Chapter 13

S&P 500 vs IUL – Who Wins?

(Case study – You vs your cool brother-in-law Todd)

Don’t skip this chapter – this is so powerful.

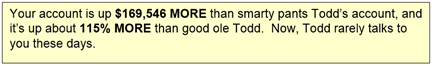

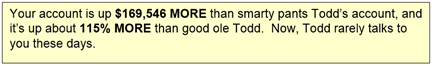

Let’s take a look at an example of ACTUAL market performance

over 15 years. This is amazing! The chart below compares the results of

two different options. We use the actual S&P 500 historical returns from

1998, through 2012, to compare.

Let’s say, for example, you are the green line on the chart

and your cool brother-in-law Todd, is the red line. You both put in $100,000 in

1998. Todd chooses to put his funds into a 401(k), and invests it in the

S&P 500 Index. Not a bad choice at all. You choose to put your funds into

an IUL, and you select a blended index.

The market starts out moving upwards. Around year 2, Todd is

doing great, and he’s constantly bragging to you because his account is up to

$151,409, and yours is only up to $136,890 due to the 17% cap on your account.

So Todd thinks he’s out smarted you again, and doesn’t stop reminding you of

it.

In the next few years, things start to change. The market

has fallen, and at year 5, Todd’s account has dropped to $90,664. Yikes! However, you aren’t worried a bit, because your account is still at $136,890,

due to the 0% cap you have. (You can’t lose money due to market declines.)

When the market is in negative territory, you always

preserve your gains. Unlike Todd, you never go below a 0% return due to market

declines. You’ve noticed that Todd is pretty quiet these days. In fact, Todd

looks a lot more stressed out these days. And, you’re sleeping much better

than Todd is.

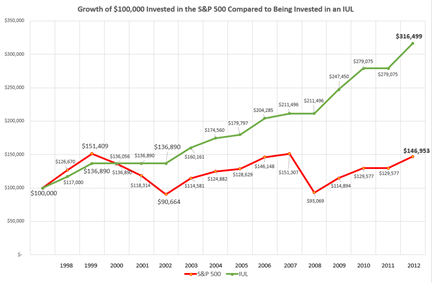

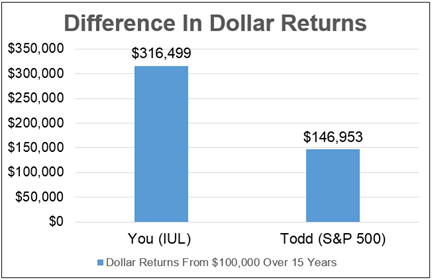

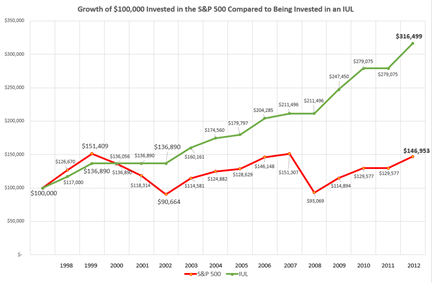

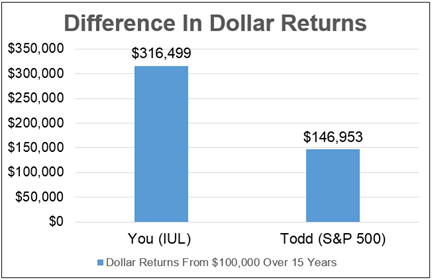

Now let’s go out 15 years. Todd’s account has grown to a

value of $146,953. You may be saying, “That’s not too bad.” After

all, Todd’s invested in the S&P 500, and the huge majority of mutual funds,

and managed accounts produce lower returns than the S&P 500 typically does.

So Todd was actually really smart for selecting the S&P 500. However, your

little IUL account is up to $316,499. Now who’s looking like the

really smart guy these days?

Key Points:

Notice the green line on the chart above. That’s the one

using the IUL. The key point here to notice is that the green line NEVER

GOES DOWN. Ever! If the market goes UP, your gains go UP. If the

market goes down, your line stays FLAT… but never goes down. Poor old Todd

certainly can’t say the same thing about his program.

Remember Warren Buffett’s rules for investing? The rule is,

if you want to be successful in the markets, Never Lose Money. The reason is, losing money kills your returns and takes a really long time to

recover from losses. Just ask Todd. He’ll tell you.

But wait, it gets better…

Genius Todd has to pay taxes on ALL the funds he

takes out of his account. All of them.

You don’t have to pay a single red cent in taxes on your

funds. None. Zero. Zip. Nada.

So for simple math, if Todd had to pay 30% in taxes, he

would only net out around $103,000. Wow!

When you compare the net spendable income (after taxes),

between you and Todd, it’s amazing. Todd has $103,000 to spend, and you have

$316,499 to spend. So you have $213,499 MORE net funds to spend than Todd,

because of a wise decision you made 15 years ago.

To be completely fair here, let’s not forget this. Back 15

years ago, you did have to pay the taxes on the $100,000, before you put

it into your IUL. Todd did not have to pay any taxes on the $100,000 he

put into his 401(k), 15 years ago.

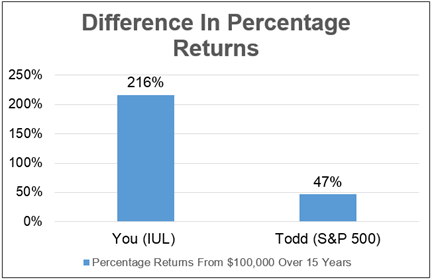

Now you’re looking like a super genius. Your account

net value is over 316k, and Todd’s is only 103k. (Now Todd doesn’t even talk

with you at Thanksgiving.)

QUESTION: How much money did Todd invest 15 years ago?

Let’s see; it seems like it was $100,000, right? So

get this. Todd invested $100,000 15 years ago. He’s sweated out all the

white-knuckle ups and downs of the S&P 500 for 15 long years. He’s watched

the markets like a hawk, read every financial article and magazine he could get

his hands on, and talked with his broker more often than he talks with his own

brother.

However, after 15 long years, (after you take out the

taxes), Todd ends up with the same stinking amount that he put in back when he

started a decade and a half ago. (Does this sound familiar?)

And… that doesn’t even account for INFLATION over all

those years. If you go to usinflationcalculator.com and plug in 1998 to 2012,

you’ll see the inflation rate during that time was 40.9%. Yikes! Todd

can’t win for losing.

Todd would have been better off putting his money in his mattress. Amazing!

And that’s not all. Todd was at least smart enough to invest

his money in the S&P 500. According to the Motley Fool, only 10 out of

10,000 actively managed mutual funds available, managed to beat the S&P 500

consistently, over the past 10 years. So you have to give Todd credit for

making a much wiser investment decision than the big majority of investors.

However, it’s shocking to see how poorly he did.

Make no mistake about it. This is HUGE and can make all the

difference in the world in you being able to enjoy the barefoot retirement of

your dreams, or having to find a job to sustain yourself during retirement.

Plus, imagine how much better you’ll sleep at night having

the absolute 100% certainty that no matter what happens in the world, no matter

what happens with the stock market; your retirement account can NEVER

lose money due to market downturns. Plus, you LOCK IN your gains,

each year, so your account can NEVER be worth less than the previous year’s

value, due to market downturns. This is a major benefit.