Mining and China

The mining sector first played its major role in the Australian economy during the gold rush in the 19th century and since then it continued to play an important role in the economy. However, the contribution of this sector to the economy was made during the Mining Boom, which drove Australia's economy for over two decades and was fuelled by foreign demand for raw materials. China had became a major trading partner for Australia during the boom and they were the main source of demand. However, China's slowdown in 2013 had caused mining in Australia to go into a downward spiral.

Growing Demand

This Mining Boom was Australia supplying a growing demand for raw materials like coal and iron ore from countries like China, Taiwan, South Korea and Japan. This demand and the fact that these countries choose Australia as the supplier is the reason why the Mining Boom came about. China would be the main buyer of Australian raw materials, which they needed to fuel their own property bubble. China in a massive urbanisation plan was building whole new cities and buildings around their country and this prompted Australian mining business's to expand their mining operations. This new boom in China and Australia would developed an interesting relationship between these two nations that even included America.

The Trio

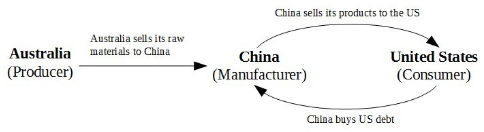

Remember the diagram shown below? It was used earlier in this book to discuss the relationship between Australia, China and the United States in the Australia in a Global Economy section. We will now go into much more detail about this relationship. We will go over this diagram again to refresh your memory. Australia mines up many raw materials like iron ore and coal and China buys this up to fuel their property bubble and manufacturing sector. China makes many consumer goods and this is sold to the United States and other countries. China keeps its currency (the Chinese Yuan) down by buying US debt through government bonds in order to make exporting its consumer goods cheap. The United States can go further into debt and engage in deficit spending by having their debt bought up by China and this keeps the US Dollar high. This is a relationship these countries will want to keep, but to due various reasons it can not last.

These reasons are as follows. Firstly, China's property market has crashed and is producing less as China goes into recession and this has ended Australia's Mining Boom. Secondly, the US runs a trade deficit in this relationship and this will overtime build up a debt that will force the United States to cease buying Chinese consumer goods. The United States are running a deficit as all their manufacturing and other useful industries are being outsourced. Thirdly, if the United States goes into a recession, which is commencing right now, then they will buy less Chinese consumer goods as American consumers can't afford them any more.

How this effects Australia

This relationship as previously mentioned has made Australia very reliant on China. In 2000, less then 6% of Australian exports were heading to China, but now over 30% of them do.19 This means where ever China goes, Australia follows and China is going down.

Impact of the Mining Boom

The Australian Mining Boom had numerous impacts on the Australian economy that were both positive and negative. The Mining Boom had helped Australia through the 2008 Financial Crisis and had improved general living standards for Australians. Many new jobs and mining towns were established with the number of jobs in coal mining going up to 60,000 by 2014 from 15,000 in 2001.20 Living costs, rents, wages and home prices all rose sharply in the mining towns and investment in the mining sector rose to 8% of Australia's GDP at the peak of the boom from the historical average of 2%.21

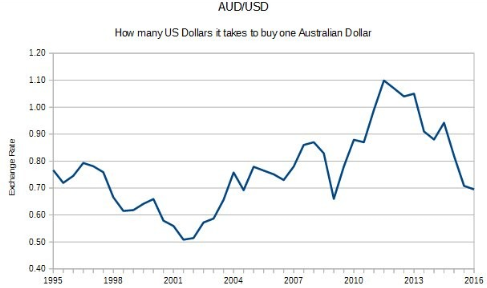

Appreciation of the Aussie Dollar

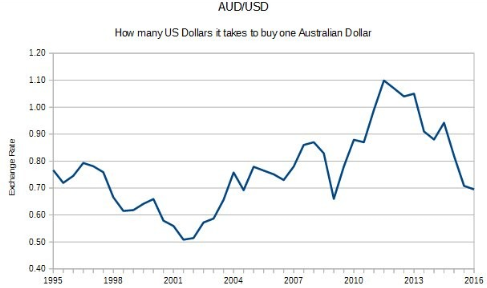

The Australian Dollar (AUD) appreciated against the US Dollar (USD) as a result of the Mining Boom in Australia. This chart below shows the exchange rate of the AUD against the USD from 1995 to 2016. The Australian Dollar appreciated from 0.51 in the early 2000's to 1.1 at the peak of the Mining Boom. The peak of the boom was 2010 to 2013, which was when the growth of the mining sector rapidly increased. During this time, the Australian Dollar was strong. This means that exporting was more expensive for Australian businesses and this hurt other Australian industries like agriculture and manufacturing. This also means that importing goods into Australia is cheaper and that would benefit importing businesses and Australian citizens. This period of a high Australian Dollar lasted for only a few years and since 2013, the Australian Dollar has been depreciating ever since and is now reaching 2008 Financial Crisis lows of under 0.7.

Source: Trading Economics, St. Louis Federal Reserve

Dependence on China

As mentioned already, the Mining Boom in Australia was a result of the relationship between Australia, China and the United States and it had made Australia very dependent on China with a third of its exports going there. So, when China went into a downturn, Australia followed.

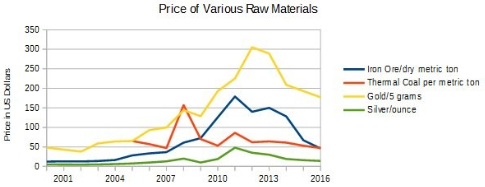

Higher prices of raw materials

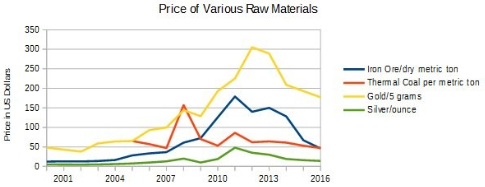

The rapid rise in demand for raw materials like iron ore and coal had caused their prices to sky-rocket. However, China's slowdown and Australia's oversupply of these raw materials had then lead to a tanking in these prices and this was essentially the main reason for why the Mining Boom came to an end.

The Boom Comes to an End

As just mentioned in “ Higher prices of raw materials”, China's slowdown and Australia's oversupply of raw materials like iron ore and coal caused Australia's Mining Boom to end. We will now look into this in to much more detail starting with China.

China's boom

In the 2000's China went through a massive boom with high growth in the manufacturing and housing sectors. China's property market was in a big bubble with very high housing prices and rapid growth of Chinese cities. This growth of cities was actually to rapid with there being large unpopulated urbanised areas. China at the same time became a major manufacturing country too and China is now expected to overtake the United States as the largest economy in the near future. This was the source of Chinese demand for raw materials like iron ore and coal. However, in 2013, China began its downturn with a crash in its property market with Australia really feeling the impact.

Oversupply!

The mining companies in Australia just had to overreact to China's demand for raw materials that Australia is a major exporter of. Feeling the need to make profits by supplying these demands, the mining companies expanded their operations and implemented technologies like automation. This caused a massive oversupply of raw materials like iron ore and coal as the businesses tried to maximise their profits. This oversupply coupled with a lower demand from China caused a glut in the market and caused the prices of these raw materials to go off the cliff. The following chart shows the prices of iron ore, thermal coal, gold and silver and what you can see is that these raw materials saw their prices rise and peak during the Mining Boom and drop after it. There are other reasons like a slowing global economy and a deflationary downturn that are also causing their prices to slump, which were explained in my previous book: A Beginner's Guide To Economics And Investing.

Source: Trading Economics, InfoMine, IndexMundi

The result of an oversupply and lower demand caused these raw materials to lose their value and this would have damaging effects for the Australian economy. The amount of revenue from mining for the Australian government and mining business dropped. Same mining business's like BHP Billion and Rio Tinto tried to further increase their output to stay profitable, but this only resulted in hurting other mining business's and a further drop in prices. Australia is now facing economic troubles due to a weakening mining sector, lower exports and decreasing prices in raw materials.

A Weakening Economy

As the mining sector weakened, Australia's national income had stagnated 22 and its GDP had actually shrunk by US$100 billion from 2014 to 2015.23Australia experienced a growing trade and government deficit and as a result the Australian government has being going further into debt. This topic of debt will be look at latter in this chapter.

Australia had faced a rash of job lay-offs, especially in mining in the aftermath of the boom. There is story after story of people in mining losing their jobs and of mining towns downgrading. One such story is the story of Peter Windle. During the good old days he had a manager job at Glennies Creek Coal Mine earning him up to AUD$60,000/year and he is now reduced to a bus driver. He states that "Everyone is getting out. Three hundred houses are for sale in my town, three in my street, and rental prices have collapsed on older weatherboard houses from AUD$1,000 a week to AUD$200." 24 He is just one of many people that are now having it hard.

The Future for Australia and its mining sector

Australia has a rough time ahead for it. Since mining went South in 2013, Australia has been getting ever closer to recession with now only housing and agriculture keeping its economy afloat. If you look back in history, agriculture supported Australia in its early days and then it was manufacturing during the first half of the 19th century. In recent years it was mining and housing. Mining left in 2013 and housing is on the verge of leaving and after those two are gone, agriculture will be left to keep Australia afloat and agriculture isn't that big any more.

So, what will drive Australia's economy in the future? Some say it will be mining again, while others say manufacturing or tourism will pick up the pieces. Australia is the world's largest supplier of uranium, so they could use nuclear energy to revive their economy. Another possibility is solar energy. The use of solar energy in Australia in the last few years has increased rapidly and Australia has a lot of sunshine over a large flat landmass. With enough improvements in solar energy, Australia could make this an industry that could help its economy in the future.

Science in the form of technology and biotechnology can also help Australia in the future with these fields having potential for advancement in the future. Australia has already done advancements in these fields. The CSIRO (Australia's government agency for scientific research) helped to develop Wi-Fi and Cochlear (An Australian global biotechnology business) has developed hearing implants. There is also potential for gene therapy in Australia. These fields can help Australia in the future, but this will need funding and encouragement.

Gold and Silver

If you have paid attention to current economic conditions and have read my previous book: A Beginner's Guide To Economics And Investing, you can see that we are on the verge of a worldwide recession. In this book I explain why we are heading towards global recession or even depression and why gold and silver should do very well then. If they do, then countries that are the main producers of them will do well and Australia is one of them and this can be another source of economic recovery for Australia in the near future.