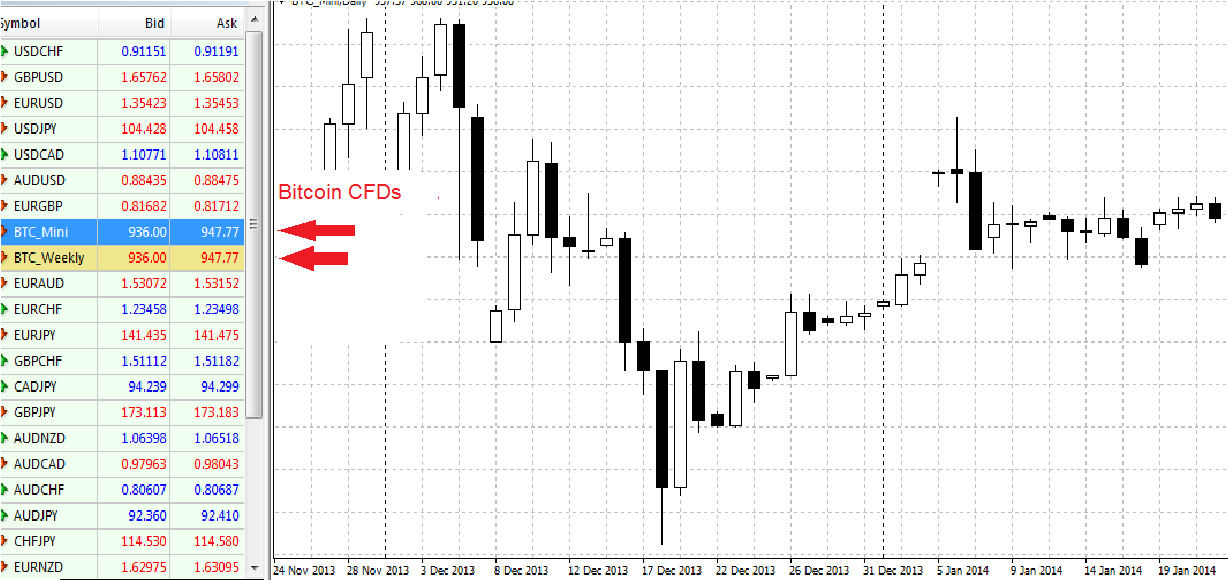

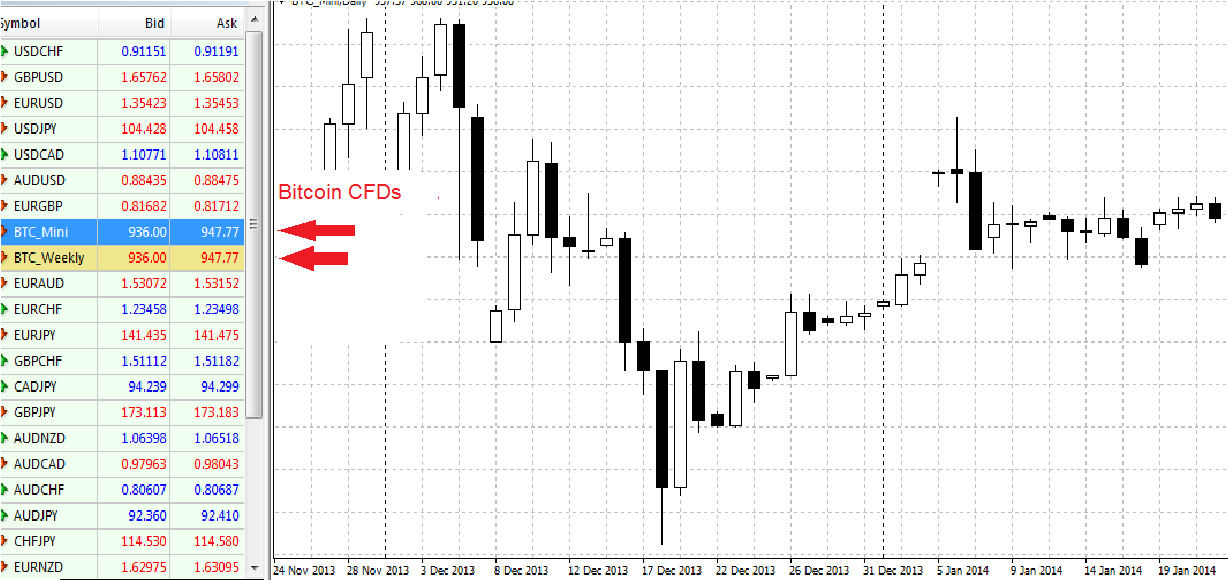

Here's a snapshot of AvaTrade's MT4.

A major flaw of both contracts is the inability to trade them during the weekend. Bitcoin trading is completely decentralized and doesn't rely on a network of banks for executing trades thus there is no set open and closing time. Unlike forex which trades 24/5, bitcoin trades 24/7 (except on AvaTrade). As can be seen on the chart, large gaps are frequent on AVA Trade's Bitcoin CFD due to this policy. AvaTrade does not accept US clients at this time.

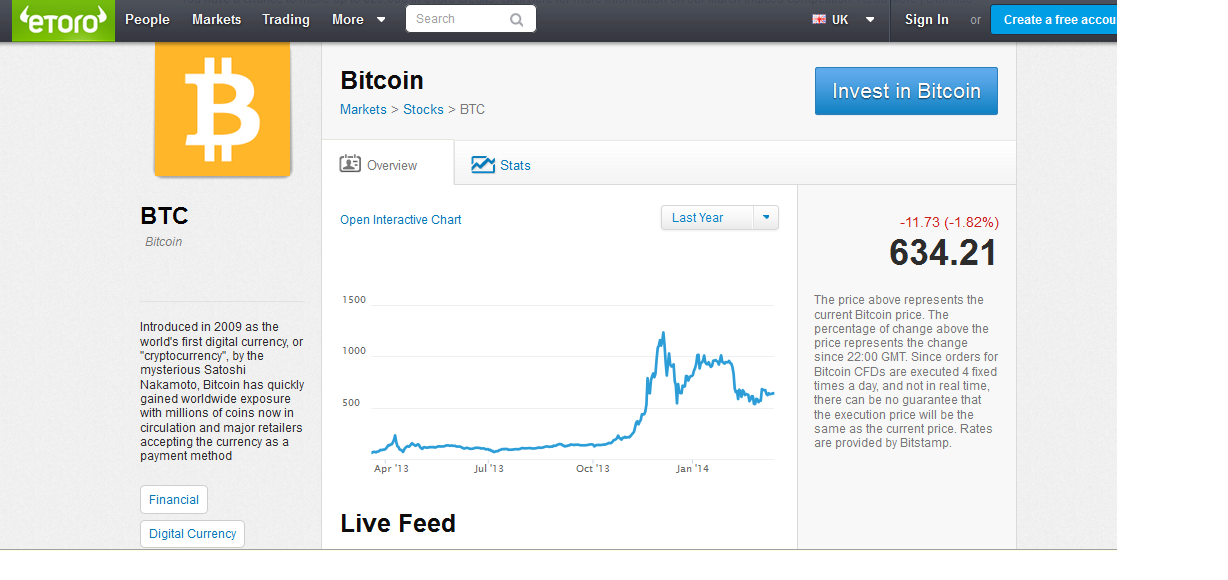

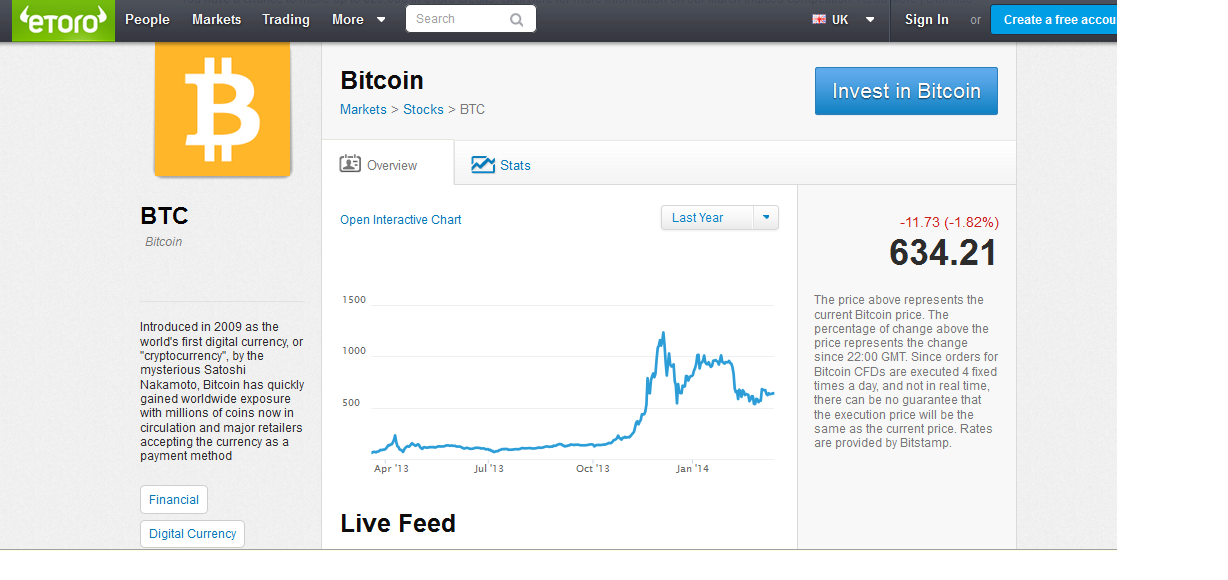

Etoro.com

Etoro.com is one of the latest forex brokers to offer bitcoin trading. Unfortunately, the product is not very suitable for day trading as you can only enter and exit the market four times per day. It uses the BitStamp's data feed as a price reference. You can read more about Etoro's bitcoin offer here. Here's a snapshot of their bitcoin CFD in action:

Unfortunately despite having a dedicated US part of the site (link to http://www.etoro.com/usa) , eToro doesn't seem to accept US clients at this time. Here's a part of the Q&A section that deals with this question: "As part of our ongoing optimization process currently underway in the US, we have temporarily suspended our service. Therefore, at this time we will not be accepting new clients or funds from existing US customers. While you're here, you are welcome to continue experiencing eToro through our practice mode, which will stay available and free to all."

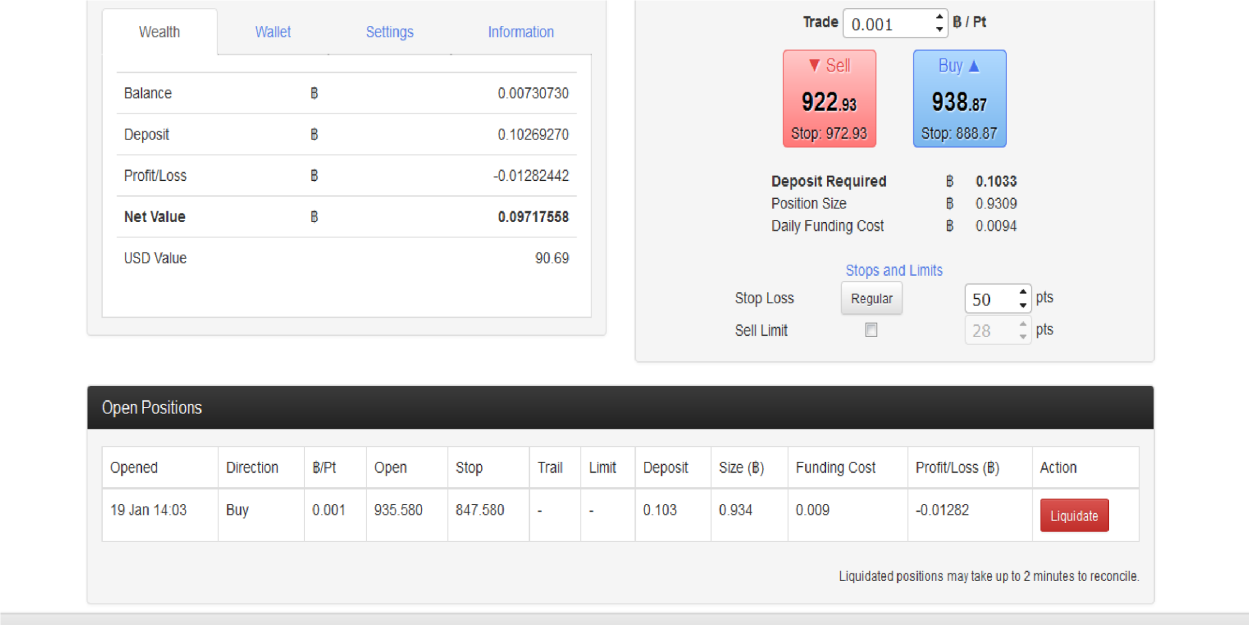

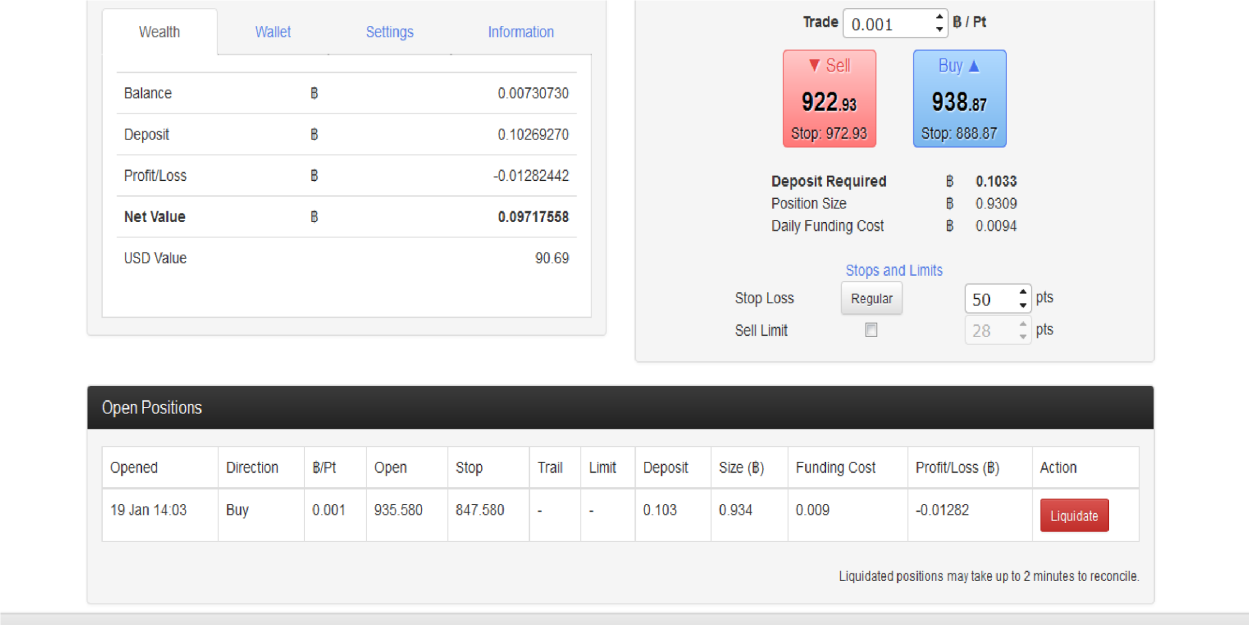

Btc.sx

Btc.sx offers a 10 to 1 leveraged product based on BitStamp's data feed. Similarly to Ava Trade, Btc.sx adds around 10$ to the spread at BitStamp. You will need a deposit of at least 0.01033 of a bitcoin in order to trade at Btc.sx. At current bitcoin prices of $250, this amounts to around 2.5$. Btc.sx is dually incorporated in England and Singapore. The exchange currently accepts only bitcoin deposits, no fiat currency deposits are allowed.

The pic above shows a bitcoin long position. Btc.sx has several restrictions that make trading with leverage problematic. The exchange doesn't support moving the stoploss after entry. When contacted about this, their support team told us that "this feature will be implemented in the next few months". Our question is why isn't it already implemented?

As you can see on the picture, you can only set the stoploss as a distance from the current price (in the pic this is set as 50 points). The default is 88 points below entry. This is exactly where my stop was, 88 points below 935 at 847. There is a trailing stoploss option but despite my best efforts, I couldn"t make it work. So essentially, once you set your stoploss on Btc.sx, you're stuck with it.

The high rollover cost also makes leveraged trading at Btc.sx problematic. The currency rollover cost for my position was 0.0094 of a bitcoin, that's 8.8 US Dollars, far too high for a 1,000 usd position in my opinion. Because the company only allows deposits and withdrawals in bitcoin, it has largely avoided the US Dollar deposit/withdrawal issues encountered by other btc exchanges. Btc.sx does allow US clients.

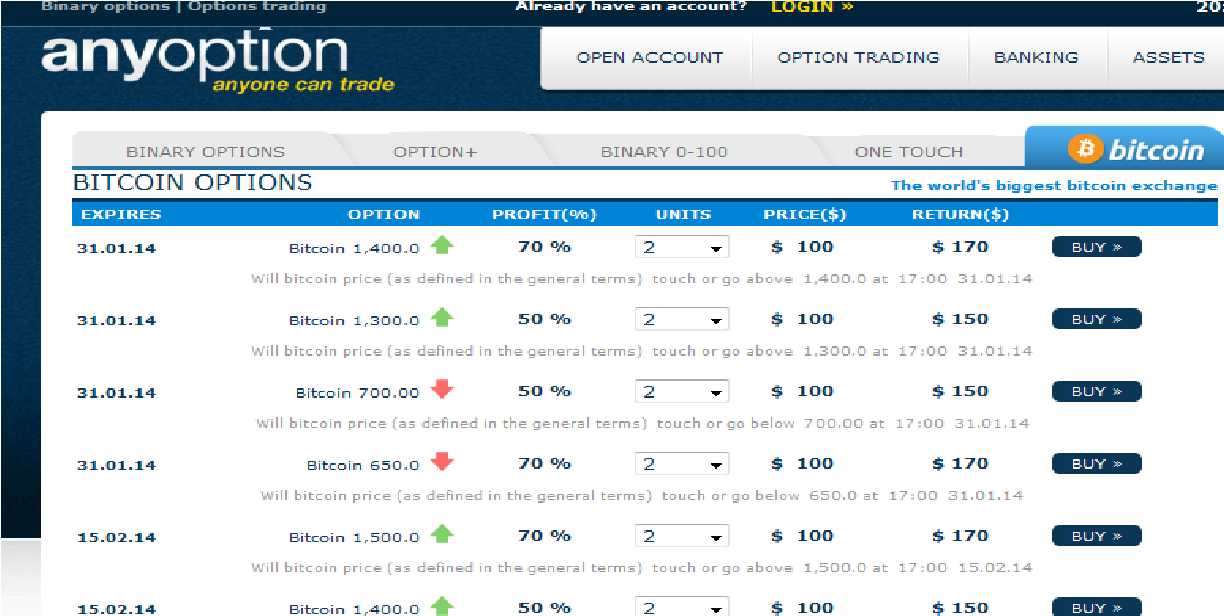

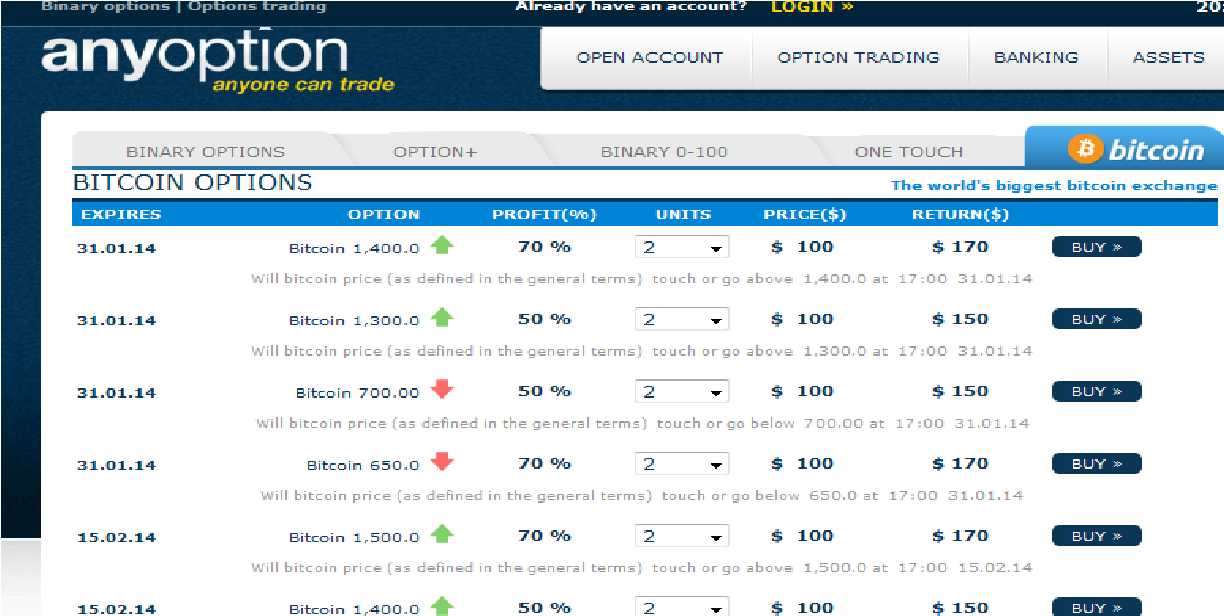

Bitcoin Options

Besides CFDs, the new cryptocurrency has also helped spawn a new options market. Currently several companies are in the business of offering Bitcoin options. Anyoption.com is one of the more established option houses that offers trading in the virtual currency. You can bet on rising or falling bitcoin prices. Anyoption.com is not an option for US clients, the company doesn't accept USA traders at the moment. Here are some of the current btc options on offer.

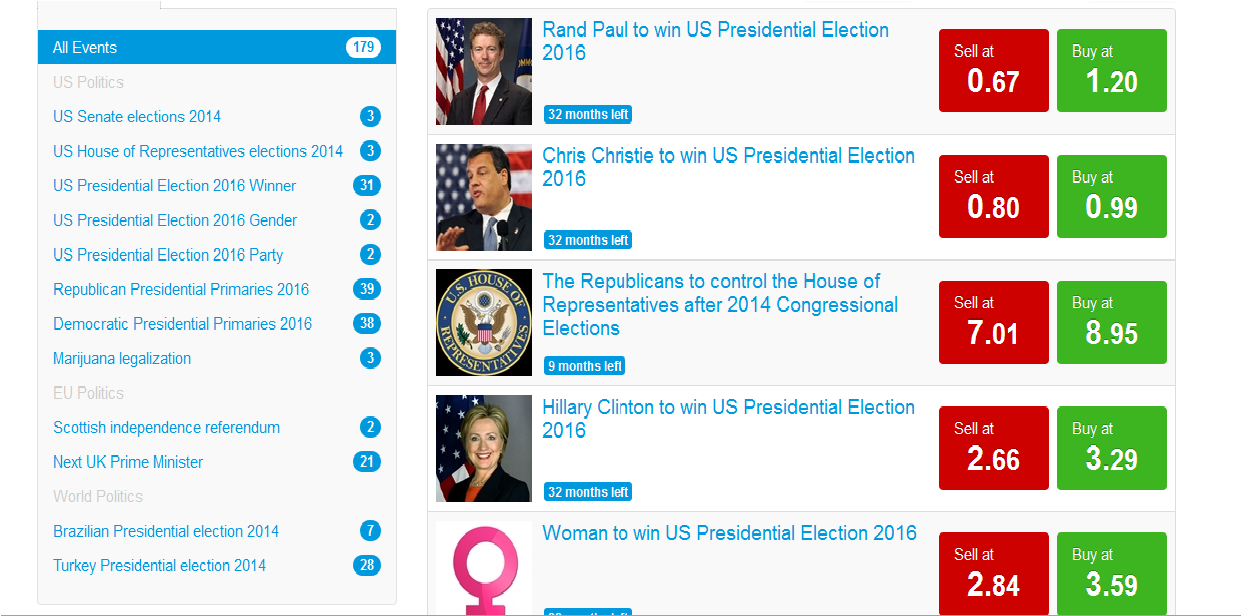

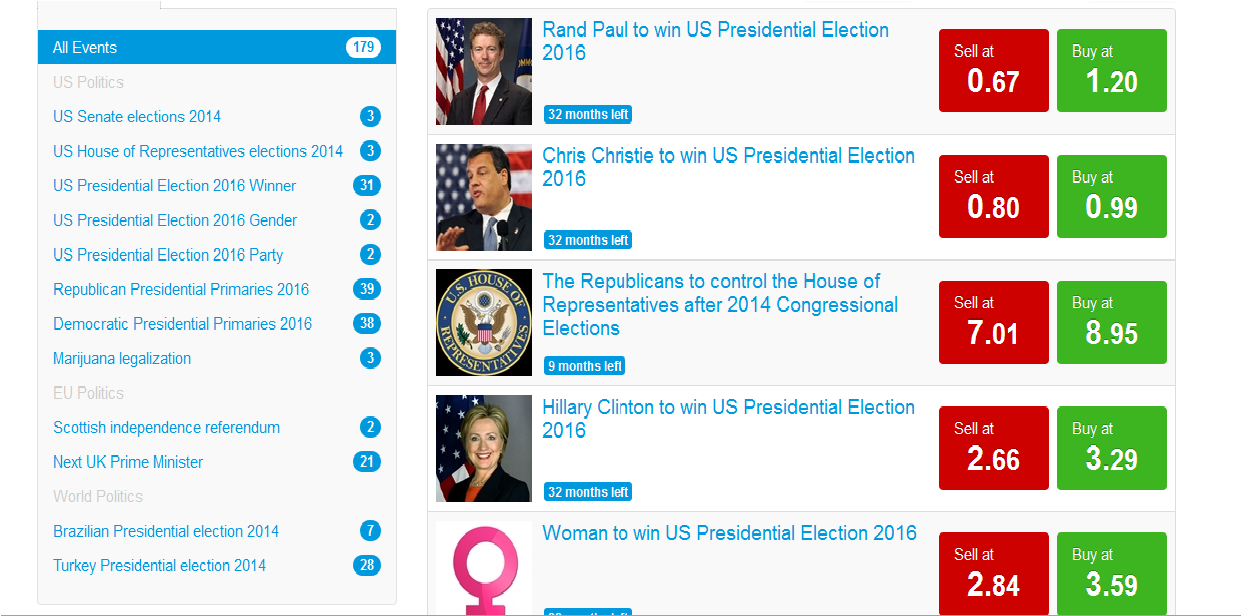

Predictious

Predictious.com is a betting websites that matches buyers and sellers and doesn't price the options themselves. Besides betting on bitcoin's demise or rally, you can also try to predict the next winner of the Oscars or bet on which party win control the US Senate after the 2014 elections. Currently the site takes bitcoin deposits only. Predictious does accept US clients.

What Drives Bitcoin Prices?

Regulation

Regulation and other actions by government entities has one of the biggest impacts on the price of bitcoin. The US and Chinese governments are the ones to watch. Somewhat favorable comments by US lawmakers in November and December of last year underpinned the bitcoin rally.

At a Senate committee hearing last month a Justice Department official said that "bitcoins can be a legal means of exchange". The new cryptocurrency can be exploited by "malicious actors" and should be subject to "rules to protect people", the agency added.

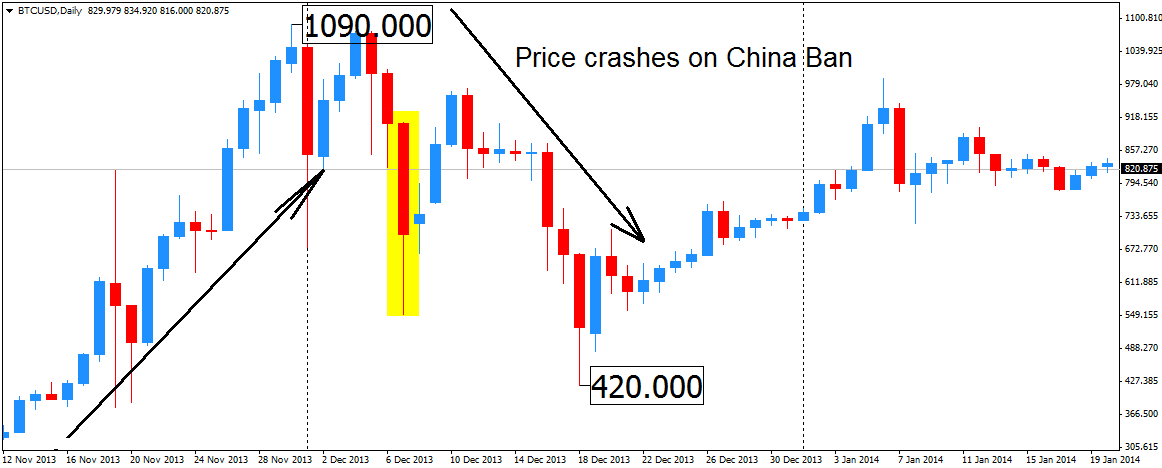

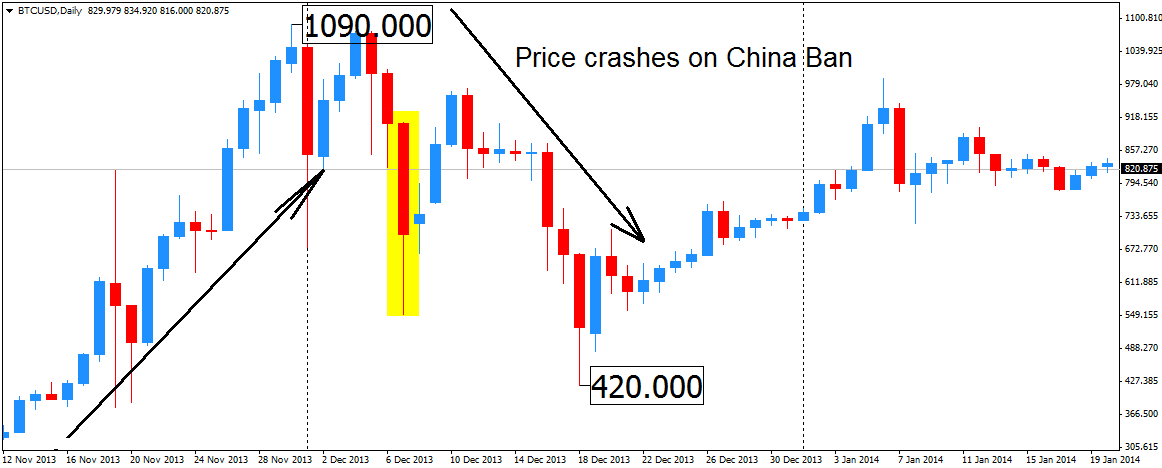

Increased bitcoin purchases from China and the adoption of the currency by Chinese online businesses were another driver that helped push the BTC/USD price from 195.5 at the start of November to a high of $1090 30 days later. Baidu, the biggest Chinese search engine started to offer payments in bitcoin. The chart below shows the remarkable November rally.

November rally

The silence of the Chinese authorities was seen as a subtle acceptance signal by market participants. The situation didn't last long however. On December 7th, The People's Bank of China barred financial institutions from buying or selling virtual currency or Bitcoin related products. The Bank also demanded that businesses stop with the practice of pricing their products in Bitcoins. BTC/USD opened the day at $906.50 on BTC-E. After the news hit the wires, bitcoin prices crashed from to a low of $551 in only 9 hours, a fall of 39%.

December 7th is marked with a yellow rectangle on the chart above. After a small dead cat bounce to $970 in the next few days, bitcoin prices resumed their decline. BTC/USD marked an interim low of $420 US dollars for one bitcoin on December 18th.

Increased Adoption and an Expanding Marketplace At the start of 2012, one bitcoin was worth exactly $4.72. One year later a piece of the new currency could buy you a book on amazon ($13.51). On January 1st 2014, buying a single bitcoin would set you back $806.

With the 2008 financial crisis still fresh in people's minds, most wrote off Bitcoin's rising price as just another "bubble". But what a lot of people failed to grasp is why the price is going up. While speculation and betting on higher prices certainly played their part in the process, a major reason behind the gains is very simple, increased adoption of the cryptocurrency.

According to BitPay, a Bitcoin Payment Service Provider, as of November 2013 there are over 14,000 merchants currently accepting bitcoins. Two years ago this number stood at few hundred. The number of transactions facilitated by Bitpay increased tenfold in 2014 and crossed the 50,000 mark in November. The payment processor said that 6,296 bitcoin transactions occurred on Black Friday last year, up from only 99 transactions the year prior.

Some of the notable adopters as of late include Richard Branson's Virgin Galactic. You can now buy a private flight into space with your bitcoins. Zynga, the facebook games platform, offered the bitcoin payment option to players in “FarmVille 2”, “CastleVille” and other games. Major adult websites are also starting to accept the new currency as a means for payment.

All of these developments point to one thing. The Bitcoin marketplace is expanding at an astounding rate of growth. The businesses and individuals that embrace this new phenomenon will have a leg up over their competition going forward.

Usage in outlawed activities

The third biggest fundamental driver of bitcoin prices is the increased (or decreased) usage in activities outlawed by governments. Bitcoin's pseudo anonymity has facilitated dealings in anything from the purchase of contraband like illegal drugs or weapons to bypassing capital and investment restrictions and tax avoidance. Government crackdown on these activities tends to suppress the price of bitcoin.

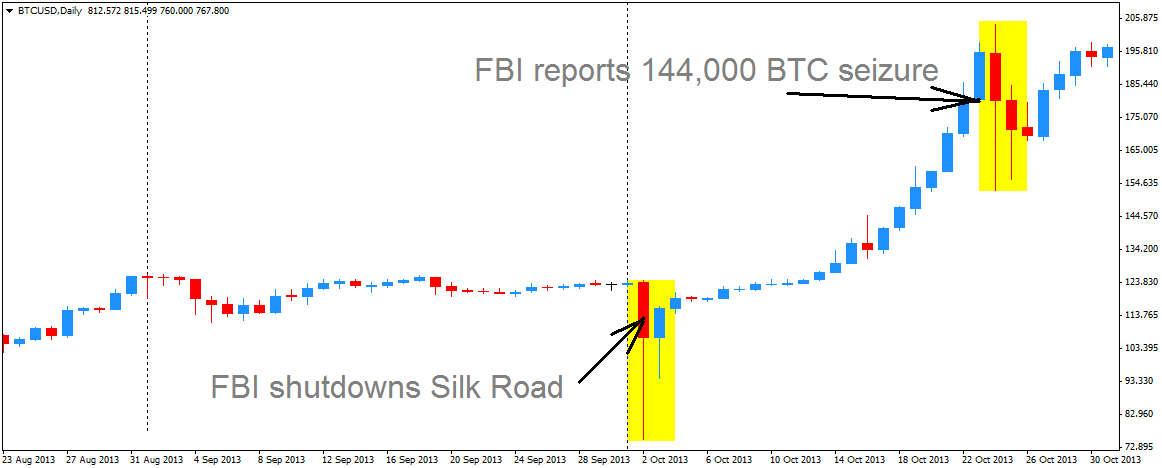

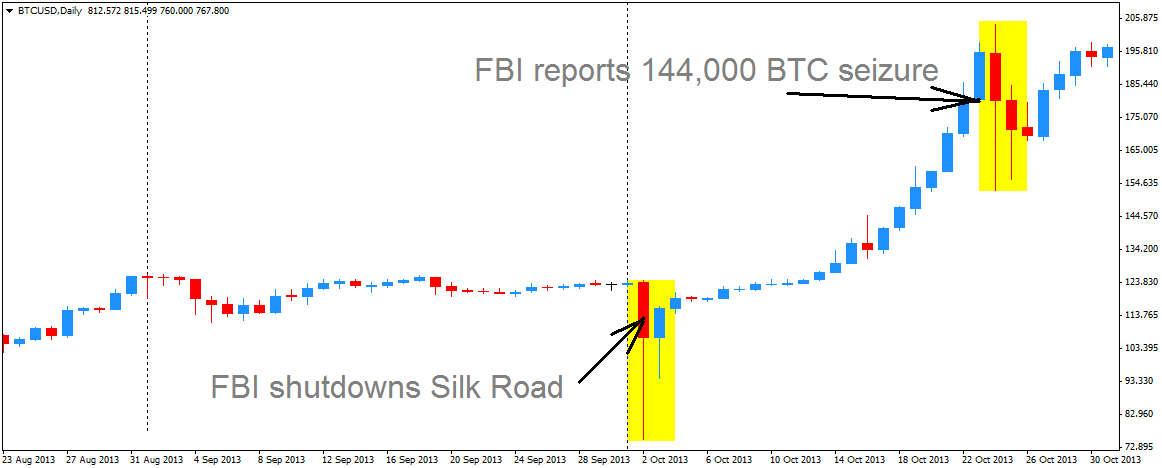

A notable example of this was FBI's shutdown of the "Silk Road" marketplace. The website had over 10,000 products for sale, 70% of which were drugs that are illegal in most countries.

Around 340 different varieties of drugs were offered on the site. The site functioned as an "Ebay for drugs", connecting buyers with sellers and not doing any dealing themselves.

The FBI shut down Silk Road on 2 October 2013. The alleged chief operator of the site, Ross William Ulbricht (also known as Dread Pirate Roberts) was charged with alleged murder for hire and narcotics trafficking violation. The agency confiscated over 26,000 bitcoins from different accounts on Silk Road, worth approximately 3.6 million US Dollars back then. Twenty days later, the FBI reported that they had seized 144,000 BTC thought to belong to Ulbricht.

The chart above shows the bitcoin market's reaction to the website's shutdown and the subsequent btc confiscation. Bitcoin prices plummeted from 123.95 to a low of 75.20 on the news. The market didn't take long to recover however as most took the plunge as an opportunity to buy some cheap bitcoins. Prices were back to 118 two days later.

The second yellow rectangle on the charts marks the FBI's announcement of the large btc confiscation. The prospect of an US law enforcement agency holding a large chunk of bitcoins spooked markets. The BTC/USD took a dive from 195.20 to a low of 152.49 on the news. But as can be seen on the chart, the spike lower was again used by investors to gabble up coins at a bargain.

It is interesting to note that a major bitcoin rally started right after the Silk Road shutdown, somewhat dispelling critics arguments that the virtual currency was mainly used as a tool for facilitating drug trafficking. In the months following the site's closure, several major online and offline businesses started accepting bitcoins. These include major US retailers like Overstock.com and Tiger Direct. The CEO of Overstock.com reported that the company logged more than 800 purchases using Bitcoin on the first day they started offering the new payment solution, totalling $130,000. The company estimates that Bitcoin buyers have made $500,000 in purchases in the first 14 days since the new payment option was offered.

But what about the supply side?

Traders with experience in other commodity markets are probably asking themselves why the supply topic is placed last in an article that goes over the drivers of bitcoin prices. The reason is because when it comes to bitcoin, the supply doesn't have much of an impact on the price. This is because the supply is constant and known beforehand and SHOULD therefore be already priced in. Situations like finding a huge oil field that significantly depresses oil prices is not possible with bitcoin. Let me explain.

The supply of bitcoins grows by the process called “mining” bitcoins. The supply is expected to increase by 10% in 2014 after going up 11.11% last year. The rate of block creation is 6 per hour with each block worth 25 bitcoins (around 25k USD). If more mining power goes online and the block generation increases to 7 blocks per hour for example, the so called “mining difficulty” will go up until the 6 blocks per hour average is reaffirmed. On the other hand if miners generate less coins then the difficulty will go down making it easier to generate new coins. You can read more about the supply of bitcoins here.

Wall Street Bitcoin Forecasts

With the mark of drug trafficking of the record, the new cryptocurrency was also starting to attract the attention of Wall Street. Wedbush Securities, a little known analyst firm put a forecast of around $98,500 on the price of one bitcoin. The analysts expect bitcoin to rise by 10 to 100 times its current value as the new technology partly replaces traditional payment processors and money transmitters. Bank of America Merrill Lynch wasn"t as optimistic in its forecasts. The Bank's analysts predict a maximum "fair" estimate of bitcoin of $1,300.

The Winklevoss twins told CNBC that a $400 Billion market cap for BTC would be a “small bull case scenario". With around 12 Million bitcoins currently in circulation, to reach that market cap one bitcoin has to be worth a fantastic $40,000. The brothers are major investors in bitcoin after getting rich from an early investment in Facebook.

The largest potential for "disruption" to the current status quo lies in taking a chunk out of the payment processors market. Visa and MasterCard are estimated to take a 2 to 3 percent cut of every card transaction. By using bitcoin instead, merchants stand to improve their bottom line by at least 2 percent. In addition, because bitcoin transactions are irreversible, there is no possibility for chargebacks and fraud. This reduces the costs of operation by another several percentage points.

Another area "ripe" for disruption is the money transfer market. The market is currently dominated by large players like Western Union and MoneyGram, WU for example can earn upwards of 10 percent per transaction on international remittances. By comparison, a bitcoin transaction shouldn't cost more than 5 percent even after accounting for all exchange and bank wire fees for both the buyer and the seller on each side of the remittance. If no fiat currency is involved, sending and receiving bitcoins is almost free and costs 0.0001 btc regardless of the amount. This is around 9 cents at current btc prices.

Additional Bitcoin Resources

There are plenty of resources online where you can learn more about bitcoin and its unique properties. Here are some of the major websites that can help you speed up the learning process.

Weusecoins.com Provides simple instructions for setting up your first bitcoin wallet and purchasing bitcoins.

The Bitcoin Wiki. Plenty of articles on any bitcoin related topic that range from securing your wallet, dealing with scams, mining bitcoins, to a list of online and offline businesses that accept the new currency.

Bitcointalk.org The main bitcoin forum. Use it only after you've got the basics down by following the previous two links. Use this resource to ask questions about more advanced topics.

Bitcoincharts is the most popular website for following the current bitcoin price. The site provides a rundown of all major btc exchanges by volume. You can also arrange the markets to only display the Euro or the Japanese Yen versus bitcoin on the different exchanges. Like the name says, the website also offers charts with several popular technical indicators. The choice of timeframes ranges from 1 minute all the way to the Weekly TF. Plus, you get to see the current market depth at the different exchanges.

Bitcoinity.org Another popular charting resource, very similar to Bitcoincharts. Recently switched to mBTC pricing, 1 mBTC = 0.001 BTC. They still offer the option to display prices in BTC instead.

CoinDesk.com Coindesk provides daily news on bitcoin and other cryptocurrencies.

DC Magnates focuses on news about different digital currencies including bitcoin. It was launched by the same team from Forex Magnates, a popular forex industry news website that many of our forex readers are probably familiar with.

Places to spend your bitcoins

The following three sites provide an interactive map of bitcoin merchants near your area.

https://en.bitcoin.it/wiki/Trade Provides a long list of bitcoin merchants. The wiki page showcases different categories of businesses. You can find anything from major retailers like Overstock and Target to forex brokers accepting bitcoin deposits and bitcoin specific stock and options markets.

https://en.bitcoin.it/wiki/Category:Games Bitcoin's pseudo anonymity helped trigger a revival in the games of chance industry. This wiki page provides a selection of places where you can gamble away your bitcoins. Includes card games, dice rolls, poker sites and online casinos.

Bitcoinstore.com One of the first websites to offer bitcoin purchases.

Gyft.com By using bitcoins to buy gift cards from Gyft.com you can get 3% back. The selection of gift cards incudes major retailers like Amazon, GameStop, Target, Wholefoods and a lot more.