is not confined to DoD. It has also been a problem at NASA, at the FAA, Homeland Security, and in many departments of state and local governments.

Design-to-cost (DTC) was one of the actions taken to deflect some of the criticism that has come from Congress and elsewhere over expensive procurement practices. Tailored procurements and use of commercial and standard components are others. As this is written, many DoD procurements are based on little more than a statement of need. The contractor has wide latitude in coming up with the most cost effective way to meet the need.

At about the same time that DoD started to get serious about controlling its costs, the world was in the midst of a quality revolution started by the Japanese. At the time, U.S. industry as a whole was suffering from some of the same problems that afflicted the defense industry. Aside from the quality issues, U.S. products often were not priced competitively. That appears to have been due to a basic difference between the way U.S. companies approached the market, and the way Japanese companies did it.

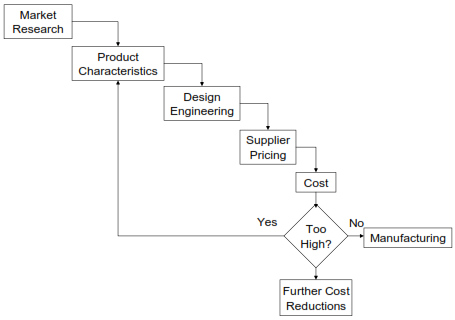

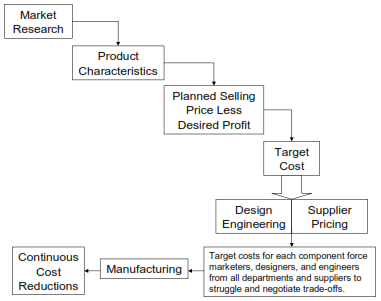

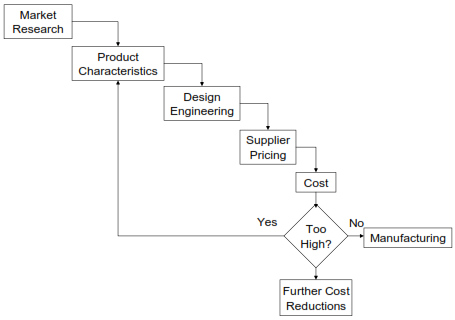

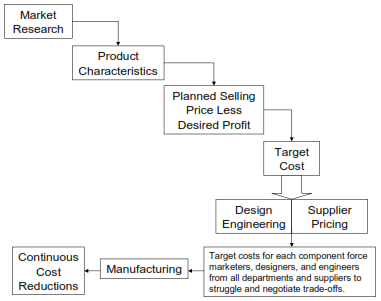

Exhibit B-1 shows the typical U.S. approach at the time. Exhibit B-2 shows by contrast the typical Japanese approach at the same time. Japan was then acknowledged to be the most competitive country in the world. As this is written, that honor goes to the U.S. We have learned a lot from those hard lessons in cost management.

Exhibit B-1—(Old) U.S. Approach

Both approaches began with market research to find out what customers want. The research was used to establish product characteristics. Up to that point the approaches are essentially the same. What happened after that is as different as black and white.

In the Japanese approach, subtracting the desired profit from the selling price the market will bear yields a target cost. That’s the cost you have to make the product for if you want to be in that business. To make it happen, design engineering and suppliers work together concurrently to arrive at a product that meets both the need and the target cost. Everybody on the team pitches in to help make it possible. The drive to meet the target cost continues once the product is in manufacturing, in the form of continuing cost reductions. It’s not uncommon for a Japanese factory to plan routinely for 5% annual cost reductions.

What a different picture we have in the old U.S. approach, which still lingers in some product teams. The product is developed with little regard for cost. If it comes out too expensive, it’s back to the drawing board until the team gets it right. Compared to the DTC/target cost approach, this process is wasteful and time consuming. It decreases competitiveness by making products late to market.

A small clarification: Design-to-cost, target cost, cost as independent variable, etc. all focus on cost. But what really interests the customer is our price. The customer’s cost is our price. Strictly speaking, we should say “design-to-price,” “target price,” etc. This mild ambiguity should cause no problems if we keep it in mind. Price includes the profit we add to our cost. Cost is always a positive number, but profit can be negative (loss), positive, or zero.

Exhibit B-2—Japanese Approach

The language of cost. Face it. Projects as discussed in this book are about technology. The main idea is usually to create something that is faster, higher, or smarter than what the competition has. In the final decades of the 20th century when the U.S. was building the national debt at a furious rate and money was no object, nobody except cost analysts cared about the language of cost. It was mostly boring stuff, anyway, and there were so many exciting new ideas in technology, like composite structures, tiny and very smart processors, stealthy airplanes, and exotic sensors.

Unfortunately, you can live beyond your means only so long. When the bills start coming due a different lifestyle is in order. Well, they came due, and to some extent we have changed our lifestyle. Cost is now a major factor in almost every project, and sometimes it is not only as important as performance, it is more important. But not every team has absorbed the message, and even if they have they don’t always know what to do with it.

To survive in a cost disciplined environment, it is good to know something of the language. Most readers will have encountered the words and phrases we are about to survey, and many will have a good understanding of them. But it’s important for the remainder of our discussion to insure that we all start marching by extending the same foot. So we will take a brief tour through the language of cost. When we have mastered that language we will feel more comfortable with some of the ideas we will advance for managing projects under cost discipline.

Dollars and other currency units are a convenient way of measuring cost, but they alone don’t express its full meaning. The best understanding may come from the ancient expression “There ain’t no such thing as a free lunch.”

Even if we were invited to a “free lunch,” ate our fill, paid no money for it, and assumed no future obligations for it, it still wouldn’t be a truly free lunch.

Why not? Somebody had to grow or find the food. Somebody had to prepare it. Somebody had to make a pot to cook it in. Somebody had to supply the fuel to cook it, and so on, and so on.

And didn’t somebody have to invest time in learning how to grow or find food? And make or buy the utensils? Didn’t somebody have to dig up and transport and refine the ore to make the metal from which the utensils were made?

The point is that costs at root are not really a matter of dollars, pesos, or euros, but rather a matter of the use of resources. Costs in currency units are really nothing more than a clever shorthand way of summarizing the use of resources so that every time we need to know the cost of something we don’t have to go back to square one and dig up the detailed history of everything that went into the product.

To further support this view, here is a definition of cost published in the fall 1986 edition of the “Dictionary of Cost Estimating Terms and Phrases,” published by the National Estimating Society (now merged into the Society of Cost Estimating and Analysis).

“Cost: The amount paid or payable for the acquisition of materials, property, or services. In contract and proposal usage, denotes dollars and amounts exclusive of fee or profit. Also with a descriptive adjective such as “acquisition cost,” “product cost,” etc. Although dollars are normally used as a unit of measure, the broad definition of cost equates to economic resources, i.e., manpower, equipment, real facilities, supplies, and all other resources necessary for weapon, project, program, or agency support systems and activities.”

Cost inflation. If you won the lottery one day, you would probably thank your lucky stars for suddenly becoming rich. But if you went out and bought a newspaper and found that everyone in the country had also won the lottery, you might well go home and cry your eyes out. Inflation is when everybody wins the lottery. It’s when the government hands out more money to everybody. The problem is that everyone is now equally enriched. So instead of asking $1 for your old slide rule in a garage sale, you ask $2. Everybody else raises their prices too, so your newfound wealth is of no value to you.

Inflation is when the money supply increases, but the goods and services available haven’t, at least not as much. Deflation is just the opposite, but historically it doesn’t happen nearly as often.

When we do business in projects that last over a year, we must consider the anticipated effect of inflation in setting our bid. Most customers understand this and will accommodate it. The U.S. DoD understands it so well that they regularly publish expected inflation tables for various commodities to help you calculate the effects.

Inflation is also called “escalation.” The meaning is the same. It is generally measured with “index numbers.” These are factors or percentages that measure the change in price, value, etc. from some period of interest to another. Here’s a simple example of computation of an index number:

1988 hourly earnings 1980 hourly earnings x 100 = $10.12 $7.27 x 100 = 139.2

Products differ in their expected inflation rates. To see examples of this refer to the DoD inflation tables, or to the tables published by the U.S. Department of Commerce. They’re available on the Internet.

Prices to customers are virtually always expressed in so-called “then year” dollars, that is, the effects of inflation are taken into account. But to keep life simpler and more manageable, projects under cost discipline frequently keep records in “base year” dollars. This means that the effects of inflation are not taken into account. The same base year will be used for all project costs in any year.

But this does not mean you are totally freed from the curse of index numbers. You still have to use them if you use historical data in a basis of estimate. You have to bring them forward to the base year. Also, as the project moves out beyond the base year, all new bids from subcontractors made in future year dollars must be backed up to the base year. At the same time that you are maintaining a cost discipline estimate in base year dollars, you also have to maintain a then year estimate for pricing purposes. Normally, you also do cost risk analyses based on then year dollars, especially if inflation is considered to be a risk. This can all get quite confusing if you are not alert or don’t understand what is going on.

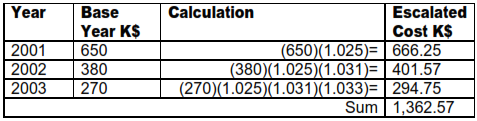

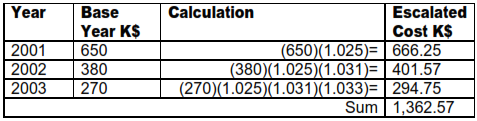

Here’s an example analysis that illustrates the application of inflation indices. Suppose you have a total of $1.3 million in base year 2000 dollars. You want to spend this money in the period 2001, 2002, and 2003, but first you need to determine an escalated amount that takes inflation into account. The projected index factors for these years are 1.025, 1.031, and 1.033. Suppose that the expected cash flow profile in base year dollars is $650K, $380K, and $270K. The escalation calculations are shown in Exhibit B-3:

Exhibit B-3—Example Escalation Calculation

Note: This method is only approximate but is frequently used because of its simplicity. More accurate methods are available.

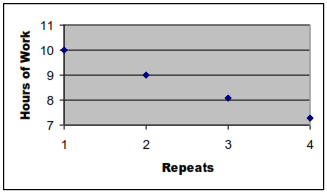

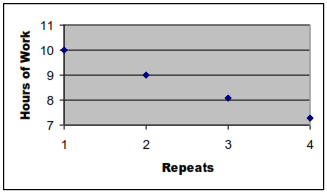

Learning curves. A learning curve is a curve that depicts the declining labor hours required to perform a repeated task. For example, if a worker does a repeated task the first time in 10 hours, he or she might be able to do it the second time (because of the so-called learning effect) in only nine hours. The third time, it might take only 8 hours and six minutes (8.1 hours). The fourth time he or she may be able to do it in 7.3 hours, and so on. This is an example of a learning curve. We plot it in Exhibit B-4.

Exhibit B-4—Example Learning Curve

Virtually all production that involves more than a few units is subject to the learning effect (unless it is fully automated production and not subject to learning). This has tremendous economic importance because every unit produced is cheaper than the last one.

In projects under cost discipline, the correct application of learning curves is of critical importance if more than a few units are to be produced. This is because the estimation of first unit production labor hours affects the cost of all subsequent units. The choice of learning rate (also called learning curve slope) has an even larger effect.

Today, for many products the prime contractor is essentially an integrator and contributes relatively little labor, perhaps less than 10% in some cases. Most of the labor is performed by subcontractors. The significance is that the learning curve calculations of suppliers may be of much more importance than those of the prime contractor. Yet many prime contractor teams working under cost discipline never inquire into those calculations and their reasonableness. This is an easily corrected error.

Unlike inflation, learning effect is seldom ignored in cost discipline situations. Proper estimation of first unit hours and assignment of learning rate can easily make the difference between “making the numbers” and not making them.

Keep in mind that learning rates are typically highest on labor intensive work. For fully automated work, learning may be zero.

As you delve further into learning curve theory, you soon learn that two distinct theories compete for the attention of analysts. They are called the unit theory and the cumulative average theory. Both, properly applied, can give good results. Neither is inherently “better” than the other. As its name implies, unit theory applies learning corrections to each unit produced. Cumulative average theory, on the other hand, applies it to the cumulative average cost of some number of consecutive units.

Learning curve theory assumes continuous, uninterrupted production. If there is a break in production for any reason, some learning is typically lost. Techniques are available to make mathematical adjustments for lost learning.

Cost elements. The traditional elements of cost are labor, material, and other. The usual definitions of these are as follows:

-

Labor. Wages, salaries, benefits and employer contributions to payroll taxes. (Note: in some companies, benefits are called “other” costs.)

-

Material. Invoice costs of raw materials, components, subassemblies and subcontracts

-

Other. All else, e.g., travel, facilities, utilities, postage, depreciation, consultants, etc.

These elements of cost probably derive from the economists’ traditional view of the sources of wealth—land, labor, and capital. Another view, now emerging, is that information is also a source of wealth. At some point, cost analysts may have to recognize costs of information as a separate category, but that day has not yet arrived in most companies.

Direct and indirect costs. Generally, direct costs are costs directly associated with a project. Indirect costs are all other costs. Indirect costs are also known as overhead or burden costs. Normally, a company will recover its overhead costs by applying them as “burdens” on direct costs. The burden applied to direct costs is based on the ratio of cumulative indirect cost to cumulative direct cost, usually applied equally across all projects.

There are many exceptions to the general rule. In some companies, a contract administrator is considered to be overhead even if he spends all his time on one project. In the same company, a subcontract administrator may be considered direct, and charge his time to ten different projects in the same day. Project managers are often indirect even though they work only on one project.

Assignment of costs to direct and indirect categories varies widely from company to company, and sometimes from division to division in the same company. The assignments are virtually arbitrary, but once they are done, they may be essentially cast in concrete, especially if a customer requires that the arrangements and all changes to them be disclosed in all of their details.

It is important in cost discipline to understand what is regarded as direct, and what is regarded as overhead. For one thing, there may be opportunities to reduce certain costs by moving the work to subsidiaries or locations that have lower burden rates. It may also be possible to organize certain work so that it is done by “free” overhead people rather than by expensive direct people.20

Manufacturing overhead is often of high importance to cost discipline situations. It generally is allocated partly to labor and partly to material. Subcontractors are typically regarded as “material.” The labor burden is typically much larger than the material burden, which tends to drive down the use of labor and increase the use of material, including subcontractors. This may bias make/buy decisions in favor of buy.

The allocation of large overheads to the steadily decreasing labor content of projects has brought about much inefficiency. The main cure that has been advocated for this unfortunate situation is called activity based costing. Activity based costing is a method of costing that attempts to dispose of most overhead costs by converting them to direct costs. For example, the purchasing function is often treated as overhead. But if the cost of writing and following up a purchase order is estimated, the project could be charged for each purchase order it issues. Activity based costing has had great success in some companies but many still hold to the old system of overheads, even with its many inefficiencies.

Depreciation, often a large contributor to overhead cost, is not a real cost in the usual sense. It is an accounting fiction designed to recapture over time the cost of one-time major capital investments. Capital investments typically benefit more than one project. They are amortized over time and get distributed to projects through an overhead allocation process. Typically (but not always) every project helps pay for them.

Profit. Profit is the difference between price and cost. Cost includes all direct and allocated indirect costs. Profit is known as “fee” in DoD “cost plus” type contracts. Profit outcomes, as opposed to plans, can be either positive or negative.

This is about all most persons involved in cost discipline situations need to know about profit. There are complexities in certain incentive type contracts that are mostly of interest to contract administrators and project managers, but need not be discussed here.

In cost discipline situations, the team often sets its goals with profit stripped off so they don’t have to worry about it. Sometimes the overhead is also stripped off for the same reason. But this assumes that nothing the team will do can affect overhead, which generally is not true.

Historical costs. Historical costs are actual costs that have been incurred in the past, direct or indirect. Examples are:

-

Records of labor hours expended on projects.

-

Prices paid to suppliers for various items.

-

Subtask costs and total project costs.

-

Expenditure (“burn”) rates.

In command economies, like the old Soviet communist economy, prices were set by bureaucrats. We depend on free markets to do the same job, much more efficiently. When we want to estimate the cost of something, we don’t ask a government agency, we ask the market what it’s worth. The simplest way to do that is to find out what it sells for now, or has sold for in the recent past. That’s called a historical cost.

If we can’t find exactly what we want on the market, we ask about what similar things have cost, and sometimes we get pretty fancy and do statistical things like regression analysis to plot cost versus weight or versus airspeed or against some combination of factors. We also look at and try to make adjustments for trends if we aren’t going to buy right now. Other factors we might consider are possible interventions such as looming shortages, expiration of patents, and new products coming on the market.

It is hard to overstate the importance of historical costs in cost discipline situations. We find their influence everywhere.

The first and most obvious application is in setting the cost goals. If the customer sets the goals, he must have considered historical costs somewhere in his deliberations. It would make no sense for the customer to say “give me fifty Mach 2 high performance fighter aircraft for $100 a copy,” even if that was all he could afford. If you set your own goals, you will be driven at least to some extent by what customers will pay, but you will still refer back to what similar things have cost in the past as a reality check.

When the customer sets the goals, you still have two problems. One is to be sure the goals, while they may be challenging, are still doable. The other is to allocate the goals down to major components or subsystems. Later in this appendix we will have more to say about allocation of the goals.

In a cost discipline project it is a first principle and an article of faith that you always have a current estimate for every subsystem virtually from day one. It’s as reasonable and necessary as turning your lights on when you drive at night. You have to know where you are going. Until more refined information is available, historical costs of similar items, adjusted as seems prudent, are often the best early source.

Even after you get what you believe to be better information from other sources, it’s well to confirm it by comparison to historical costs. Even if it doesn’t check out as closely as you would have liked, it’s a confidence builder to go through the mental disciple of explaining why.

Estimating methods. Estimating methods are discussed in chapter 10, so here we merely provide a quick summary.

In the larger sense, all estimating is based on historical data. If you wanted to walk to the corner market to get some junk food before the Super Bowl starts, you might be interested in estimating how long it will take. If you have walked to that market many times and have kept records or have a good memory, you should be able to make a very close estimate. If you have never walked there before, you might try comparing that journey to other walks you have taken where you did keep records. Or, you might know your walking speed, and measure the distance to the market on a map. A simple computation would get the desired number.

When you boil it all down, all estimating is based on historical data or memories. We can’t estimate anything if we know nothing about it. But sometimes even fragmentary information can result in a pretty good answer.21

While all estimating is at root based on history, there are useful variations that should be understood. We will look briefly at five of them.

Analogy. Analogy is finding a cost for a current good or service by comparing it to similar goods and services and their historical costs. It can be used only where analogies exist. It is highly favored by some customers in analyzing your bids.

The better the analogy, the better is the quality of the estimate. Even if the analogy is a bit weak, it can often be improved by making certain carefully considered adjustments. Commonly made adjustments are for inflation, complexity (difficulty), inheritance from other projects, and skill level of the team. Team members not experienced with making these kinds of adjustments are well advised to leave them to professional estimators or cost analysts.

Parametric. Parametric estimating is the use of statistical and other sophisticated methods to create mathematical and logical relationships that predict cost based on values of certain parameters of the product. Estimators determine the proper values for the parameters, enter them into the model, and produce a cost estimate. At least some of the parameters are usually of a technical nature, so estimators typically collaborate with engineers and other specialists to create parametric estimates.

A great advantage of parametric estimates is that they can be done rapidly and reproducibly, and are therefore much favored for trade studies, which are typically done under time pressure.

Bottom-up. Bottom-up estimating is based on personal experience. It often represents a commitment as well as an estimate, if the person making the estimate will also do the work. Bottom-up estimating is notably inaccurate when design definition is poor. It is also expensive and time consuming. Generally, a bottom up estimate should be only the final estimate made before a proposal is submitted.

Customers are often rightly skeptical of bottom-up estimates because they are potentially self-serving, especially in a cost plus bidding situation. To the extent possible, bottom-up estimates should be reinforced with other methods.

Standards. Standards estimating is also known as industrial engineering estimating. It relies on statistical and empirical treatment of a certain kind of data. The data used are from factory time and motion studies. The method is successful when standards are kept up to date and when standards are properly adjusted for known variances. Standards estimating can be regarded as a sub-type of parametric estimating. It is generally applied to factory work but also finds application in the construction industry.

Level-of-effort. This is a variation on analogy estimating that is frequently used for very small tasks when it is not worthwhile to make a more reasoned estimate. A typical level-of-effort estimate might be “1/4 of a reliability engineer for 8 months.” The estimate proclaims that not much reliability engineering will be needed, and it is hard to predict exactly when it will be needed. So the assigned reliability engineer(s) can work on the project when needed for an average of 10 hours per week (1/4 time based on a 40 hour week).

When customers are allowed to study the contractor’s estimating details, as in cost plus contracts and even certain fixed price ones, they have a tendency to disallow level of effort estimates if the amounts are large. If the amounts involved are significant, the customer may be justified in believing that the contractor doesn’t understand the job, else better justification would have been provided.

Bases of estimate. The basis of estimate (BOE) is one leg of a three-legged structure.

The legs are:

-

Task description (what is to be done).

-

Estimate (resources needed to do it).

-

BOE (how the estimate was arrived at).

A professional estimator does not consider any estimate complete without all three legs. BOEs are especially vital in cost discipline projects. In these projects the number of estimates made may be twice or three times the estimates made in ordinary projects. Not to have a basis for each and every estimate would result in chaos.

We should readily understand the need for task descriptions for work to be done, and estimates of the cost. What often does not come through to many of us is the importance of a good basis of estimate. Fact is, an estimate without a good basis is probably a guess and is likely wide of the mark. It can’t command much respect.

A subject we will talk more about shortly is quality of estimates (QOE). This is a useful concept in any project, but especially when cost discipline is involved. Estimates without a good BOE must be assigned a low QOE. It is especially important that high dollar items have a good to excellent QOE, else the credibility of being able to meet the cost target is suspect. Just because our aggregated estimate is currently lower than the target does not mean we will meet the target. Like an experienced defense lawyer evaluating weak prosecution evidence, a skilled cost analyst can quickly punch holes in a poorly founded cost claim.

Here are ten reasons to have good BOEs:

-

The law. If we are bidding a U.S. Government project and are required to reveal cost details, the Federal Acquisition Regulations require BOEs.

-

Company policy. Many companies that repeatedly bid major contracts have strict policies that require BOEs for all estimates. Some companies even provide guidance on how to write them. One of your authors once consulted for a company and trained people in writing good BOEs. The company did this because it saw that its BOE quality was generally poor and its bids were being questioned by its customers.

-

Helps sell. If you expect your customer to believe that you can meet your cost target, can there be any doubt that your estimates must be well supported?

-

Supplements the statement of work. Claim: The BOE supplements the statement of work and the task description in defining the task. Basis of claim: Just as you never really understand a subject until you are prepared to teach it to someone else, you never really unders