Chapter 14

More Unbeatable Benefits

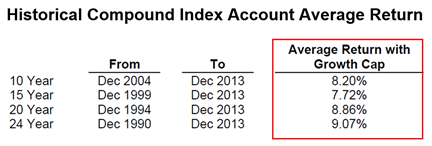

I’m sure you know the value of compounding. I love this

quote:

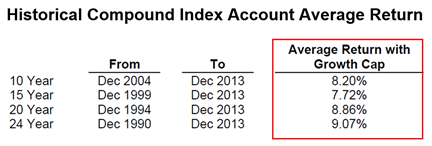

When you combine the power of compounding with Warren

Buffet’s #1 rule of never losing money, you get the perfect scenario with these

types of accounts. They never lose money, and they compound year after year

after year. Just take a look at these historical compound index account average

returns. When you combine having zero risks and these kinds of returns, you get

an unbeatable program.

This is a 9.07% average return over 24 years using this type

of account with a 16% market index cap. (Note: They have recently raised the

market index cap to 17%, and that change would bring the 24 year average

return to 9.28 %.) Obviously, no one knows what the future will bring nor

what the market returns will be in the future. All we know for sure is this is

what the returns have been in the past.

Fixed Return Option

If it would suit your individual needs better, you also have

the option of selecting a FIXED rate of return each year.

At the time this is written, the current fixed return rate

is approximately 3.5%. You can move in and out of the fixed rate account as

often as you wish.

When selecting the index or blended index accounts, you can

choose to move in and out of them once each year.

Ease of Operation

Setting up your IUL is pretty easy. You complete an

application, work with a Barefoot Retirement advisor to design the plan that’s

right for you, have a medical screening, and fund your policy. That’s pretty

much all there is to it.

Once you get your account set up, it pretty much works on

autopilot. There’s really not much that you need to do, other than continue to

fund your policy for the remaining years needed on your policy. You don’t have

to watch the stock market; you don’t need to call your broker and worry about

how all the crazy world events will impact your investments, and you don’t have

to make, buy and sell decisions.

You can just relax, spend time with your family, and go

fishing, play golf, whatever you wish. You receive periodic account statements

so you can monitor your account. Your agent is available to you at any time to

answer any questions you have along the way.

Typically, we will schedule an annual phone consultation

with you to discuss how your plan is progressing and see if any tweaks are

needed, but there rarely are. Depending on market conditions, you may choose to

switch from an indexed account to a fixed account, or vice versa. If you are

taking loans from your account, we will review your account values and ratios

to make sure you are making the right moves to keep your policy in good shape.

Is There Really No Maximum Or Cap On How Much I Can Put Into an IUL?

You do have to qualify for the policy. Both health wise

(unless using the strategies mentioned above of insuring a spouse or a child)

and from a financial standpoint. For example, if you make 50K a year, it’s

unlikely you will qualify for a 10 million-dollar policy.

However, if you are a qualified, high net worth individual,

you may be surprised at just how much funds you will be able to sock-away into

an IUL.

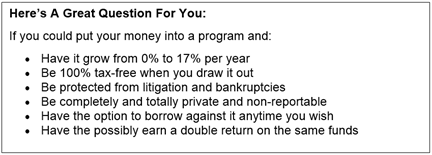

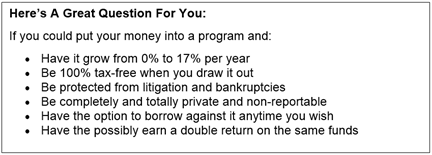

The unique aspect of this program is that once people fully

understand the power and the benefits this program offers, they usually do

everything they can to put every penny they can find into this program. Like we

said before, it’s that good.

How much would you want to put into a program like this?

Allows You to Sleep Like a Baby

Can you just imagine how much better you will relax and

sleep when you know 100% for sure that your retirement fund will NEVER lose

money due to market declines? Ever!

These days all of us know in the back of our minds that we

could wake up on any given day and find out a horrific terrorist event has

taken place, or a massive war has broken out in the Middle East or Russia, or

global oil supplies have been cut off, or our US Dollar has crashed or is no

longer the World’s Reserve Currency, or a million other scenarios that could

take place on any given day.

(Most of us know that fears like this are more about WHEN

they will happen than IF they will happen.)

You know if these types of events were to happen, they would

most likely set off a global panic and send stock markets crashing. What if you

were close to retirement, and most of your retirement funds that you are

relying upon are in the markets? Can you afford to take that risk? Do you have

the stomach for that risk? Do you have the endurance and/or time to try to

fight your way back and recover from your losses after another Wall Street

debacle?

Why subject yourself to the risk, uncertainty and the

constant worry and fear if you don’t have to? By simply making a decision to

put some or all of your retirement funds in this IUL program, you can 100%

insure your retirement fund from ever taking another loss again….PERIOD.

How many people have you seem who’ve had their lives ruined

by the constant stress and worry about their money and retirement? Remember the

pie chart earlier in the book that showed 61% of Americans feared running out of

money during retirement more than they feared death? You now have a perfect

solution for this. You can now totally and completely protect your retirement

funds from ever taking a loss again, and you can greatly increase your quality

of life and peace-of-mind at the same time.

Protection from Creditors, Lawsuits and Bankruptcies –

In many states, the cash value of your policy is totally and

completely protected from all creditors. In some states, creditors don’t even

have the right to ask about these funds. Should you face a bankruptcy or

lawsuit, you can relax and know that all the cash value funds in your policy

are locked up, protected and safe and sound. This may not seem important to you

at the moment, but if the unexpected were to arise, this benefit alone could

make all the difference in the world in the quality of the retirement you will

have.

This is especially meaningful for high-income earners in

professions or businesses that are prone to lawsuits. Physicians, in

particular, love this aspect of this plan. You can do everything right for your

entire career, amass a huge retirement fund, and then have a malpractice suit

that comes along and takes it all away.

When you couple the fact that you can put an unlimited

amount of funds into this program AND keep them safe and protected from

creditors, this benefit alone makes this program worth doing!

What If You Are Too Old Or In Poor Health?

This is a question we sometimes get. If a potential client

is really getting up there in age, or sadly if there’re in poor health and

don’t think they will be able to pass the medical exam that’s given to all

applicants to be sure they qualify for the life insurance policy, they are

sometimes quick to want to give up and say, it’s such a great program. Too bad

I can’t qualify.

We have lots of ideas and strategies that we use to help our

clients. One option is to consider insuring a spouse or child who could

qualify. You simply name yourself as the beneficiary of the policy, and you can

get very similar benefits even though you’re not the one actually insured.

Even if you’re starting to get up there age-wise, don’t

worry. One of our partners coined this phrase:

If you’re in doubt, the best thing to do is contact us and

discuss your individual situation with one of our skilled advisors. They are

trained to help you discover the best ways to help you maximize your retirement

resources.

No Minimum Age or Income Requirement

Most qualified plans like IRAs, 401(k)s, ROTHs, SEP IRAs,

etc. either require an amount of earned income or an age requirement before

anyone can set up one of these programs. So if you are thinking about your

young children, it’s pretty hard for them to have an earned income when they

are just little kids. This program is different! If you want to purchase an IUL

for your children or grandchildren right after they are born, that’s perfectly

fine. No problem at all.

Image how much of a head start a child could get and how

much further ahead they would be if an IUL was purchased for them when they

were very young? You could give them a 20 year head start over other kids their

age. Imagine having an extra 20 years for the funds to grow and compound and

then be completely tax-free any time they choose to borrow them out.

No Mandatory Distribution

As you probably already know, the Government has strict

rules that require you to start withdrawing your money out of qualified plans

when you reach 70 ½. It does not make one bit of difference if you need the

money at that time or not, the Government is going to force you to start

pulling it out, or they are going to sock it to you with a 50% penalty. That’s

right. You either start withdrawing the required minimum distribution amount,

or they are going to take 50% of that amount from you if you don’t.

The reason the Government does this is because they want to

get their hands on your money in the form of the taxes you will now have to

start paying on the funds you draw out of your qualified plans. The Government

figures they have waited long enough, and now it’s time for them to start

getting their money back from you. You either play by their rules, or they will

start taking your money from you one way or another. Sounds pretty harsh

doesn’t it?

As you know by now, YOU are in complete control of your IUL.

You can take your money out at ANY time you wish. You get to make up your own

rules and don’t have to be burdened by some arbitrary rules that bureaucrats

came up with many decades ago that say when you need to start pulling your

money out. They don’t know your nor do they know or care about your individual

needs. They just care about getting your money.

Why bother with all of that? The IUL gives you the freedom

to live your life on your terms. If you need the money early on, no problem,

just pull it out. If you choose to retire at 50 years old, no problem, you can

start pulling it out then. If you don’t need the money until you reach 100

years old, no problem. It’s your money, your plan, your policy. You can do with

it as you wish. That’s the freedom that the Barefoot Retirement Plan gives you.

The IUL Does Not Create Taxation of Your Social Security Benefits

Many people are not aware of this, but a significant

percentage of your Social Security benefits can be subject to income tax when

you receive them. They compute the amount of income tax you owe based on WHERE

your other retirement income comes from.

All of your money that comes from qualified plans like IRAs,

401(k)s, SEP IRAs, SIMPLE IRAs, etc., during your retirement WILL be included

as additional income that can affect the amount of taxes you have to pay on

your Social Security benefits. This can add up to a large amount of money.

The Government, however, does allow an exemption on this.

The rules say, ALL income coming out of cash-value life insurance policies does

NOT count as additional income that will affect the amount of taxes you will

have to pay on your Social Security benefits. That’s right. And it does not

matter if the funds are withdrawn from your policy or borrowed against your

policy, they DO NOT negatively affect the amount of taxes you have to pay on

your Social Security benefits. This is a really big deal and can save you a

boat-load of money. This is yet again, another reason that makes this the most

powerful retirement program in America!

IULs Help You Avoid Probate

You can’t really appreciate the value of this unless you’ve

been involved in a lengthy and stressful probate battle in the past. They can

get ugly and seem to drag on forever. Yet again, the IUL comes to the rescue.

If you have an IUL, you can totally and completely avoid probate. Here’s how it

works.

When you set up your IUL, it is a life insurance contract.

As part of setting it up, you name a beneficiary or beneficiaries and they

become part of that contract. The laws are totally favorable to you again in

this instance. When the policy holder passes away, the death benefit funds are

paid DIRECTLY to the named beneficiary(s) within only a matter of days. These

funds are completely exempt from probate and drawn out legal battles. This advantage

saves you a ton of time, money, aggravation and stress.

Become Your Own Bank

When you see those gigantic skyscraper buildings owned by

the mega banks, do you ever wonder how they got so much money to pay for it

all? A good bit of their profits comes from the interest that you pay them on

your home loan, car lone, credit cards, etc. There’s huge money in collecting

interest payments. Banks use fractional reserve lending to earn interest on

money they have already lent out. Our strategy allows you to use a similar

method and to earn gains on the same money twice.

How would you like to never have to borrow another cent from

a bank again? How would you like to put all of those interest payments in your

pockets, and not in the bank’s pockets anymore? With this program, you can

actually become your own bank, and borrow the money from yourself. It’s true.

Heck, you can even be your own bank president.

After your IUL is established and funded, you’ll have your

own source of funds to turn to. The next time you need to borrow money to buy a

car, a boat, a plane, send your kids to college, invest in a business, expand

your business, buy real estate, or just about anything you can think of, you

can forget about having to go down to the bank, get on your knees, and beg for

a loan. You won’t have to stress-out about having to qualify for a lone. You

won’t have to worry about how your credit score is doing. You won’t need to

worry about proving income or putting up assets as collateral. None of that BS

anymore!

Since you are your own banker, of course you need to act

responsibly and make wise decisions about your money. However, as you know,

over time, various financial needs will always arise. When a financial need

arises, you simply have a meeting with yourself, (the bank President), and

decide if the purchase is a wise decision. If so, you simply approve the loan,

and borrow it from your IUL. You can set up your own terms to pay back the loan

if you wish. Depending on your situation, you could choose to never pay the loan

back. You are in complete control.

Imagine all of the interest you could save over a life-time

if you did not have to borrow money from others, and pay interest to them? Even

though interest rates are super low at this time, we all know there will come a

time again when they go through the roof. When that time comes, it will be very

comforting to know you have your own source of funds to turn to.