Chapter 23

Frequently Asked Questions

Below is a list of some of the questions that are asked most

frequently by our clients.

Q. Can I own more than one IUL policy?

A. Yes. Any individual can own multiple different IUL

policies. And, each policy can have a different owner, insured and beneficiary.

A family could have a policy for each spouse and one for each of the children,

grandchildren, etc. Plus you can set up policies for your businesses as well.

Q. I’m stuck in a bad insurance policy. Can I switch over

to an IUL?

A. Yes. You can easily use a 1035 exchange to do

this. It allows you to move your money from your poorly performing policy to

another better performing policy, while keeping your tax basis the same.

Q. Most of my retirement funds are tied up in my IRA and

401(k). Can I switch them from those programs, to and IUL?

A. Yes. It is important to keep in mind that there

are different tax ramifications depending on your age and income. It’s always

best to consult your tax and securities advisor prior to liquidating any

qualified funds. We do have clients who are so frustrated with the performance

of their current retirement programs that they are willing to take the tax hit

now, to be able to sleep better at night.

Q. Can I really miss or skip premium payments and still

keep my policy intact?

A. Yes. This is a BIG benefit to the IUL. When you

have a properly structured policy, you have almost infinite flexibility with

your annual contribution amounts. When we design your custom plan, we do

analysis to determine the appropriate death benefit amount. The death benefit

has two important minimum and maximum numbers. In between those numbers is the

flexibility you have.

There is a minimum amount you can contribute per year. This

is what the insurance company defines as the minimum amount needed to pay for

their cost to insure you. The maximum amount is defined by the IRS, and it’s

based on the amount of death benefit attached to your plan. We’re happy to run

some analysis for you to show you what your numbers look like.

Life is full of surprises and changes, so it’s comforting to

know that you have tremendous flexibility with your IUL

contributions, without having to worry about negative effects to your policy.

Often, just the first few months of contributions is WELL

over the minimum annual amount necessary to keep your plan active. This premium

flexibility is something our clients really appreciate. Other plans require set

premiums, and if they aren’t paid, it can have VERY negative effects on

the policy’s performance.

Q. How safe is my money in an IUL policy?

A. As discussed earlier, we work with the highest

rated Mutual Insurance companies. Most of these companies have been in business

over 100 years. They have withstood the test of time, and survived and thrived.

In today’s crazy financial markets, we believe these companies are among the

safest companies in the world. Plus, since they are mutual companies, and not

publicly owned stock companies, they are not as subject to much of the madness

of Wall Street.

Q. What are the downsides to an IUL?

A. The IUL has the same downsides and risks that are

associated with any retirement plan, but on a much smaller scale due to the

floors, caps, and other protections that are in place. When you understand the

benefits of an IUL, you’ll find that almost all the “downsides” are associated

with short-term pain to receive long-term gain. IE: Short Term ‘cost of

insurance’ expense, to receive long-term, tax-free income, and death benefit.

Q. Can Canadians use this same Barefoot Retirement Plan,

eh?

A. Yes. Not all of the Insurance providers we work,

offer policies that will work in Canada, but we do have some great providers

that will.

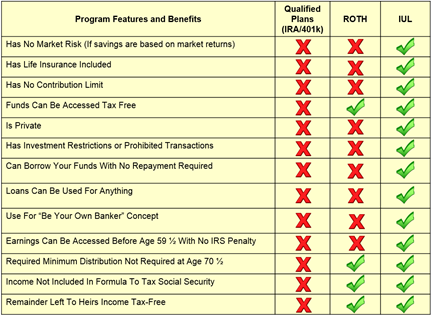

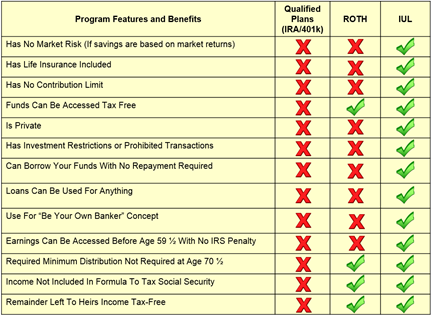

Q. How does an IUL compare overall to an IRA, 401(k) and

ROTH account?

A. Good question. We thought the easiest way to show

this would be in the chart below. We simply took the most important, key

factors of retirement plans, and compared them all together. We think the chart

speaks for itself.